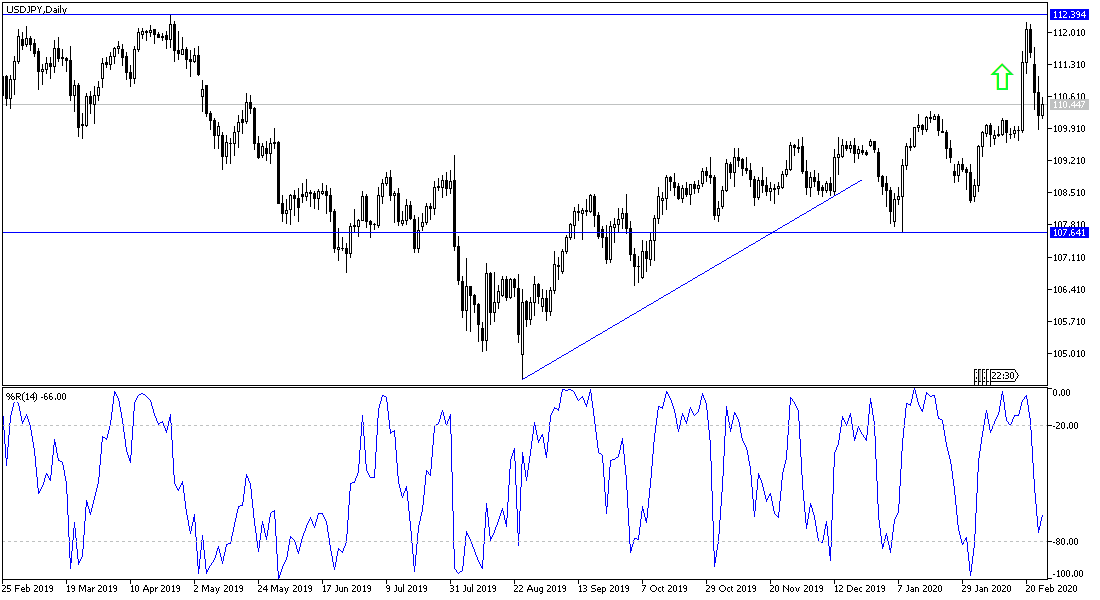

USD/JPY gains evaporated quickly and the pair retreated to the 109.88 support during yesterday's session before settling around the 110.37 resistance at the time of writing the analysis. Gains by the end of last week were launched towards the 112.22 resistance, supported by heightened fears of the Corona outbreak in Japan. The Japanese yen has returned to show its strength and that it is the preferred safe haven asset in light of the continuing global anxiety of the Corona pandemic, which spread to 34 countries around the world from China, the source of the epidemic, the longevity and spread of the virus is a strong and explicit threat to global economic growth. Corona has proven to the world that it is more lethal and more widespread than previous viruses. The world has not yet found a vaccine to end the virus, which increases the number of infections and deaths around the world.

China is trying to persuade people to return to work in factories that stopped and support companies with the damage caused by the Coronavirus. But companies and economists say it may take months before Chinese production returns to normal, with the biggest problem being supply chains. China lacks raw materials and workers after the most intense disease control measures imposed shutting down factories, cutting most access to cities with more than 60 million people and imposed travel restrictions.

The COVID-19 virus has so far caused 8,038,38 cases in 34 countries and 2,700 deaths, according to the WHO statement. While the number of new daily cases in China is declining, the number of new countries reporting cases of the virus is increasing, as the epidemic is transmitted strongly in Japan, South Korea, Italy and Iran and to less varying degrees in other countries.

On the economic level. Consumer confidence in the United States improved slightly in February, rising to 130.7, the highest reading for the index since August. Conference Board confirmed yesterday that the consumer confidence measure rose from a revised reading of 130.4 in January. The January reading was revised down from the initial estimate of 131.6. Consumers' views about the current state of work conditions and the job market declined this month, but their expectations for the future rose.

Lyn Franco, an economist at the Conference Board, said consumers continue to see expectations as favorable, and when combined with strong employment growth, this should be enough to support continued spending and economic growth in the near term. Consumer spending has been the driving force in current economic growth, and is now in its eleventh year.

Other analysts have indicated that this survey came too early to get a good read on the impact of the escalating Corona Virus outbreak in China. But many said that due to high confidence during the trade war between the United States and China, among other shocks, the virus may not have much effect as long as the stock market will recover in the coming days.ֿ

According to the technical analysis of the pair: Stability of the USD/JPY above the 110.00 resistance will continue to support the bullish trend in general. The pair needs to break through that level to return to the recent gains. On the downside, any movement below the 109.00 support is a confirmation of bears controlling performance. We currently prefer to buy the pair from every low level. Developments in China regarding the Coronavirus will create the safe heaven challenge in this pair.

For the economic calendar data: All focus is on US economic data; new home sales and crude oil inventories.