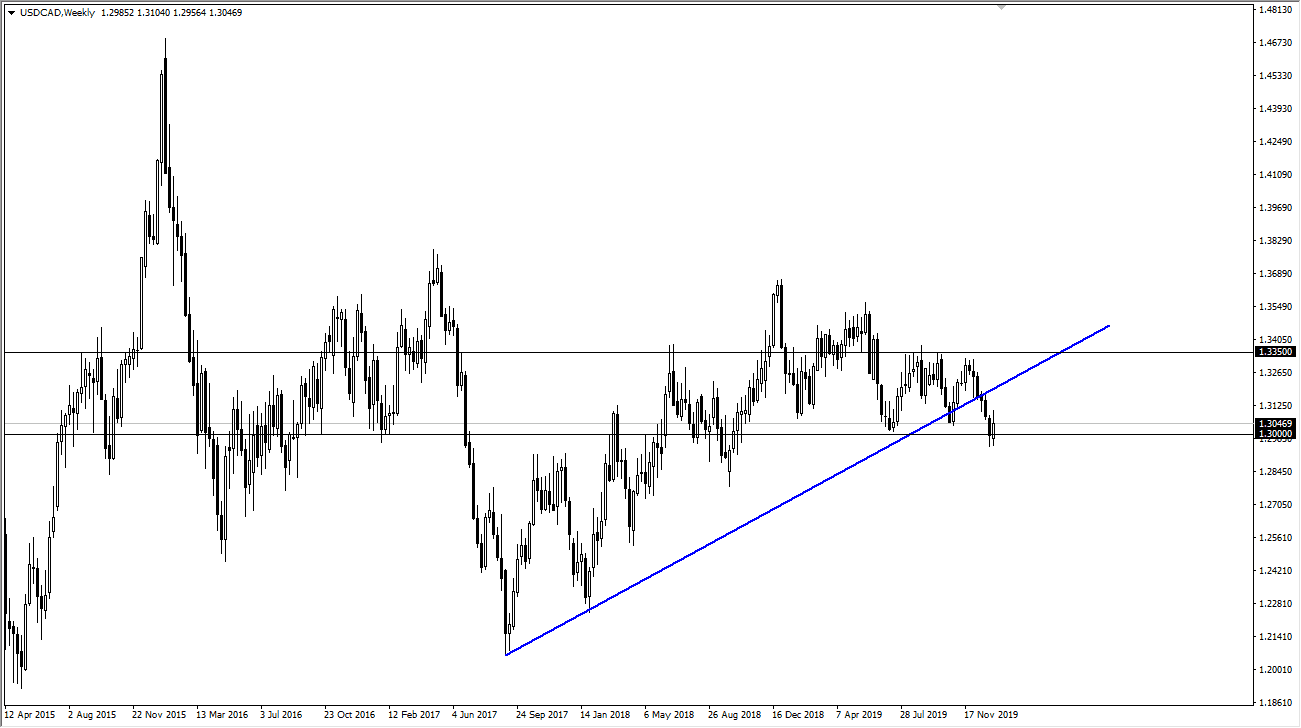

EUR/USD

The EUR/USD pair continues to do almost nothing as we hang around the 1.11 handle. We are currently trading between the 1.12 level on the top, and the 1.10 level on the bottom. I suspect that this market is going to continue to do more of the same but keep an eye on the area above 1.12 that extends to the 1.1250 level. If we do in fact break above that handle, then the uptrend starts for a longer-term move. Otherwise, I anticipate that the best way to trade this market is to simply use the 1.11 level as a bit of a “magnet.” In other words, if we break down towards the 1.10 level, I’d be a buyer, aiming for that level. Furthermore, if we reach towards 1.12 level and show signs of exhaustion, I’d be a seller.

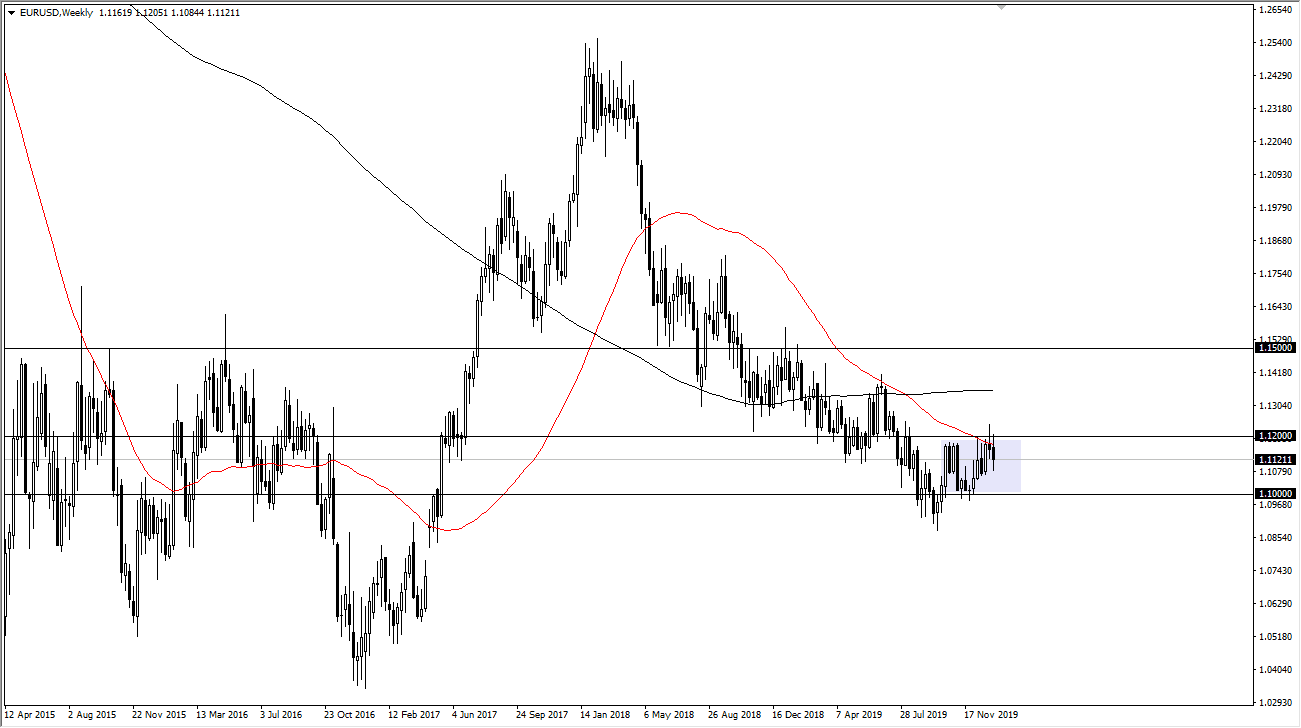

AUD/USD

The Australian dollar initially fell during the week but has turned around to form a bit of a hammer. I think at this point we are in the midst of trying to change the overall trend, but I also expect a lot of noise in this general vicinity. With that being the case I like the idea of buying the Aussie dollar on short-term pullbacks, as long as we can stay above the 0.68 level. I also recognize that the 0.7050 level above will continue to be very resistive.

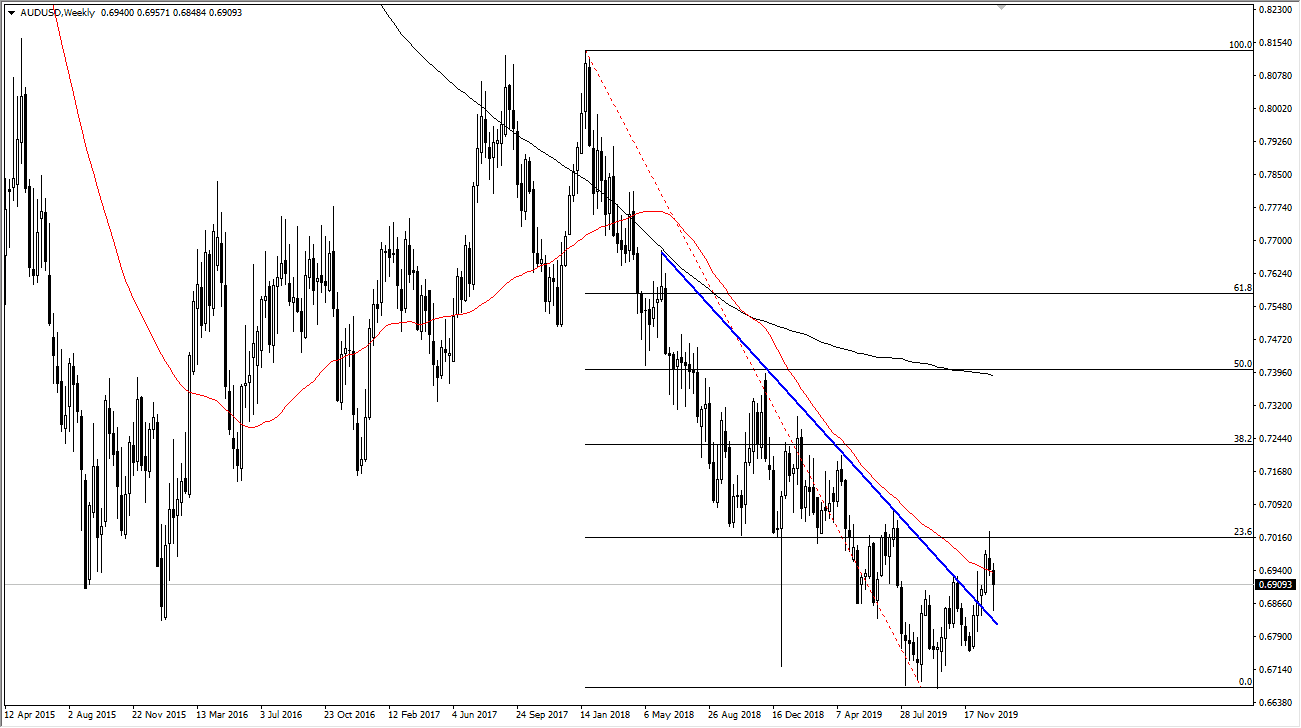

USD/JPY

The US dollar has rallied rather significantly during the course of the week to park just below the massive resistance that starts at the ¥109.60 level. Simply put, if we can break above the ¥110 level then I would be a buyer. Otherwise, I suspect that we are going to pull back and find buyers closer to the ¥108.40 level. I don’t have any interest in shorting this market, but I’m not necessarily going to jump in and buy it right away either. I need a breakout or some type of value.

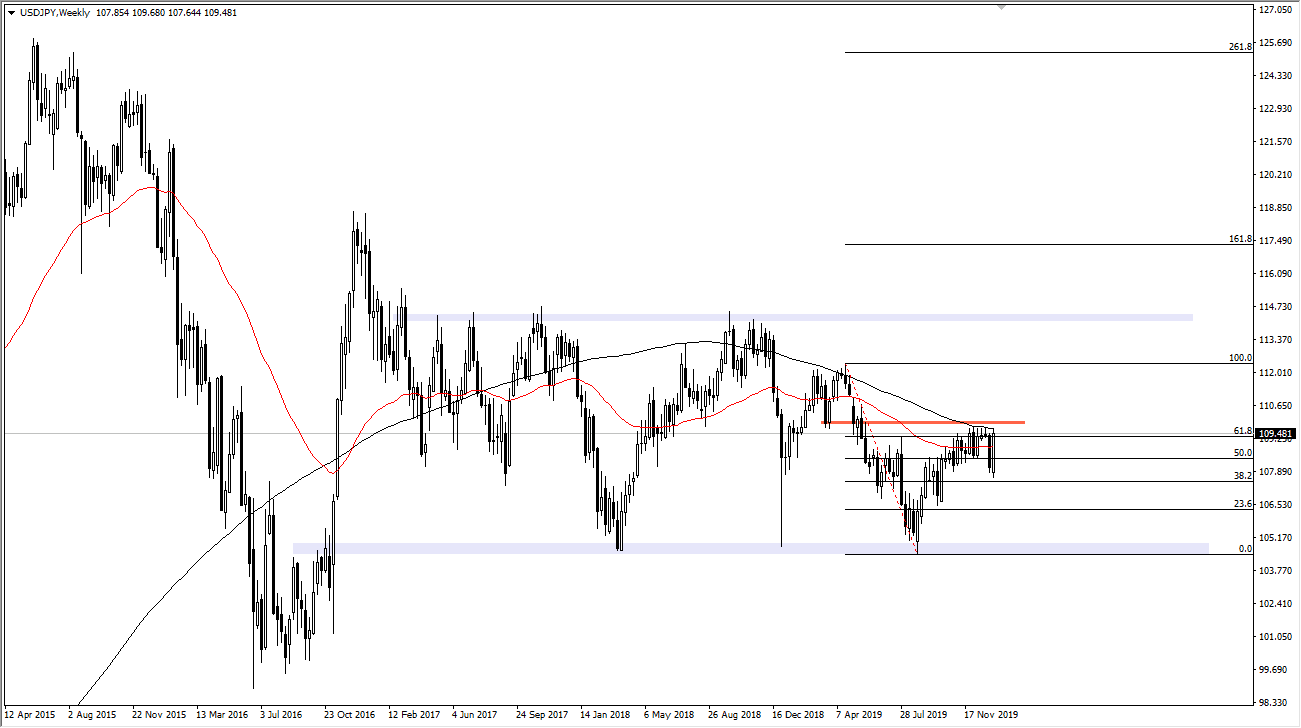

USD/CAD

The US dollar has rallied quite nicely during the week but has rolled over again as we continue to see a lot of negative pressure, even though oil has taken a bit of a bashing. I believe that this point if we can break down below the bottom of the weekly candlestick, this market will go looking towards the 1.2750 level. I have no interest in buying but would be interested in fading short-term rallies.