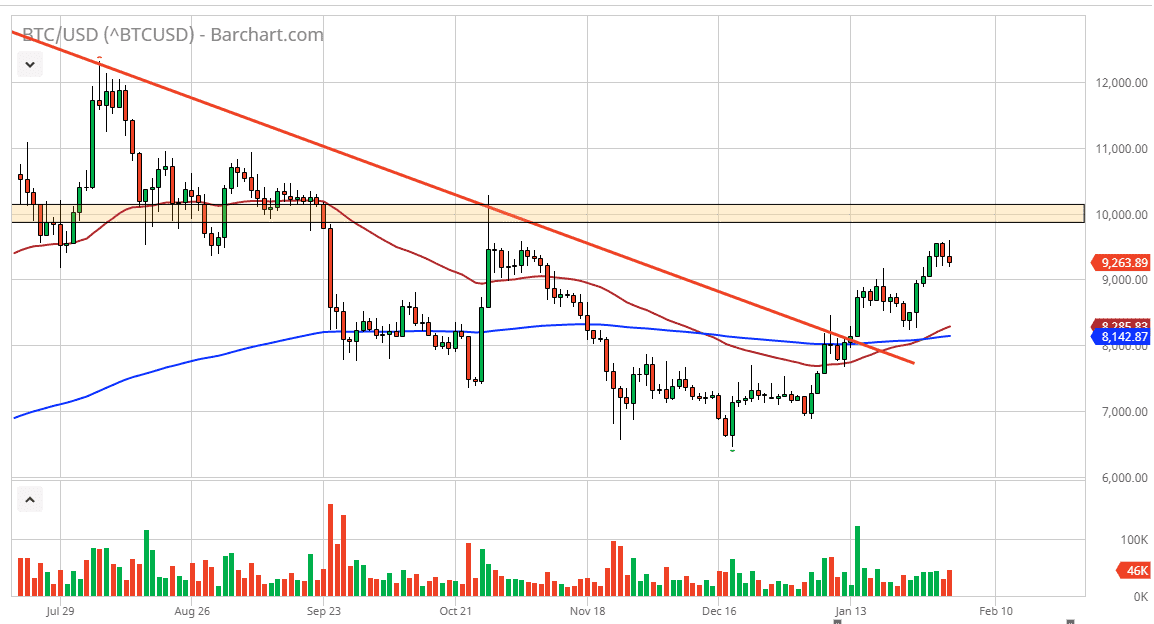

Bitcoin went back and forth during the trading session on Monday, as we continue to see a lot of noise when it comes to financial markets in general. At this point, the market is likely to pull back a bit though based upon the candlestick for the trading session on Monday, and quite frankly we are a little bit overdone at this point. The $9000 level underneath will probably offer a bit of support, as it was the most recent highs, and of course the figure is also a large, round, psychologically significant level in the market anyway.

That being said, it would be surprising at all to see the market reach down towards the 50 day EMA, as it takes a bit of a breather when it comes to the grind higher. At this point though, I do believe that Bitcoin is probably going to go looking towards the $10,000 level above. That’s an area that obviously has a lot of psychological importance built in, and of course an area where we had seen a significant amount of support. Now it should offer a significant amount of resistance, as it is a phenomenon known as “market memory” that will come into play. The 50 day EMA has recently crossed the 200 day EMA, so that forms the “golden cross.” This is a longer-term technically bullish signal, but it does tend to be a bit of a laggard.

The market more than likely will show quite a bit of volatility, but I still believe that there is a buying opportunity on dips. However overall, if the market reaches towards the $10,000 level, at that point I think it will be very difficult to break out. If it does, then Bitcoin would more than likely take off for a much bigger move. The $10,000 level will be crucial, and at this point the easiest trade is to try to buy it on a dip, that way you have enough real estate to make profits before you even get to the $10,000 level. However, if the market breaks down below the $8200 level, then it would kill the uptrend. Right now, I do not anticipate that, but I think a bit of a pullback is probably the healthiest thing that buyers will look towards, as it would give the markets the ability to build up enough momentum to make that charge towards the $10,000 level.