The Bitcoin market has fallen rather hard during the trading session on Monday, losing almost 7% by the end of the session. The $10,000 level has caused a bit too much in the way of trouble for the market, as Bitcoin had certainly gotten overbought. One of the highlights of the session was that someone liquidated a $2 million Bitcoin position, causing a lot of volatility. Ultimately, that has been the game when it comes to crypto, traders will come in and pick it up when it’s cheap and then dump it off to retail traders at higher levels. One only has to look at longer-term charts to see that fact.

Bitcoin also has lost a major catalyst, or at least is starting to. Money flowing out of China will be slowing down now that the coronavirus is starting to slow down and people are starting to question whether or not it truly is some type of massive sea change when it comes to the global economy. Granted, it of course will be disruptive, but money flowing out of China seems to be slowing down. Chinese traders typically will throw money into the bitcoin market to avoid capital controls in the mainland, bypassing the Chinese Communist Party if at all possible.

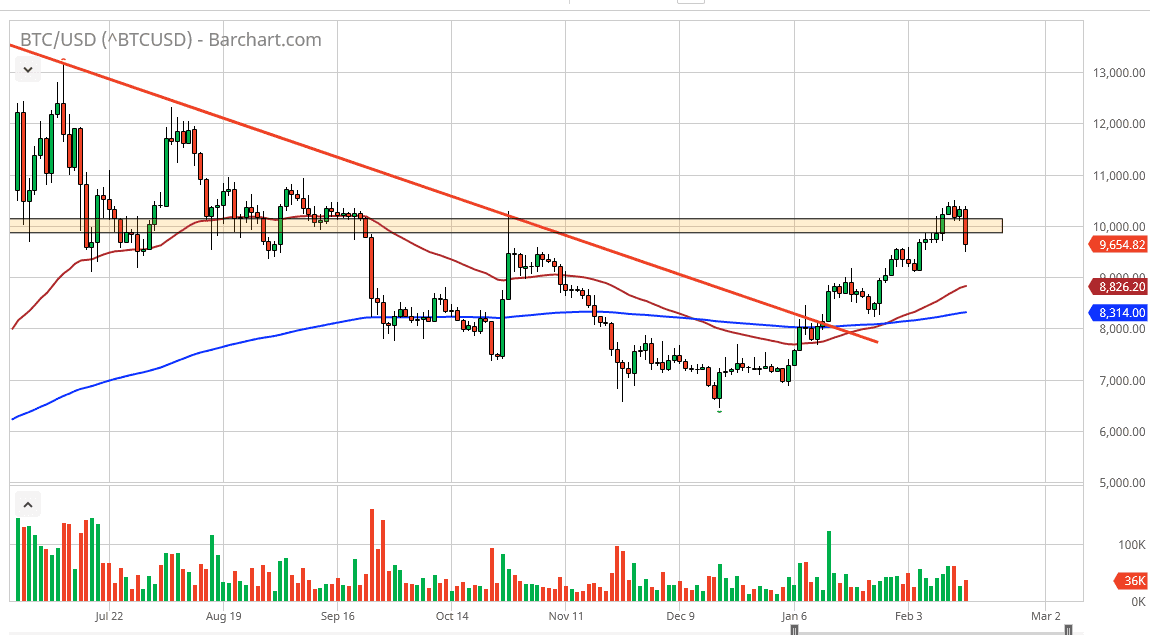

That being said, and the fact that the candlestick is very bearish, isn’t quite enough to get me looking for Bitcoin to break apart though. I think the pullback makes quite a bit of sense considering that it had been far too bullish, and overvalued. The 50 day EMA is reaching towards the $9000 level, and I anticipate that might be where we go before it’s all said and done. If you remember, I had previously suggested that a pullback from the $10,000 level might be possible, and quite frankly healthy. This might just be that pullback. It would essentially be a 10% pullback by the time it was all said and done, something that’s quite common in markets that are in a healthy trend. However, the market breaks below the $9000 level, then we need to start rethinking some things. Obviously, if the market was to break above the top of the last couple of sessions, then Bitcoin is ready to go towards the $11,000 level above which I see as the next major resistance barrier. While Bitcoin is still very bullish looking in general, Monday’s candlestick certainly will have rattled a few nerves.