After a massive advance across the cryptocurrency sector led by industry bellwether Bitcoin, volatility started to expand as price action approached key resistance levels. While a Golden Cross, the move in the 50-DMA (daily moving average) above the 200-DMA, is receiving ample social media attention, it is pre-mature to confirm this bullish development. It may be a false signal, prone to a reversal. The violent near-$1,000 price plunge in less than sixty minutes, after the BTC/USD lost momentum inside of its resistance zone, is evident that more downside cannot be ruled out.

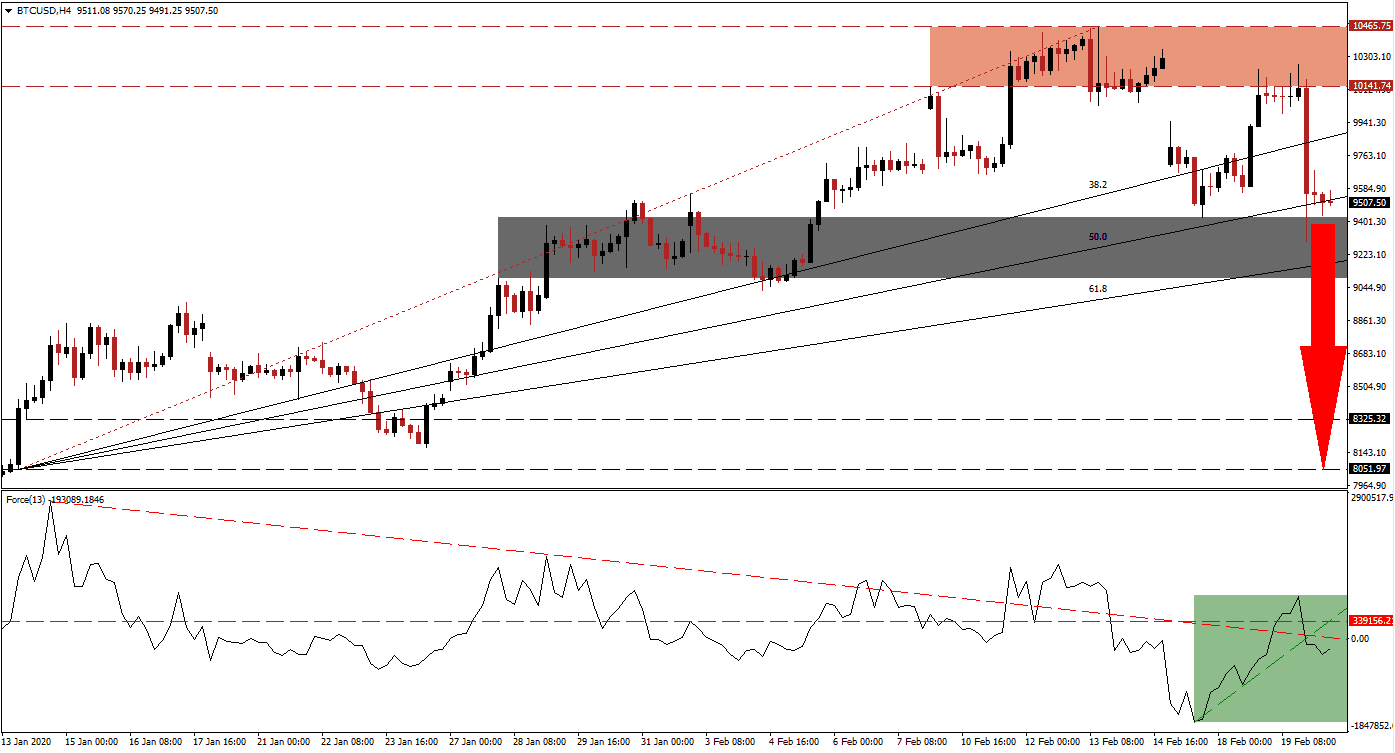

The Force Index, a next-generation technical indicator, indicates the absence of bullish momentum to extend the current advance. Over the past four weeks, as the BTC/USD pushed to a fresh 2020 high, the Force Index recorded a series of lower highs. A negative divergence formed but was briefly interrupted before exercising its dominance. This technical indicator has now converted its horizontal support level into resistance, while also moving back below its descending resistance level, as marked by the green rectangle. Adding to bearish pressures is the contraction below its ascending support level, granting bears control of this cryptocurrency pair after a drop into negative territory.

Following the breakdown in price action below the key psychological 10K level, sell-orders piled into this cryptocurrency pair. This level is embedded into the resistance zone located between 10,141.74 and 10,465.75, as marked by the red rectangle. The initial breakdown resulted in a massive price gap and was reversed by its ascending 50.0 Fibonacci Retracement Fan Support Level. The second rejection by the bottom range of its resistance zone is enforcing a short-term bearish scenario in the BTC/USD. You can learn more about the Fibonacci Retracement Fan here.

This cryptocurrency pair is now positioned to challenge its short-term support zone located between 9,095.00 and 9,423.86, as marked by the grey rectangle. A breakdown is favored to materialize, as a bearish chart pattern is forming through lower highs and lower lows. One key level to monitor is the intra-day low of 9,296.60, the low of the violent contraction in price action. A breakdown below this level is anticipated to spark the next phase of the corrective phase. The BTC/USD will face its next long-term support zone between 8,051.97 and 8,325.32.

BTC/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 9,510.00

Take Profit @ 8,060.00

Stop Loss @ 9,950.00

Downside Potential: 145,000 pips

Upside Risk: 44,000 pips

Risk/Reward Ratio: 3.30

A breakout in the Force Index above its steep ascending support level, currently temporary resistance, is favored to allow the BTC/USD to retake the 10K psychological resistance level. Price action will then be cleared to push out of its resistance zone and accelerate farther to the upside. The long-term outlook remains cautiously bullish, but the third having-event of Bitcoin in May could have a negative impact on this cryptocurrency pair, unlike the preceding ones that sparked rallies to new all-time highs. The next resistance zone to monitor is located between 11,190.00 and 11,521.74.

BTC/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 10,400.00

Take Profit @ 11,500.00

Stop Loss @ 9,900.00

Upside Potential: 110,000pips

Downside Risk: 50,000 pips

Risk/Reward Ratio: 2.20