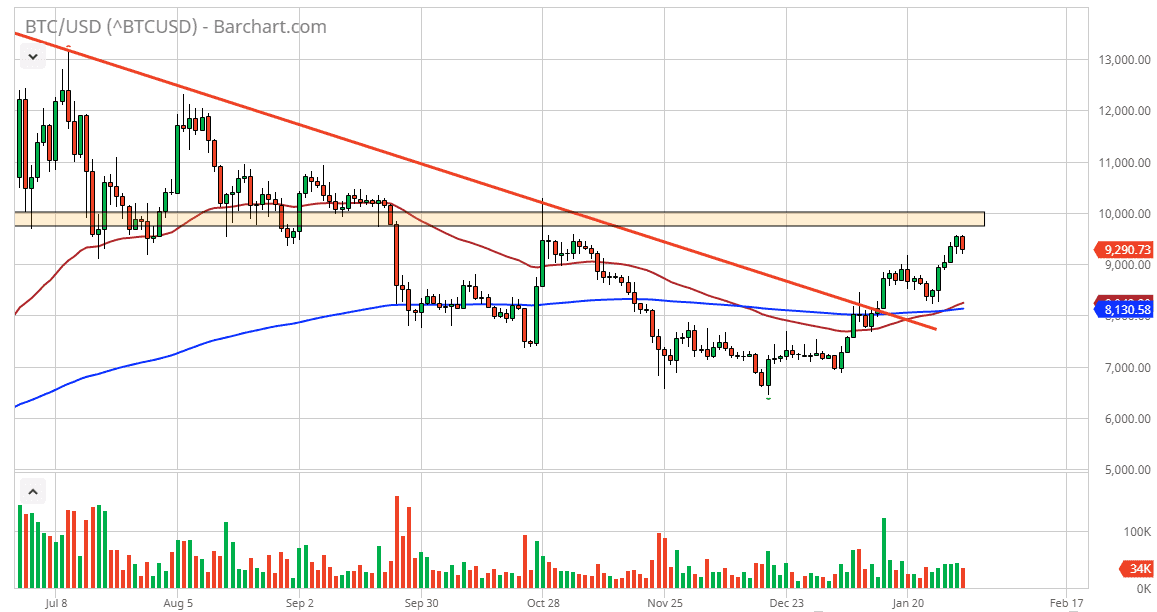

Bitcoin markets have fallen a bit during the trading session on Friday, pulling back from the $9500 region. This is an area that begins significant resistance that extends all the way to the $10,000 level, so it’s not a huge surprise to see a little bit of a pullback at this point. Recently, we have seen bullish pressure on the Bitcoin market, as we have not only cleared the $9000 level, but previously had seen the 50 day EMA cross above the 200 day EMA, the so-called “golden cross.” That being said, it doesn’t mean that we need to go straight up in the air forever. It’s not a huge surprise at all to see the market pull back from this area as it has been resistance previously. It also had been supportive so chalk this up to “market memory”, and the fact that the $10,000 level is such a large, round, psychologically significant figure.

All things being equal though, this pull back is probably somewhat limited in its scope, as I think the $9000 level will probably offer short-term support, but even if we break down below there the 50 day EMA will probably come into the picture as well. While I do think that Bitcoin pulls back from here it’s not necessarily going to be a signal to start selling in the short term. However, the market was to turn around a break above the $10,000 level, it’s likely that the market will continue to go much higher, as it would be a psychological hurdle to overcome. That being said, if it happens over the weekend it carries much less weight, as we can trading tends to be rather thin. In the short term, a pullback probably offers an opportunity to get involved, but pay attention to the value of the US dollar because it is the other side of the equation, and we will need to see whether or not it is relatively strong.

Keep in mind that most of the alternative coins out there have yet to catch up, so the real trade may be to pay attention to Bitcoin, and then start buying something like Ethereum or even Stellar. After all, Bitcoin does tend to drive the markets overall, and it’s very likely that the rest of the markets will eventually try to reach towards major resistance barriers such as Bitcoin is doing so right now.