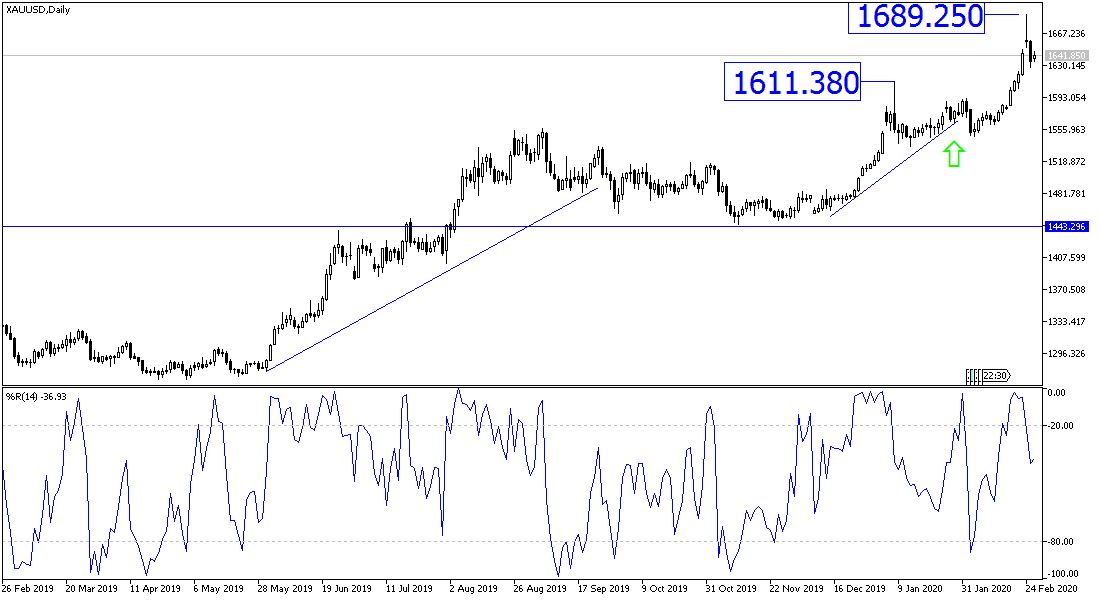

Profit-taking sales were widely expected for a while, but with the rapid movement of gold prices to $1689 an ounce, its highest level in seven years in the beginning of this week’s trading, was the best opportunity to do that. The correction pushed the price of an ounce of gold to the $1628 support before returning to the $1645 level at the time of writing. Gold is still receiving more support due to the outbreak of the Corona epidemic to 34 countries around the world led by China. The recent retreat is an opportunity for gold investors to return to buying, as reaching a vaccine to eradicate the epidemic is still a long way off. Longevity of the disease increases pressure on global economic growth. The major global companies issued a bleak forecast for sales and revenues for the first quarter of 2020. The scene may get darker if this epidemic continues for the second quarter.

The coronavirus, has infected more than 80,000 people and caused the deaths of more than 2,700 people. Of course, China was topping those numbers. The panic that hit the world was because the source of the epidemic was from the second largest economies in the world. The Chinese government attempts, almost daily, to stimulate the economy, supporting the affected companies, and motivates people to gradually return to the closed factories. But the stoppage remains a feature of the Chines situation.

In Japan, where the infection cases increased, a spokesman for the Japanese government said on Wednesday that the International Olympic Committee and local organizers are moving ahead as planned with the Tokyo Olympics despite the Coronavirus threat. The comments of Yoshihide Suga's spokesperson followed the confirmation of Richard Pound, a veteran member of the International Olympic Committee, that regulators have been monitoring the situation for three months to determine the fate of the games. The Olympic Games are scheduled to open on July 24, with 11,000 athletes participating. Pound told the Associated Press that the rapidly spreading virus could cancel the Olympics. Suga says Pound's opinion does not reflect the official view of the International Olympic Committee, which has repeatedly said that there are no plans to cancel or postpone the Tokyo Games.

This important event was not the only one threatened to be canceled because of Corona, as many festivals, conferences and festivals were canceled for fear of the spread of the epidemic in these gatherings, which would have an economic impact as well.

According to the technical analysis of gold today: Moving towards the $1625 level may be the beginning of a fresh start for gold prices to move in the path of a stronger bullish channel, which still supports the possibility of testing new highs. The $1715 resistance may be the next bulls’ target. A reversal of the trend will not happen without moving below the $1600 level. At the same time, I still prefer to buy gold from every downside level. The elimination of the epidemic will take time, and gold will also receive additional support from the mysterious future of Brexit, the slowdown in the European economy and the global central banks beginning easing their monetary policy.

Gold will react to the US economic data, with the most prominent being new home sales. This is in addition to updating the human and economic losses figures due to the Corona virus.