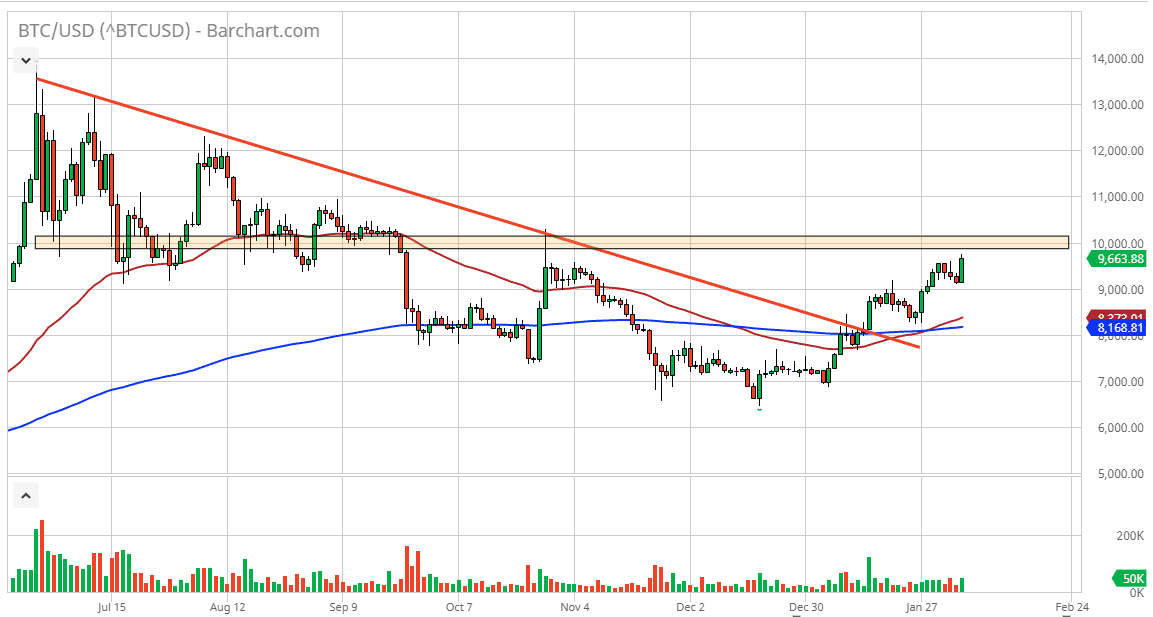

Bitcoin has rallied significantly during the trading session on Wednesday, breaking towards the $9600 level and beyond. It now looks as if the market is ready to reach towards the $10,000 level above, which is a significant round figure that will attract a lot of attention. This is an area that has seen buyers and sellers in the past, as it was the bottom of a major descending triangle. Having said that, the 50 day EMA has broken above the 200 day EMA recently, which is a longer-term bullish signal. The strength of the candle is rather impressive, but I do anticipate that the $10,000 level is going to be difficult to slice rate through. I think that the market will probably pull back multiple times are poor broken through there, but if it does slice through the $10,000 level rather quickly, the market is likely to go towards $11,000 next.

Underneath, it looks as if the $9000 level is going to offer temporary support, but I think there is even more support underneath at the 50 day EMA and most certainly at the 200 day EMA. We had recently broken above a major downtrend line, and now it looks as if we are trying to change the overall longer-term trend to the upside but at this point it will be interesting to see how the Chinese affect comes into play.

Recently, several of the rallies that we have seen in Bitcoin has been due to the Chinese trying to send money out of the country. It’s very likely that the coronavirus has played some part in this situation again, as the wealthy Chinese tend to use Bitcoin as a way to get money out of the situation before monetary controls come back into play. All things being equal though, the $10,000 barrier is going to cause quite a bit of struggle in this market all things being equal.

If the market turns around though, I think that there are multiple areas that could cause issues as far as selling is concerned, so keep in mind that the selling of Bitcoin is going to be a bit difficult in the short term. All things being equal, it’s very likely that the market will be very noisy, but obviously the buyers have had the upper hand as of late. It appears that Bitcoin has been used more as a transmission for crossing borders these days than anything else.