The West Texas Intermediate Crude Oil market gapped lower at the open on Thursday, breaking all the way down to the $55 level as the inventory number was better than anticipated, but still should be thought of as “less bad” than anticipated. “Less bad” certainly isn’t enough of a reason for the market to suddenly get bullish, and therefore the market continues to show signs of exhaustion.

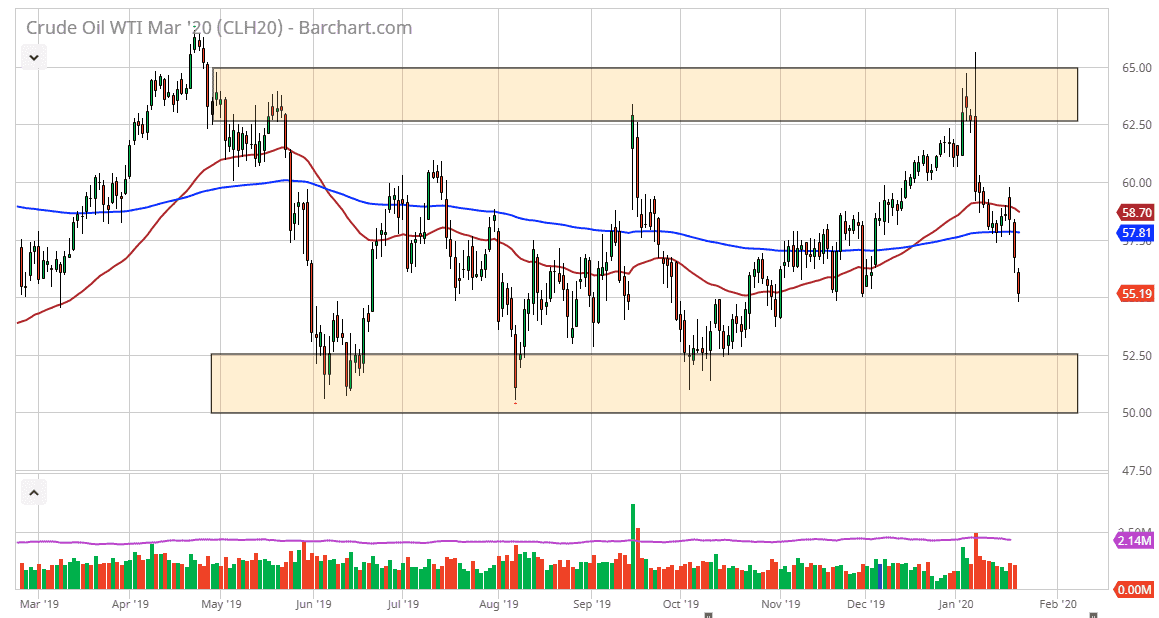

Looking at the overall picture though, you can see that the market has been consolidating between the $65 level on the top and the $50 level on the bottom. Overall, this is a market that is very noisy, but is still hanging in the same general vicinity. Even though we have fallen hard of the last couple of weeks, the reality is that we are still very well within the tolerances of the consolidation of the last several months. That being said, it does look like we are going to try to go to the downside, reaching towards that $52.50 level.

The 200 day EMA has been broken through rather significantly during the trading session on Wednesday, and Thursday is a simple continuation of that. Ultimately, the $55 level should cause a little bit of a bounce, because at this point the market still should see quite a bit of resistance above, especially near the $57.50 level. At this point, I think it’s much easier to buy this market closer to the $52.50 level but this area that we are sitting at right now is a short-term bounce just waiting to happen. At this point in time, it’s likely that fading short-term rallies that show signs of exhaustion will be the best way going forward, and then it’s likely that the market will continue to see a lot of downward pressure. To the upside, if we were to break above the 200 day EMA, it could change some things but it’s very unlikely that we will be able to happen in the short term without some type of economic shot coming out of the Middle East. Keep in mind that the upward pressure of OPEC cutting production isn’t quite enough to overcome the lack of demand. Iit’s very likely that the oversupply of crude oil will continue to be a major issue, and therefore I still favor the downside. Whether or not we can break down below the $50 level is a completely different question.