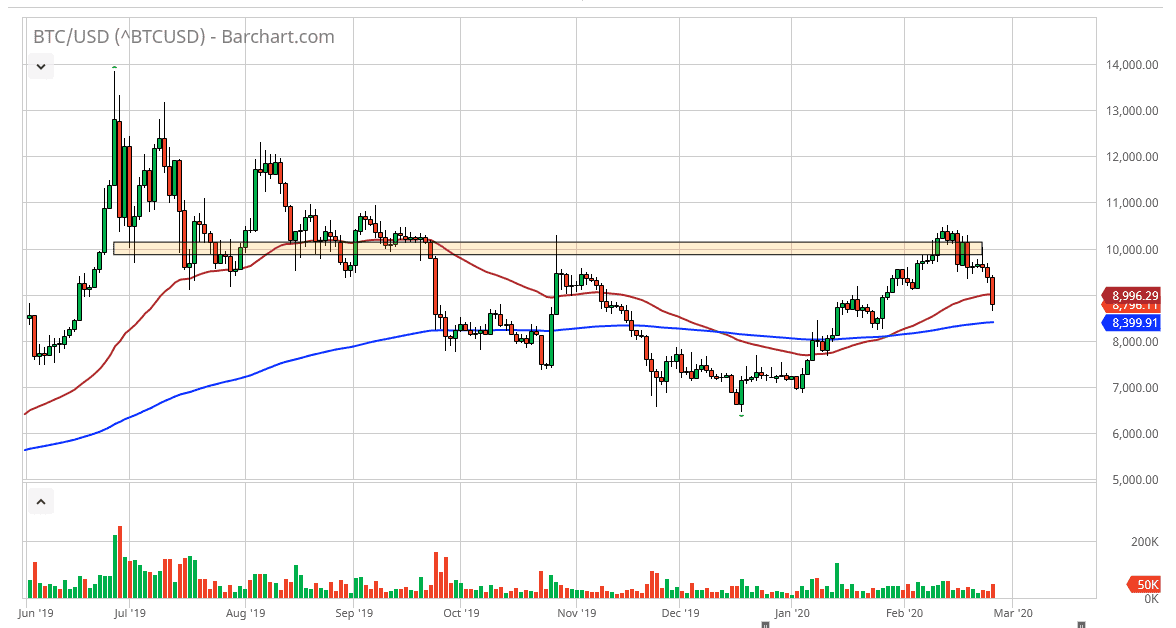

Bitcoin has broken down significantly during the trading session on Wednesday, breaking below the 50 day EMA. The candlestick is rather negative looking, and it appears that the market is going to go looking towards the 200 day EMA underneath at the $8400 level. The fact that we have broken through the 50 day EMA is a bit surprising considering how bullish Bitcoin had been, but I think money has already left China to get away from the economic damage, and this is simply another sign just how important China is for Bitcoin.

Ultimately, this is a market that could be going as low as $7000, especially if we do slice through the 200 day EMA. The $8000 level could offer a little bit of psychological support, but at this point it seems very unlikely to be as important as the 200 day EMA. Furthermore, it should be noted that the US dollar is finding a bit of strength against most currencies around the world, and by extension the Bitcoin market has fallen as well.

To the upside, if the market does turnaround it’s likely that the $10,000 level could offer resistance, as the market recognizes that level as a large, round, psychologically significant figure. At this point, the market is starting to test its mettle, as this is a point in time where Bitcoin needs to recover or it’s facing a significant break down. Rallies at this point do look a bit suspicious, so as far as buying is concerned, I would need to see some type of bullish candlestick or support of bounce on the daily timeframe in order to get involved.

At this point, the daily candlestick does look like it’s going to close at the very bottom of the range, so therefore it looks like the market probably has more downward pressure than up. Closing at the bottom of the range of course is a negative sign so I do believe that there is still a little bit of selling coming, and that’s why I am a bit hesitant to simply jump back into this market and start buying. Either way, pay attention to the US dollar in the Forex world, because if it does strength and then it should continue to cause negative waves over here as well. At this point, it’s likely that the volatility is just starting.