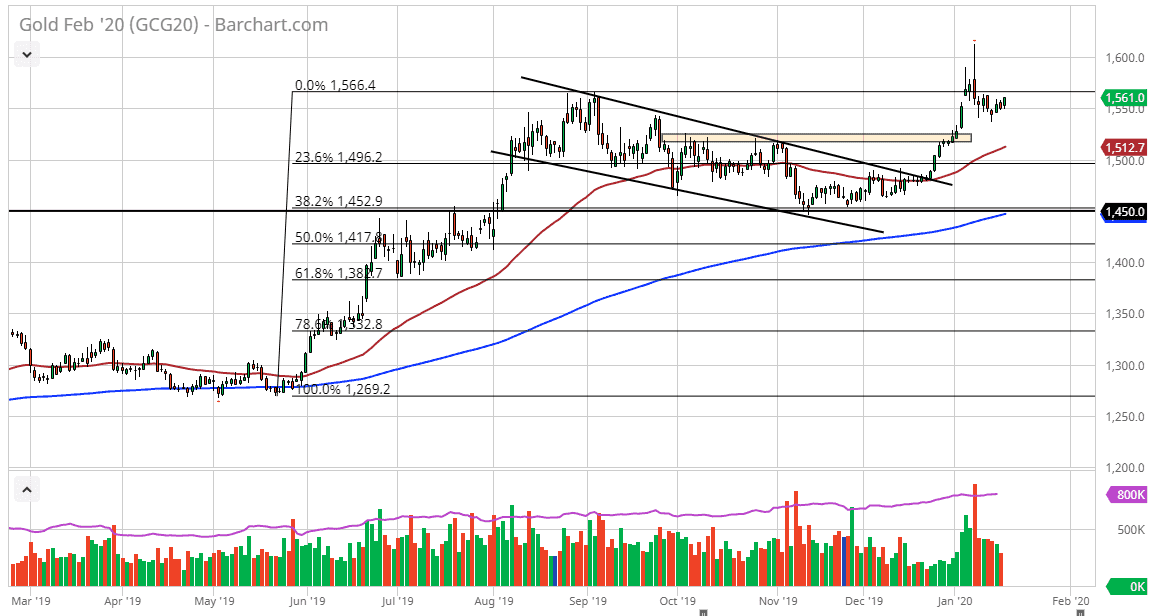

Gold markets have rallied a bit during the trading session on Friday, reaching towards the $1560 level. This is a market that continues to find plenty of buyers, and I do think that we are going to be bullish over the longer term. However, this is a market that has a lot of resistance just above so don’t be surprised at all if it takes a while to finally break out. Short-term pullback should continue to be buying opportunities, as the momentum may have gotten a little bit ahead of itself. Keep in mind that the big spike on the shooting star was based on all of that noise coming out of the missile strike by the Iranians against the Americans. We have since calmed down, but you will notice how we are still going higher.

The 50 day EMA underneath continues to offer a bit of a floor near the $1515 level, which is currently higher. If use a little bit of artistic license, you can see that we have formed a bit of a bullish flag, which measures for a move all the way to the $1650 level at the very least. Ultimately, the market should continue to see buyers on dips, as we have the blues central bank policies around the world that can continue to lift gold itself. This is a market that I think will have plenty of people willing to pick up little dips along the way. The one thing that I pay attention to the most right now is the fact that the Tuesday candle ended up forming a hammer and I think that is a nice “cyclical low” for a potential move. If we were to break down below the candlestick, things will get rather ugly, but I don’t think that happens. Even if we do, I believe that the 50 day EMA underneath is going to be massive support. To the upside, I think that the $1600 level is going to be difficult to break out above, but I do think eventually that does happen as we have already pierced that level in a bit of a panic. All things being equal, this is a market that you should be looking for value in, and at this point I believe it is almost impossible to short this market as there is so much in the way of bullish pressure in general.