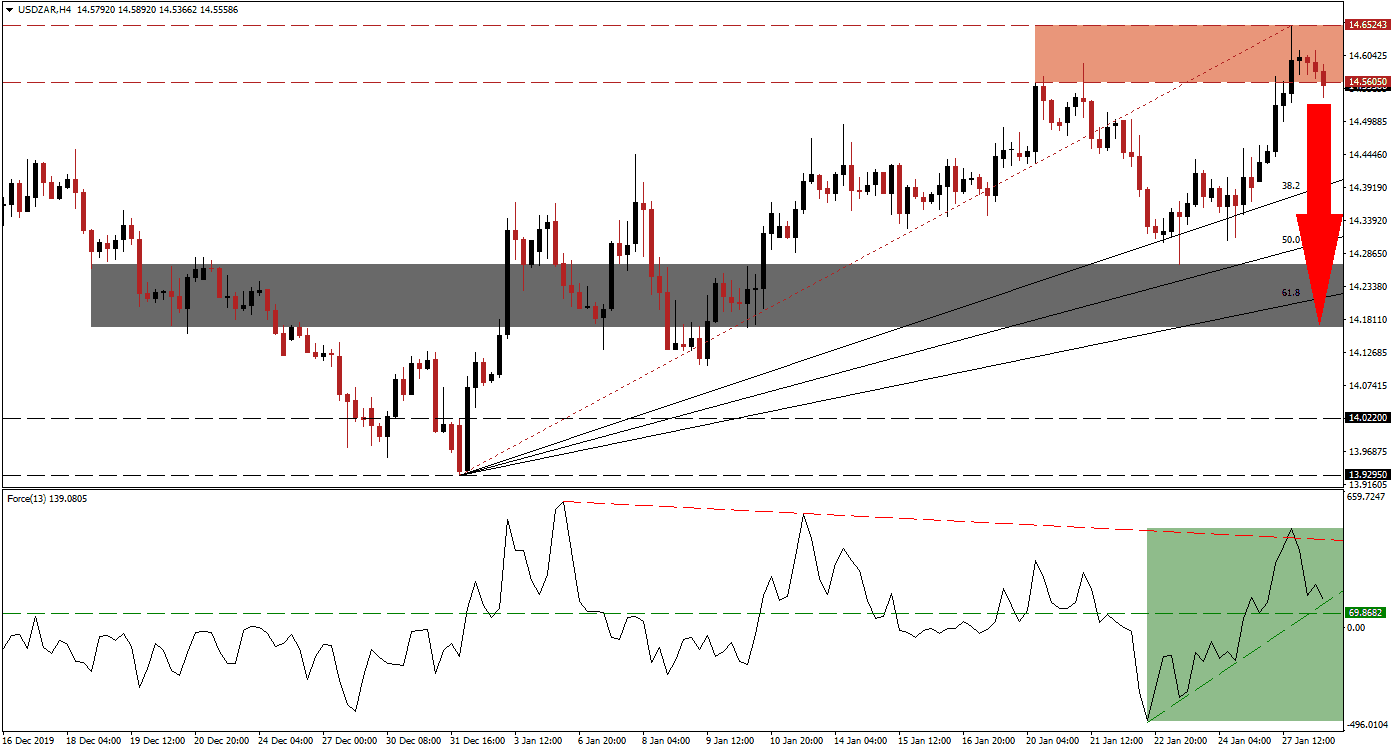

Price action is nearing the end of a strong rally, spanning a pivotal support zone and a substantial resistance zone. The first breakdown in the USD/ZAR below its resistance zone was reversed by its ascending 38.2 Fibonacci Retracement Fan Support Level. It resulted in a higher high inside of its resistance zone, but bullish momentum failed to force a breakout. An increasingly positive outlook for the South African economy against the backdrop of a struggling US economy favors an extended sell-off in this currency pair. You can learn more about the support and resistance zones here.

The Force Index, a next-generation technical indicator, indicates strong bullish momentum but was unable to extend the advance in the USD/ZAR. It advanced from a lower low, briefly piercing its descending resistance level to the upside, before reversing from a marginally lower high. The Force Index remains in positive territory, as marked by the green rectangle, suggesting bulls remain in control of price action. As the ascending support level and the descending resistance level converge, pressures for either a breakout or breakdown are building.

US economic data continues to come in mixed with a bearish bias, adding to fundamental pressures on this currency pair. A second breakdown in the USD/ZAR below its resistance zone located between 14.56050 and 14.65243, as marked by the red rectangle, is expected to materialize. It should close the gap to its 38.2 Fibonacci Retracement Fan Support Level, partially powered by a profit-taking sell-off. Adding to bearish developments is the move in price action below its Fibonacci Retracement Fan trendline. You can learn more about a profit-taking sell-off here.

One key level to monitor is the intra-day high of 14.51239, the peak of the last instance price action was located above its Fibonacci Retracement Fan trendline. A breakdown is likely to result in the net addition of new sell orders, driving the USD/ZAR farther to the downside. Volatility is anticipated to remain elevated, especially as the deadly string of a coronavirus is spreading globally. This currency pair is favored to reverse into its short-term support zone located between 14.16826 and 14.26820, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 14.57000

- Take Profit @ 14.17000

- Stop Loss @ 14.70000

- Downside Potential: 4,000 pips

- Upside Risk: 1,300 pips

- Risk/Reward Ratio: 3.08

Should the Force Index sustain a breakout above its descending resistance level and advance into a higher high, the USD/ZAR is anticipated to attempt a push above to the upside. The upside potential for a breakout remains limited, and this currency pair will face its next resistance zone between 14.86322 and 14.94492. It will take price action to the bottom of a previous price gap to the downside, presenting Forex traders with a good selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 14.74000

- Take Profit @ 14.94000

- Stop Loss @ 14.65000

- Upside Potential: 2,000 pips

- Downside Risk: 900 pips

- Risk/Reward Ratio: 2.22