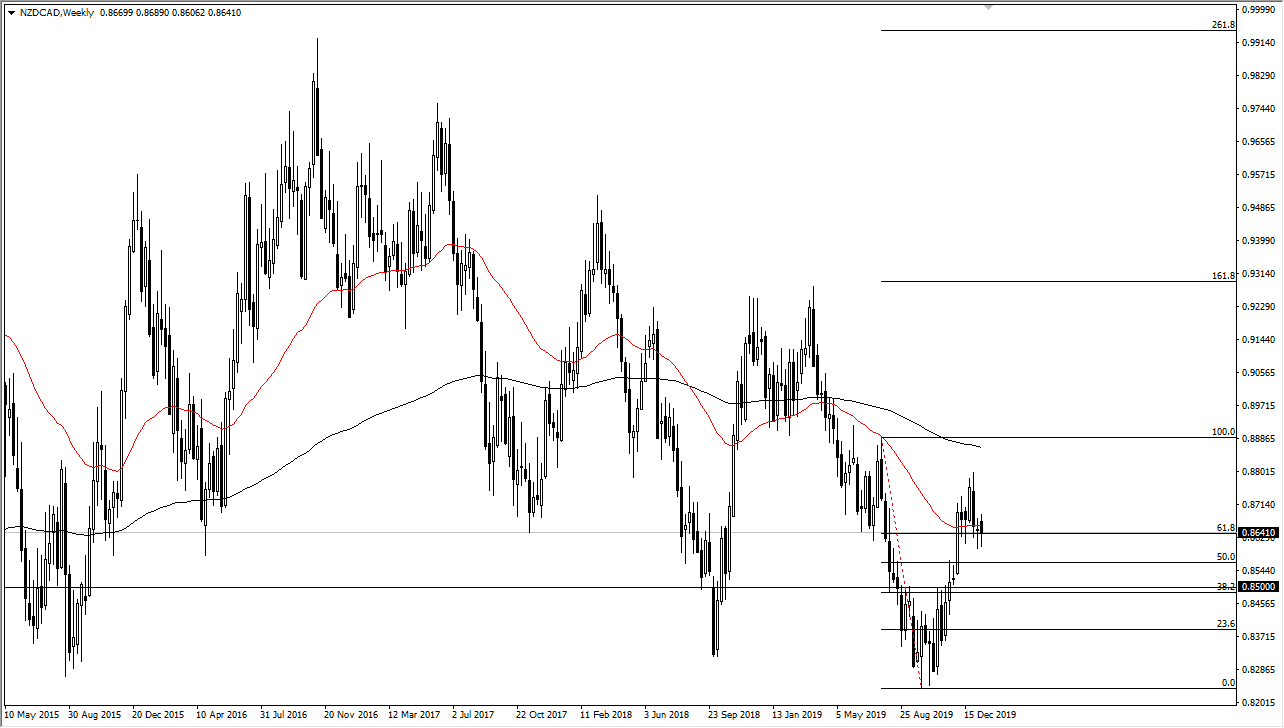

NZD/CAD

The New Zealand dollar pulled back a bit during the week but continues to find plenty of support near the 0.86 level against the Canadian dollar. It looks as if we will continue this consolidation area over the next couple of sessions, but if we were to break down below the 0.86 handle, it most certainly will open up a move down to the 0.85 level. Alternately, if we were to break above 0.88 in what would be an explosive move to the upside, we should see the New Zealand dollar skyrocket against the Canadian dollar.

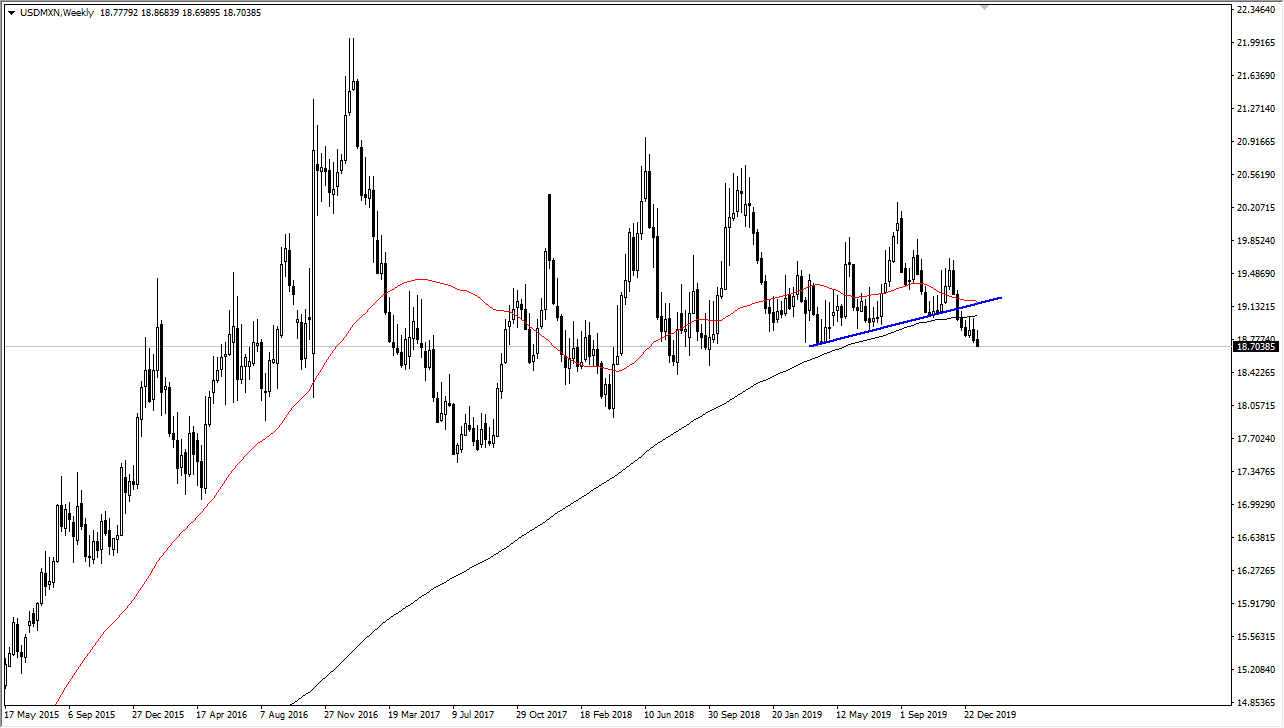

USD/MXN

The Mexican peso continues to strengthen against the US dollar, as we have reached the 18.70 level. The market has broken significantly below the 200 weekly moving average and looks as if it is ready to continue going lower. With that being the case, this could be the beginning of a move towards emerging markets in general and shows more of a “risk on” flavor to the world. I expect this pair to continue grinding lower, perhaps down towards the 18.50 level over the next week or so.

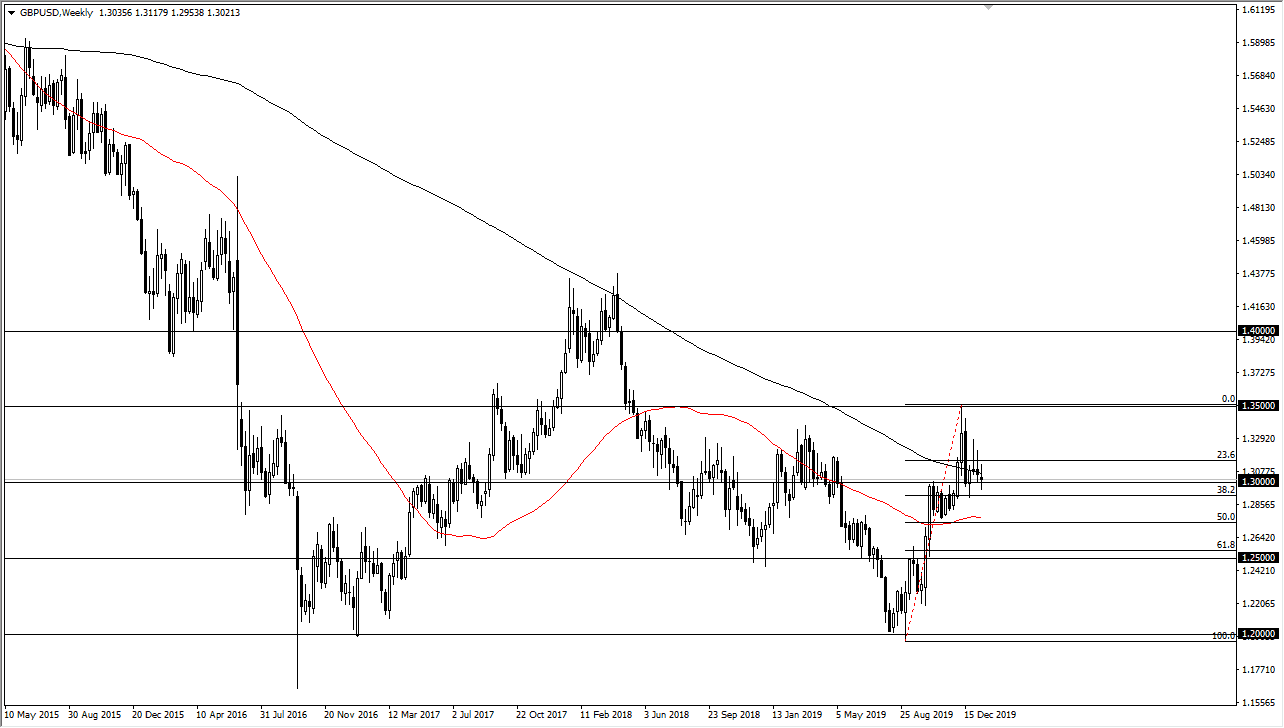

GBP/USD

The British pound went back and forth during the week, showing indecision but the one thing that I do see is that the 1.30 level continues offer plenty of support. Over the last four weekly candlesticks we have seen a hammer, a shooting star, another shooting star, and now in neutral candlestick. This shows just how much tension there is between the buyers and sellers in this marketplace, and I expect that to continue to be the case going forward. Range bound trading will more than likely be the feature of this market for the next couple of weeks as we continue to see the markets tried to discern what’s going to happen between the European Union and the United Kingdom.

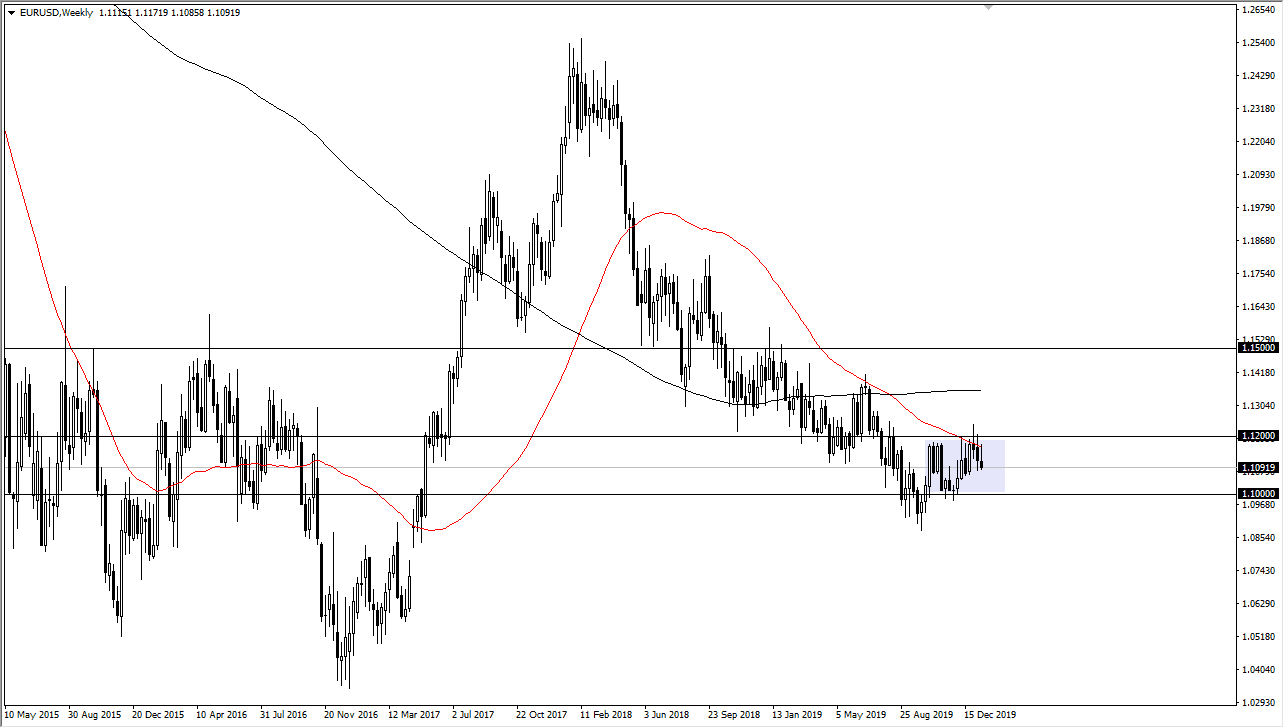

EUR/USD

The Euro tried to rally during the week but found enough resistance near the 50 week EMA to turn around a rollover again. We are at essentially “fair value” as we close out the week near the 1.11 level, an area that is right in the middle of the overall range between 1.10 on the bottom and 1.12 the top. I anticipate more range bound trading with a slightly downward tilt this coming week. Having said that, if we are to break out of this 200 PIP range, we obviously need some type of catalyst.