For the second week in a row, the price of the USD/JPY pair continues its bullish correction, and gains were crowned by moving towards the 110.28 resistance, the highest level in seven months, and it closed last week's trading near that level. The pair is now waiting stronger catalysts to complete the bullish correction. The US dollar remained the strongest against most other major currencies, with good performance of the American economy compared to other global economies, which support the maintenance of the monetary policy of the Federal Reserve Bank, which contrasts with the trend of many other central banks towards more monetary policy easing to counter weak economic performance. The closest to which is currently the Bank of England and the European Central Bank.

The Japanese yen, which is considered an ideal safe haven for investors in times of uncertainty, is the second worst performing major currency for 2020 until now, and it is indeed the biggest loser from the formal signing of the “Phase 1” trade agreement to stop the tariff war, even if temporarily, between the two largest economies in the world. Calm tensions between the United States with Iran have weakened the Japanese yen a lot, as well.

The global economy has been hit further by the US-China tariff war, which has dominated the economic news agenda since early 2018, and as a result, global central banks have overall cut their interest rates and warned that further cuts will follow any additional economic slowdown. This has resulted in lower bond yields and made stocks more attractive to investors from all sectors, including those in Japan.

This week, the Central Bank of Japan will announce its monetary policy, and it is widely expected that the bank will maintain a negative interest rate of -0.10% as is, as well as suggest the possibility of further policy easing, as long as it is in favor of supporting the Japanese economy, which is still suffering. On the other hand, American interest rates have now been reduced three times, taking them from 2.5% to 1.75%, and expectations still indicate the possibility of reducing these rates further during the year 2020, especially if the results of the US economic data turn out weaker than expected, in contrast to the current situation.

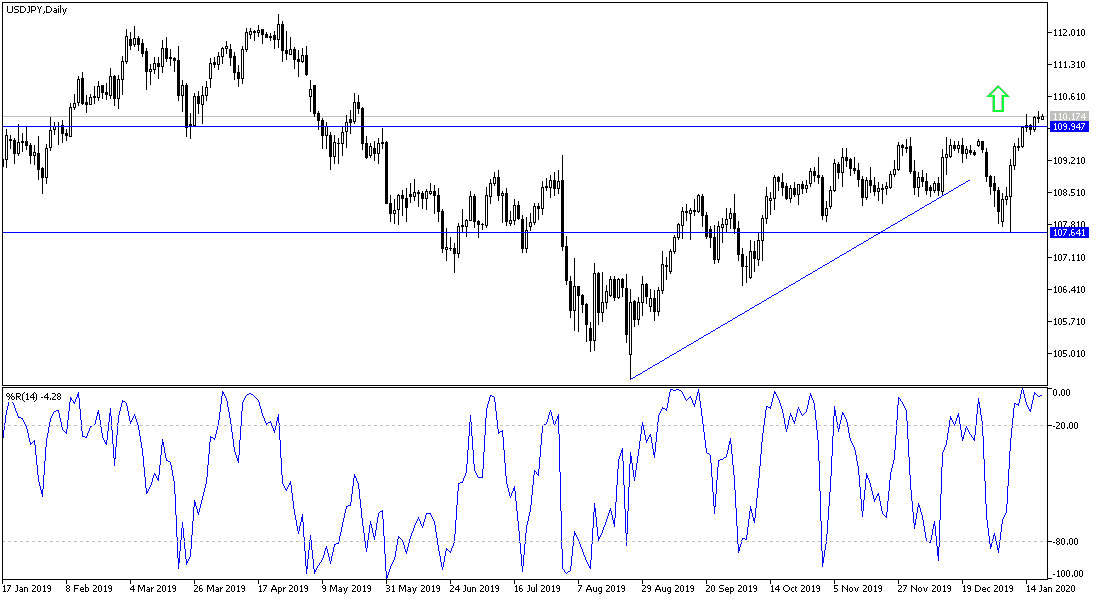

According to the technical analysis of the pair: Stability of the USD/JPY price around and above the 110.00 psychological resistance will remain supportive for the uptrend awaiting movement towards higher levels to confirm the strength of this reversal, and resistance levels 110.45 and 111.20 may be the closest to confirm bulls control over performance. I still prefer to buy the pair from each lower level, with the closest support levels for the pair are currently at 109.65 and 108.80, respectively. A limited range trading is expected for the pair today in light of the US market holiday.