At the end of last week’s trading, the price of the EUR/USD pair got a new long awaited momentum for the upward correction supporting gains to the 1.0863 level before closing the week's trading around the 1.0847 level, recovering a small part of its recent losses that pushed it towards the 1.0777 support, its lowest in three years . The US dollar fell after the PMI survey data showed that the country's services sector contracted in February after a reading of 49.4, which is much lower than expectations for a reading of 53.0, and this was the first decline in this sector in four years.

Likewise, the Composite PMI - which measures both the manufacturing and services sectors - came below expectations at a reading of 49.6. Commenting on the results, Chris Williamson, chief economist at IHS Markit, said: “Except for the 2013 government shutdown, US business activity contracted for the first time since the global financial crisis in February. Weakness was mainly seen in the services sector, where the first decline in four years in activity was announced, but industrial production was also almost halted due to a drop in demand.

Meanwhile, the country's manufacturing PMI rose to 50.8, which was disappointing against expectations for a reading of 51.5. The disappointing US PMI surveys contrast with the UK and Euro zone opinion polls also on Friday, which exceeded expectations. All in all, the US economy still has superior growth rates comparing to the rest of the world, but recent PMI data casts some doubts on this assumption.

On the other hand, IHS Markit PMI surveys surprised the markets with a stronger than expected rise in February, which raised unlikely hopes that the Eurozone could overcome the Corona virus storm better than expected. The German manufacturing industry does not seem to have rapidly collapsed by the Corona virus in the same way that the Chinese factory sector has seen, given the IHS Markit PMI gauge rose from 45.3 to 47.8 in February. Expectations were for a decrease to 44.8.

However, the Services PMI fell from 54.2 to 53.1, while markets were expecting a decrease to only 53.9. Meanwhile, France's manufacturing PMI fell surprisingly while its services index rose higher, as results pushed both Eurozone purchasing managers sharply higher.

The Eurozone manufacturing PMI rose in February from 47.9 to 49.1, and expectations were for a drop to 47.4, bringing it close to the 50.0 level that separates sector growth from contraction. The Services PMI rose from 52.5 to 52.8 against expectations of reading at 52.4.

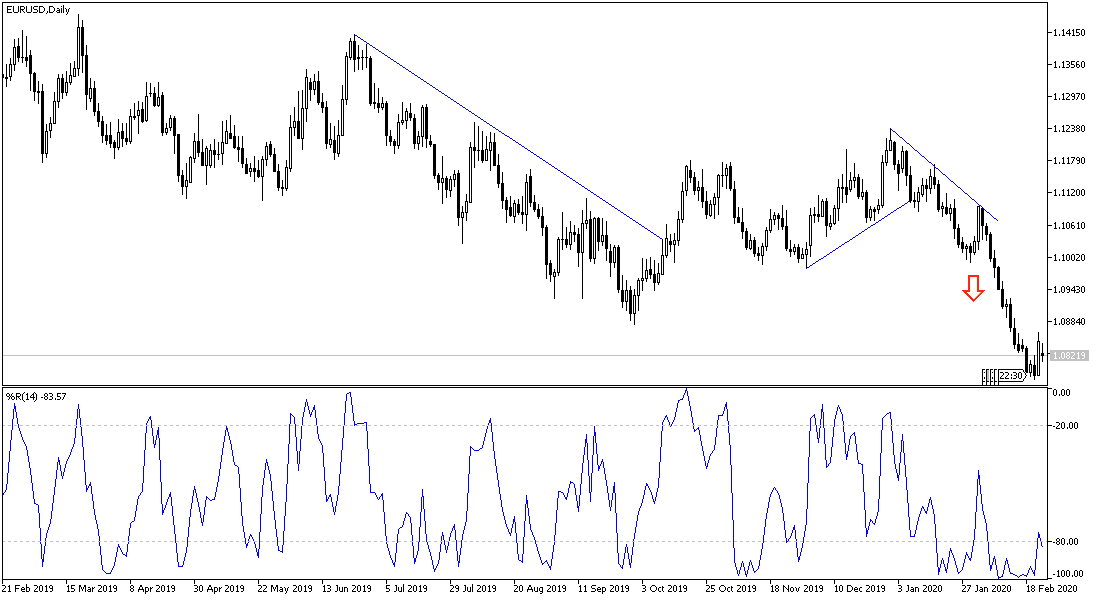

According to the technical analysis of the pair: Despite the rebound in the EUR/USD pair last week, the general trend is still bearish and still needs to break the 1.1000 resistance to start reversing the trend. The Euro lacks the momentum due to the Coronavirus, which added more pressure on the bloc’s economy, which suffered from the global trade war. On the downside, a return to stability below the 1.0800 psychological support, would continue the bearish path, and this could push it to the support levels at 1.0770, 1.0700 and 1.0640, respectively.

As for the economic calendar data: The focus will be on the announcement of the German IFO Business Climate Index. There are no significant US data releases today.