Gold markets rallied rather significantly during the trading session on Friday, cranking above the $1550 level before stalling out at the end of the day. This was of course in reaction to the Americans killing an Iranian general, getting even more concerned when it comes to a geopolitical situation and a major “risk off” move. Gold of course is one of the first places that safe haven traders will look towards, so it makes sense that we would reach towards the level. A pullback from here could send this market down to the $1525 level, an area that had previously been resistance. We are a bit overextended though, so we are going to need to see some type of exacerbation of the fear in order to have gold continue much higher.

Going into the weekend would be very difficult, but one would have to assume that we are going higher. However, if we went through the entire weekend without a lot of rhetoric being thrown around the world, gold could turn right back around and drop $25 rather quickly. With this being the case, it’s very difficult to imagine a scenario where this is going to be an easy trade. I certainly would be a seller of gold, but I like the idea of buying pullbacks as they occur. We had recently been breaking out anyway, so this is more or less just an excuse to go long.

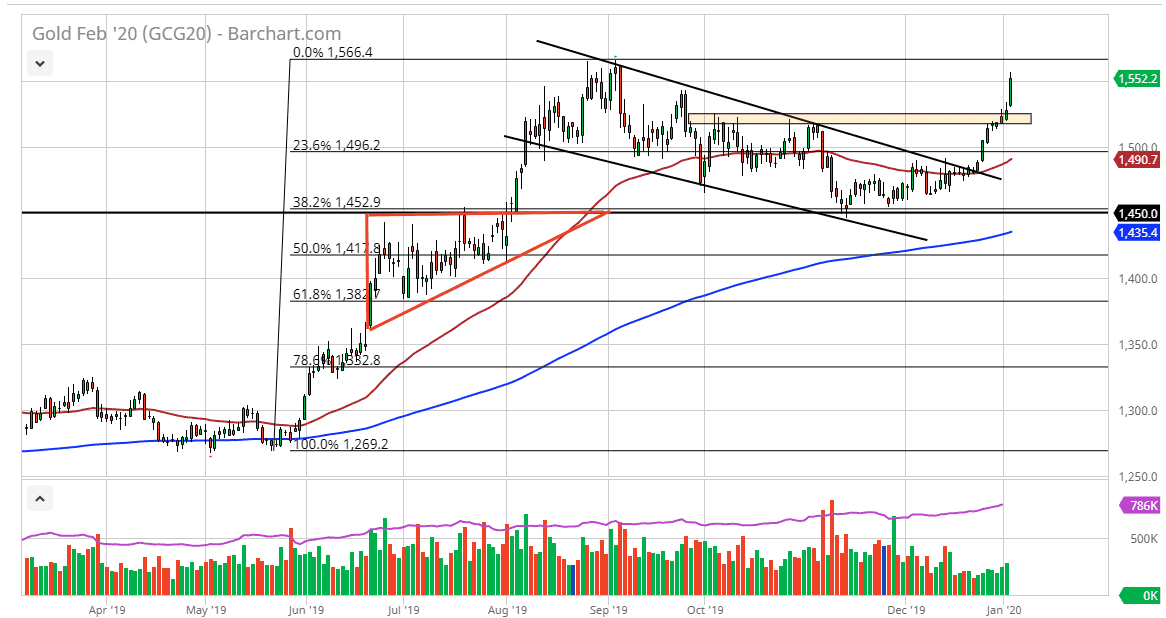

The 50 day EMA is starting to curl higher and reach towards the $1500 level so it’s very likely to be crucial. The $1500 level of course is a large, round, psychologically significant figure which of course will attract a lot of attention anyway. We had recently broken out of a down trending channel, which of course is a very bullish sign. Ultimately, I like the idea of buying dips, but I wouldn’t be a buyer up here, mainly because the market is overextended and therefore not offering much in the way of value.

Looking at the chart, I anticipate that we should reach the highs again, and then eventually break through there on some type of major “risk off” scenario. I believe that this point it’s likely that we will see plenty of buyers on dips based upon the fact that gold is obviously a very bullish market from a longer-term standpoint as we only dropped to the 38.2% Fibonacci retracement level before bouncing.