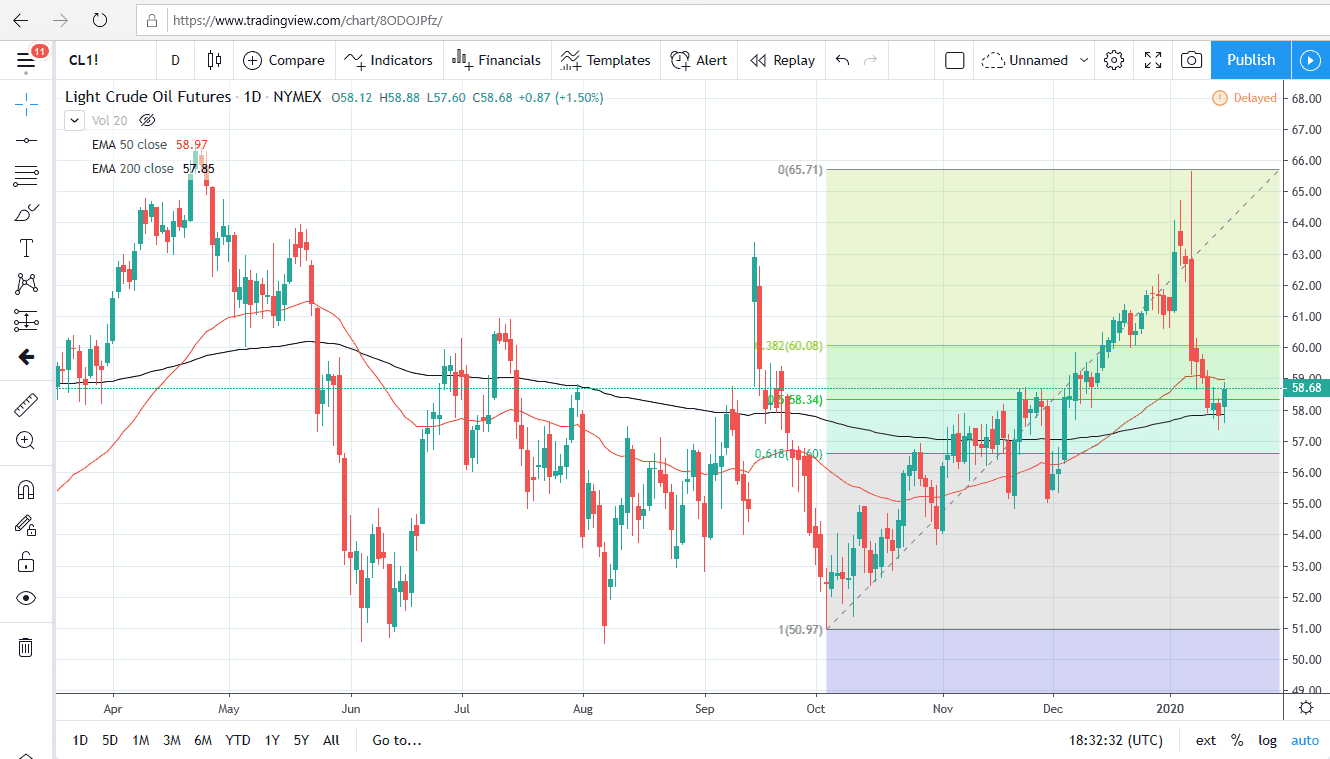

The West Texas Intermediate Crude Oil market had a somewhat choppy and volatile day, but the candlestick does look rather healthy. What is a bit interesting is that we had broken below the 200 day EMA during the trading session, but then turned back around to not only rally from there but break above the top of the shooting star or “inverted hammer” from two days previous. In the process, we had broken above the top of the hammer from the Wednesday session, so all in all, this is a relatively strong sign. At this point, the market is also showing signs of life right around the 50% Fibonacci retracement level, so that’s something to pay attention to as well.

Granted, the market fell off of a cliff earlier but that was due to a lot of shocking headlines coming out of the Middle East. The tensions rising between the Americans and the Iranians of course sent the markets much higher, and then the Iranians attacking the US with a missile strike only fanned the flames. However, it was obvious that the Iranians weren’t trying to kill any Americans and were simply sending a message, traders around the world began to take off some of the risk premium in the market.

The massive candlestick from last Wednesday is one that certainly will have an effect on the market going forward but you should also keep in mind that it will have been a bit thinner in that area that it would be on the uptrend where we had been grinding away to the upside slowly. Ultimately, this is a market that looks as if it can break above the 50 day EMA, it may have a bit of catching up to do to reach towards the $60 level, possibly even the $62 level. I don’t necessarily think that we are going to break out to the upside and above the top of the candlestick that was so massive, but a bit of a relief rally would make a certain amount of sense considering that we had broken down so rapidly. Furthermore, you can make an argument for a bit of a trend line right about this area as well, so I do believe that we go higher, although I’m not willing to get married to a position here and would be quick to jump out if signs of weakness reoccurred. The alternate scenario of course is that we break down below the candlestick from the Wednesday session, which would open up the door to the $55 level.