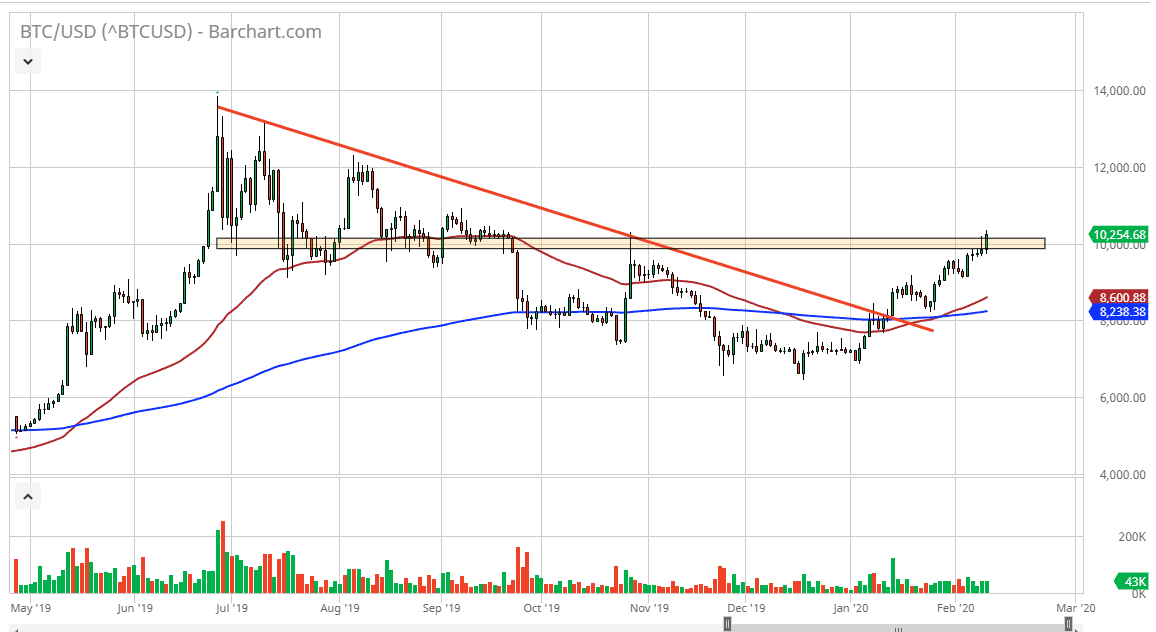

The Bitcoin market has rallied quite significantly during the trading session on Tuesday, breaking above the shooting star from the Monday session. Remember that I suggested that the $10,000 level would cause a bit of a pullback, but also mentioned that if we break above that shooting star it would be an extraordinarily bullish sign. At this point, it now looks as if the market has decided to reach to the upside. Overall, I believe that the Bitcoin market is ready to go towards the $11,000 level, and then towards the $12,000 level after that.

If we were to break down below the bottom of the range for the Monday and Tuesday candles, then we could go looking towards the $9100 level which is the pullback that I suggested could happen. Because we have not done that and everybody who had tried to short the market on Monday are now underwater, it’s likely that we will see a continued chase to the upside.

That being said, you should also pay attention to the fact that the 50 day EMA has broken above the 200 day EMA, which sets up a “golden cross.” That is a very bullish sign for longer-term traders, so therefore more of a “buy-and-hold strategy” may be starting up with longer-term traders now. They are normally a bit late to the party, but they tend to be large in size. The $12,000 level was significant resistance previously, so I do think that there is going to be a major fight once we get there but at this point it looks as if the market is in fact certainly trying to get to that level.

Pullbacks offer value, as the market is likely to continue to find buyers on these dips. As far as selling is concerned, the market needs to break down below the 50 day EMA which is painted in red on the chart in order to feel comfortable doing so, and at that point it would probably open up the door to the $8000 level, and then eventually the $7000 level. That being said, as long as there are fears in China, money will flow out of the mainland and into Bitcoin.