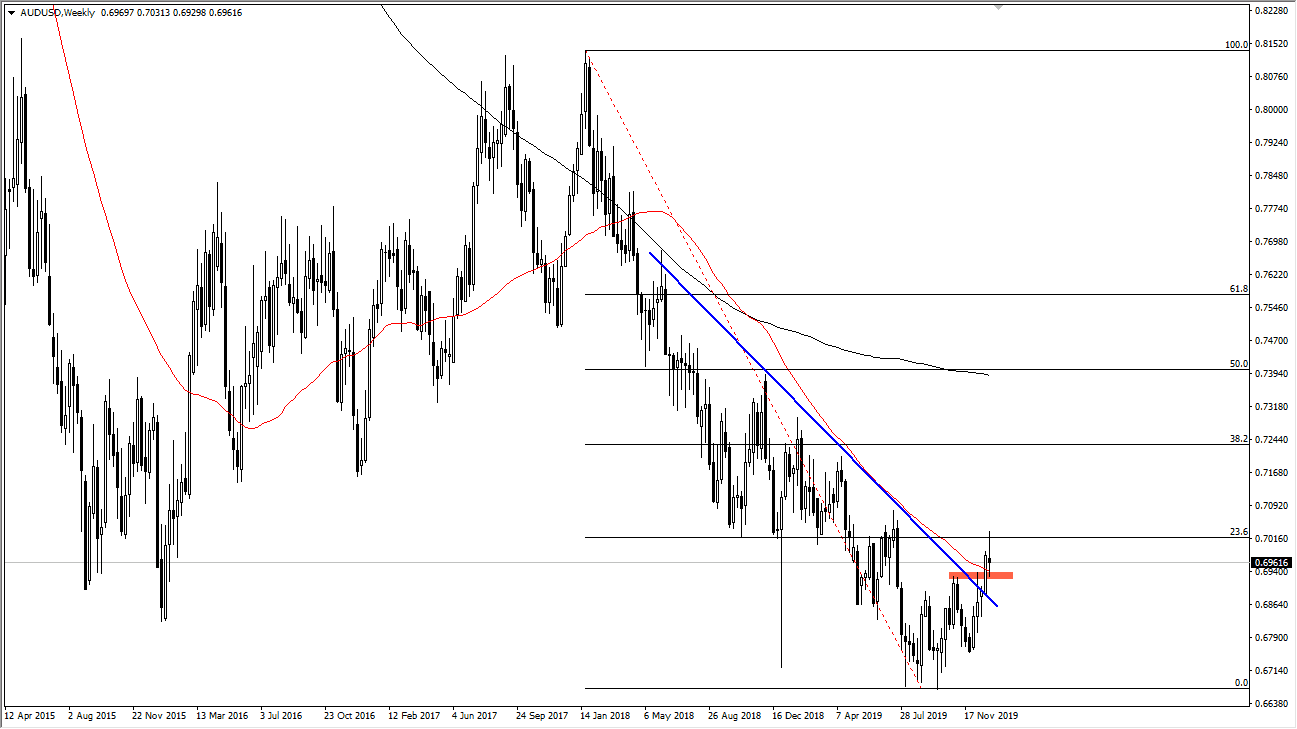

AUD/USD

The Australian dollar went back and forth during the bulk of the week as it is a risk sensitive currency. Typically, I am talking about the US/China trade relations but with the Americans killing an Iranian general, that is a whole new monkey wrench into the idea of geopolitical situations. That being the case, the Aussie will continue to go back and forth in the 0.70 level above will continue to cause massive resistance. However, the 50 week EMA underneath is offering support, meaning that I would expect more choppy behavior.

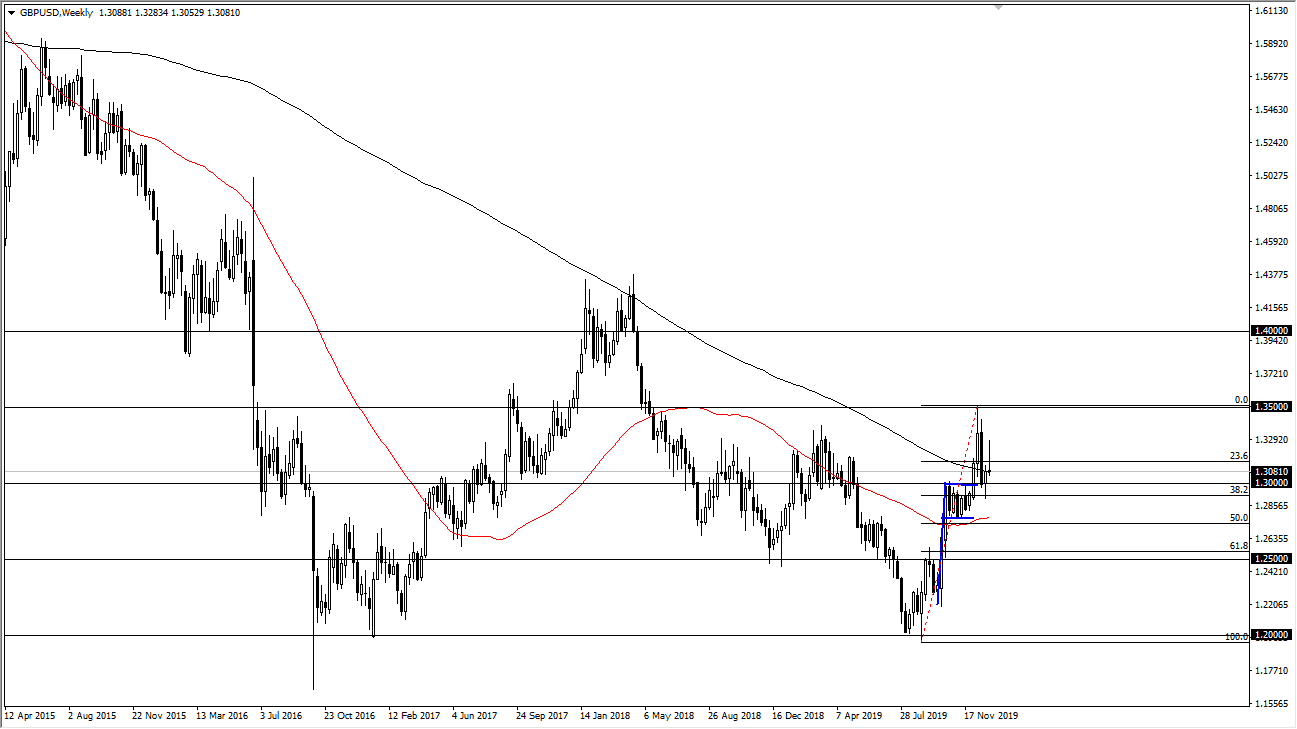

GBP/USD

The British pound initially rally during the week but gave back all of the gains as we continue to see a lot of volatility. This is an even to do with Brexit, this is more about geopolitical concerns. All things being equal we have a shooting star that was preceded by a hammer at the 200 week EMA. In other words, this is a market that is also going to be very choppy and looking for some type of direction. I would expect more noise and meaningless trading over the course of the week, at least until we get the jobs figure on Friday.

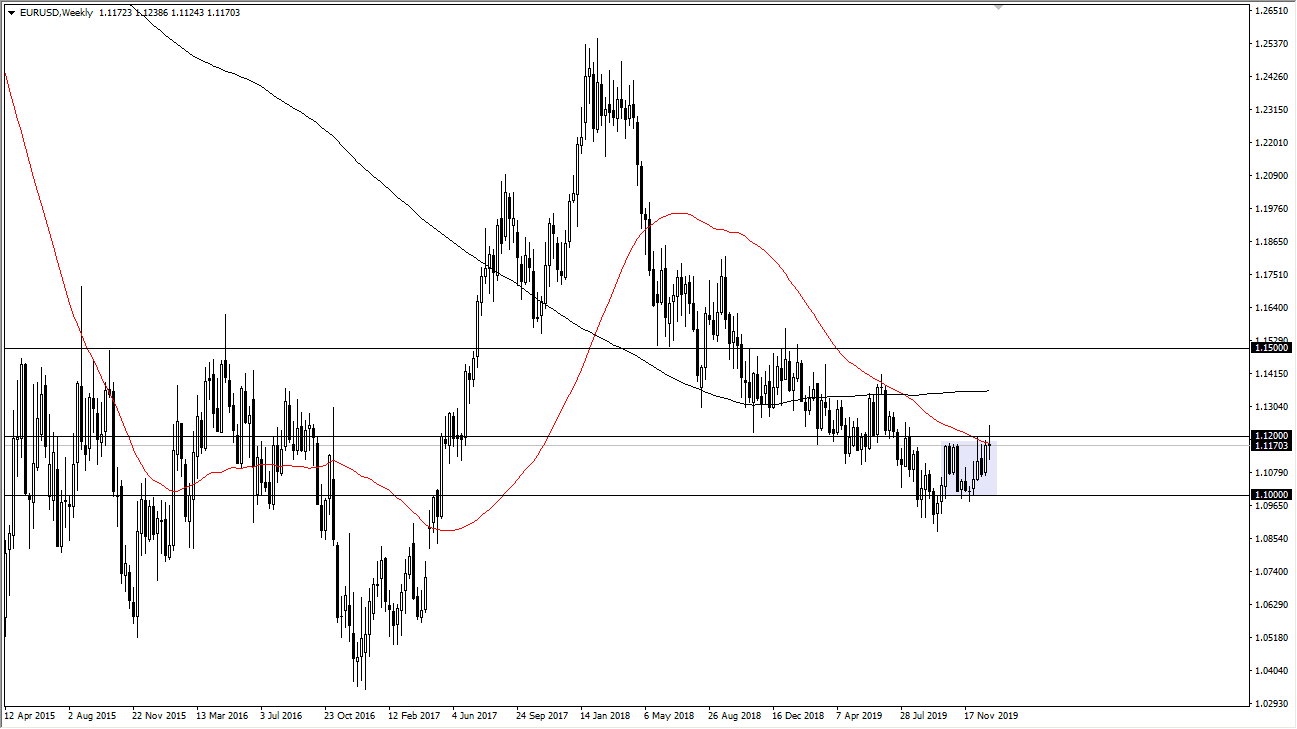

EUR/USD

The Euro went back and forth during the week as well, as we continue to see a lot of volatility in this pair. The fact that we did up forming a relatively neutral candlestick rent the 50 week EMA shows that nobody really knows what to do with this one either, but I think if we can break above the top of the weekly candlestick it's very likely that the Euro will go looking towards 1.14 handle. Alternately, if we were to break down below the bottom of the candlestick, it's likely that the market should go looking towards the 1.10 level underneath.

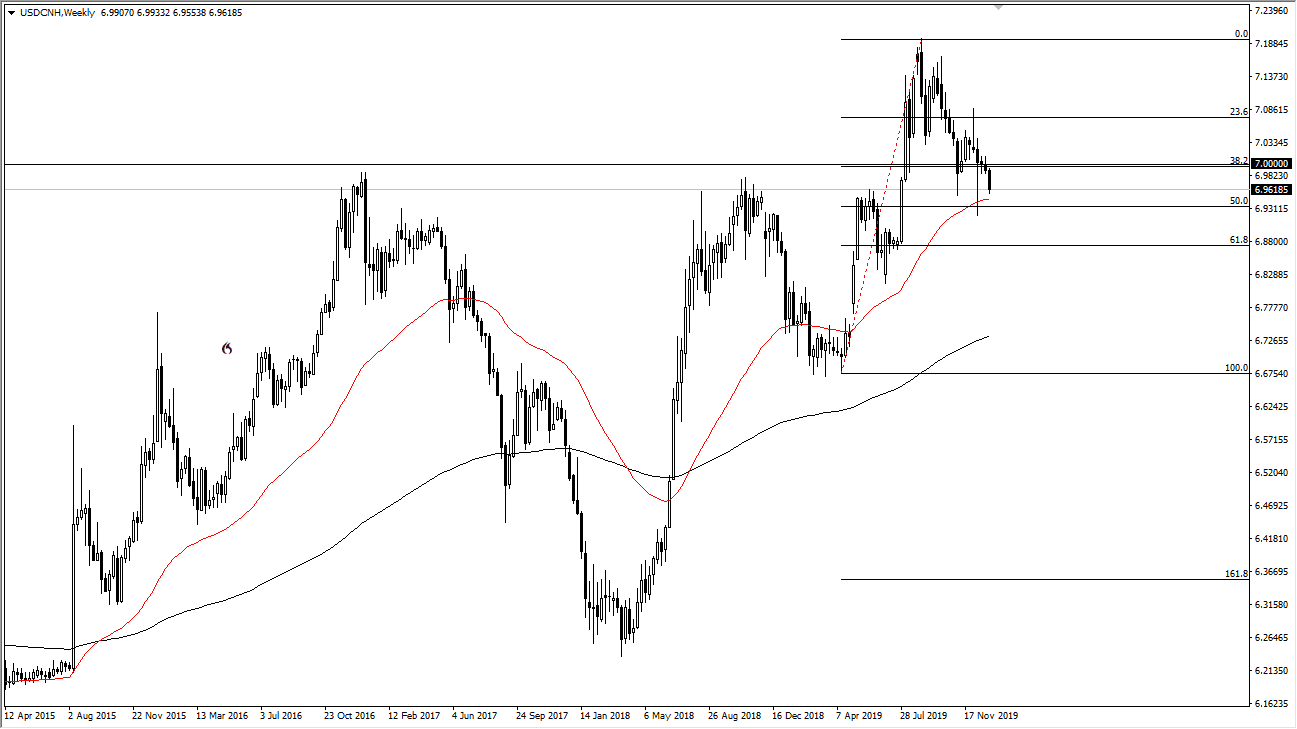

USD/CNH

The US dollar has fallen against the Chinese Yuan during most of the trading week, reaching towards the 50 week EMA. This is an area that also has the 50% Fibonacci retracement level around it, so it’s very likely that we could get a little bit of a bounce. At this point, the market is very likely to continue to find buyers underneath, unless of course we get some type of major “risk on rally”, which could break this market down to the 6.88 level which is the 61.8% Fibonacci retracement level.