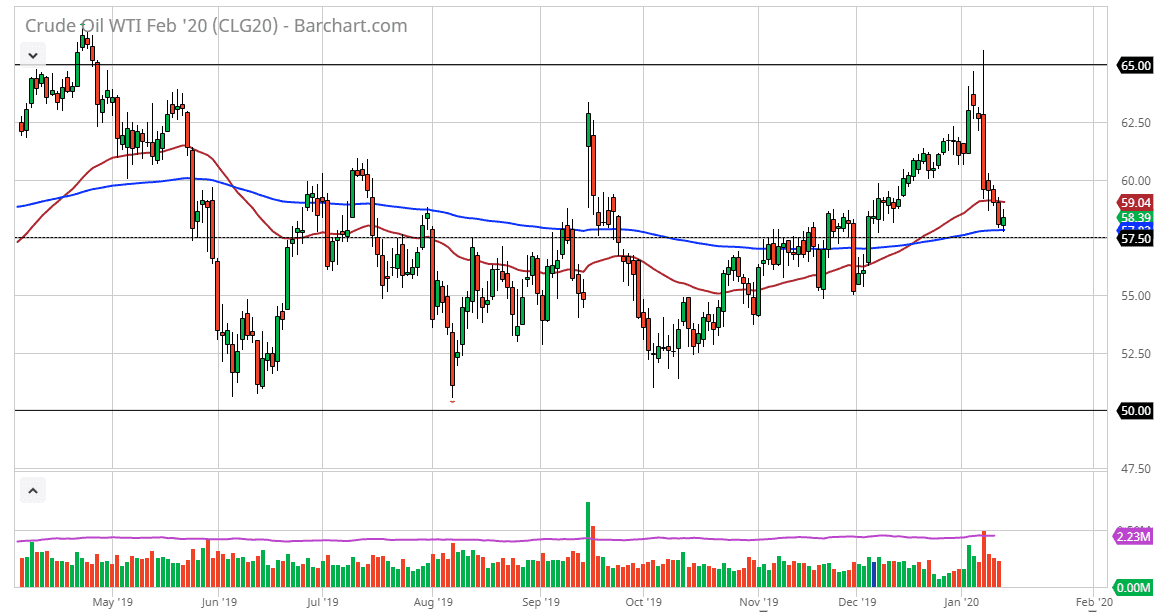

West Texas Intermediate Crude Oil has had a slightly positive session on Tuesday as we continue to hang around the 200 day EMA. That’s obviously an area that will attract a lot of attention, as it is a larger timeframe technical signal that people pay quite a bit of attention to. Furthermore, we are near the $57.50 level, which is right smack dab in the middle of the overall range that starts at the $50.00 level on the bottom and the $65.00 level on the top. In other words, we are essentially priced at “fair value” for the time being.

At this point, the market breaking above the 50 day EMA which is currently at the $59 level could be up positive enough sign to cause a bit of a bounce, but I recognize that the $62.50 level above is rather resistive based upon that massive red candlestick breaking down from there. Alternately, if the market was to break down below the $57.50 level on a daily close, that probably opens up a move down to the $55.00 level underneath. At this point, it seems likely that the market will be making a significant decision rather soon, but at this point we have to wait for that move in order to put money to work, as we are sitting at a level that could break in either direction.

You can make an argument for the market hanging onto a bit of a trend line here, and that does help the bullish case, but it clearly is a market that has been rattled after the calming of tensions between the Americans and the Iranians. With that being the case, there isn’t much concern when it comes to the free flow of oil, and of some type of supply shock. Quite frankly, the Americans tend to use the WTI crude oil market more than anything else, and as a result this market will be somewhat sheltered from Middle Eastern tensions as the Americans can produce all of the crude oil they need. At this point, all you can do is simply wait for an impulsive candle in one direction or the other and follow, using the levels mentioned in this article as potential targets. The 200 day EMA of course is going to catch a lot of attention in general, so having said that it’s likely that we will continue to see a lot of back and forth on short-term charts but eventually will get that move we need.