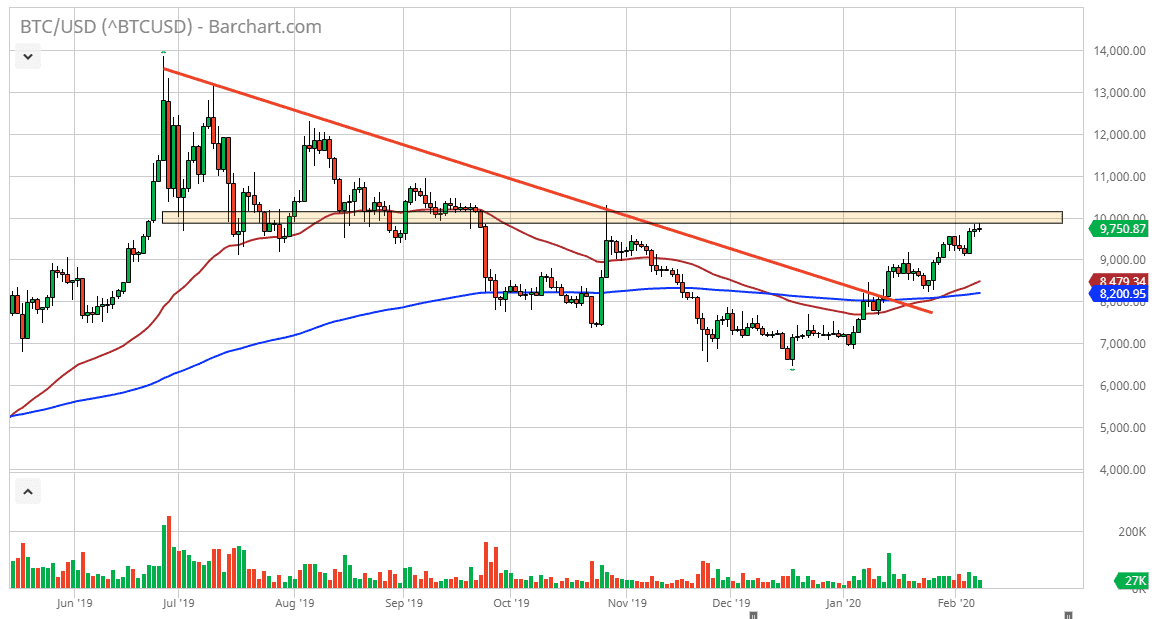

Bitcoin markets were relatively quiet during trading on Friday, as the market sits just below the $10,000 region. The candlestick was very quiet, and the range was very small, suggesting that perhaps there is a bit of a pause before trying to take out that large, round, psychologically significant figure. Ultimately, this is a market that has been rallying for some time but now is starting to approach a significant resistance barrier in the form of that figure. This sets up the market for short-term pullback, but it does look as if the market is trying to find enough momentum or at least a reason to finally go higher.

One of the biggest drivers of Bitcoin rallied a bit at this point I believe is that the Chinese are trying to get money out of the country. We’ve seen this before, and the most recent break out above the downtrend line does coincide roughly with the timeline of headlines coming out of China involving the coronavirus, so although the coronavirus itself shouldn’t directly affect the value of Bitcoin, the reality is that those who have the ability to do so are probably sending money out of the country right now. The Chinese government is notorious for putting capital controls on its populace, so Bitcoin has been used as a vehicle to get money out of the country for some time. At this use of Bitcoin has been quite effective in the past, so there’s no reason to think that it will be any different now.

That being said, if we do get a pull back, it’s the $9000 level that looks to be very supportive. However, if we were to turn around and simply break higher the you have to pay attention to that as well. A daily close well above the $10,000 level would signify that the market was ready to go looking towards $11,000, followed very quickly by $12,000 in my estimation. The 50 day EMA is starting to curve higher at the $8500 region, and it looks as if it will coincide with the $9000 level relatively soon. I would have no interest in shorting Bitcoin at this point, because the momentum is most certainly with the buyers. However, if the market was to break down significantly below the 200 day EMA, then it could change the overall attitude of the market.