The price of the EUR/USD pair still lacks the necessary momentum to complete the upward correction, which did not exceed the 1.0890 level before settling around the 1.0870 level at the time of writing. Recent losses have pushed the pair towards the 1.0777 support, the lowest level in three years. Concerns about the spread of the Coronavirus outside China after the outbreaks in South Korea, Japan, Italy and other areas, support the US dollar as a safe haven and limit the investors risk appetite. Recently, concerns about more turmoil in global supply chains and aggregate demand have increased, adding to pressure on the fragile European economy.

Italy recently quarantined towns and villages in its northern regions in an attempt to stem the spread of the virus, which is the first sign in Europe of the same kind of turmoil that caused the Chinese economy to stop this year. In contrast, the number of reported coronavirus cases in China is declining, but the economy has been severely affected by this disease after efforts to combat it, which contributed to turning big cities into ghost cities. Traffic in the Chinese capital, Beijing, on Tuesday indicated a 49% drop from normal levels despite efforts by the government and companies to encourage employees to return to work, while risky assets remained weak after recent losses in global stock markets.

As is well known, the Euro, like the Japanese Yen and the Swiss Franc, is a popular financing currency, used to borrow cheaply (due to interest rates) in order to buy higher-yielding but more risky assets. This is a common strategy in stress-free market conditions. The apparent slowdown in China has raised concerns about the global economy, prompting investors to seek bond market value and boost the value of safe havens, while putting pressure on risk currencies. Because Italy is not yet able to eradicate infections, the possibility of the disease spreading to Europe as it did in China could pose a threat to the euro.

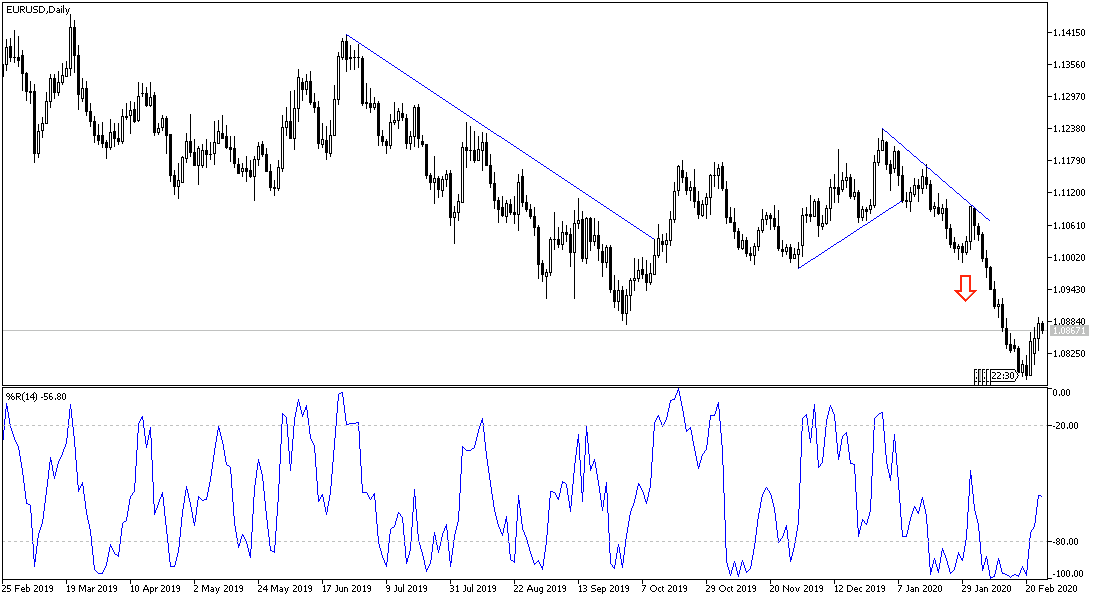

According to the technical analysis of the pair: The EUR/USD pair still needs stronger incentives to complete the correction opportunity, but so far it is unable to move towards the 1.1000 resistance, which is the first stop for the bulls to push the pair out of recent quagmire of losses that culminated in the move below the 1.0800 support. On the long term, Euro is still inside a violent bearish channel. The worsening situation in Italy may weaken the opportunity of the Euro to benefit from the recently improved economic data results.

For the economic calendar data: All focus is on the US session data, when the new US home sales and oil stocks data will be announced.