Bitcoin initially shot much higher during trading on Monday, as fears about the coronavirus continue to have people trying to hide their money in alternative investments. There is a certain amount of flow that comes out of China regardless, and then the fact that people will have been trying to protect their wealth during the latest economic shock makes quite a bit of sense that we would see Bitcoin move.

Bitcoin

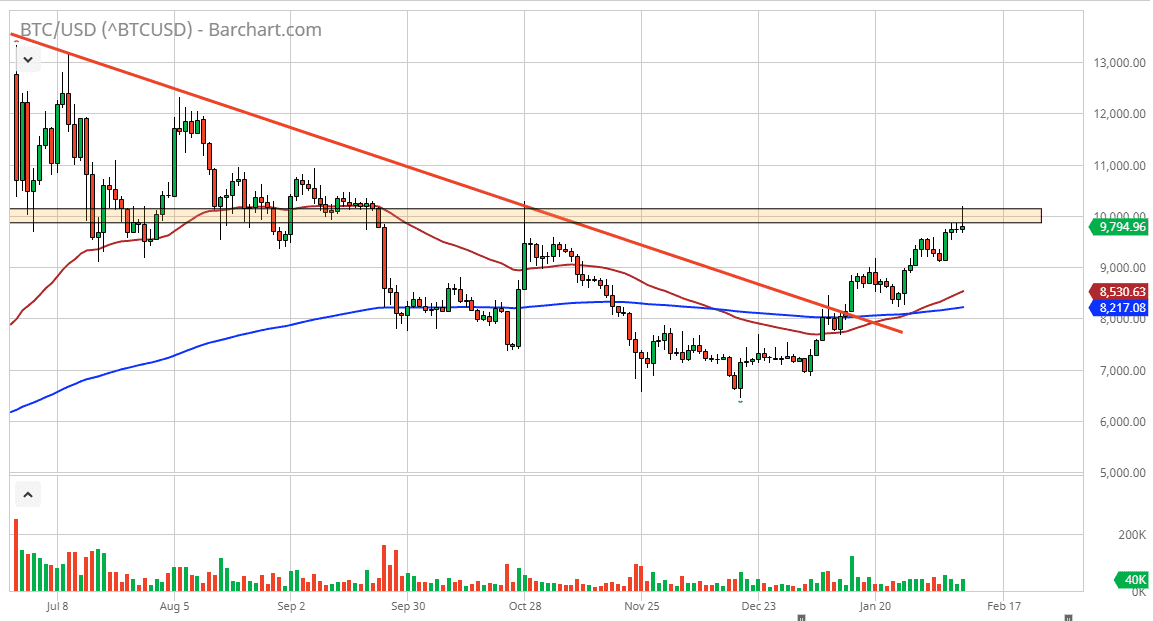

Bitcoin initially rally during the trading session on Monday, spiking well above the $10,000 level, an area that I have been talking about for some time. Now that we have seen the market break above there and then break back down below it, we have formed what is known as a shooting star. This is a very bearish signal, although it doesn’t necessarily mean that the world is going to fall apart for crypto. What I do think it means is that we could very well get a bit of a pullback. If you remember on Friday, I had suggested that perhaps the market was going to pull back from the bullish candlestick or if we get close to $10,000 above, and it now seems as if we are ready to do so. I had also stated that $10,000 probably wasn’t a level that gets broken above the first attempt.

On a break down below the bottom of the candlestick it’s very likely that this market will go looking towards 9504 support and then possibly as low as 9100 which is essentially the bottom of the candlestick from Thursday. At that point, it’s very likely that value hunters will come back in and try to push this market higher.

Having said all of that, there is an alternate scenario and that is one that the market turned around and breaks above the top of the candlestick that just formed. By breaking the top of the shooting star, it shows that there is a huge push to the upside, and therefore a major breakout. You need to think of it in terms of the market not only breaking out above the psychologically important $10,000 level, but also the fact that it would be breaking above the highs from the previous session that had seen so much selling pressure. I do think we eventually break out above there, but it may take some time to happen and therefore a pullback is very likely going to be something that a lot of Bitcoin traders take advantage of.