The Bitcoin market has initially tried to rally during the trading session on Wednesday but failed to continue going higher and hang on to the gains. This isn’t much of a surprise, considering that the $10,000 level attracts a lot of headline attention, and therefore will bring a lot of buyers and sellers back into the marketplace. That being said, it would not be surprising at all to see this market simply go back and forth during the next couple of days as we tried to discern whether or not the Bitcoin market can continue the bullish run that they have been in.

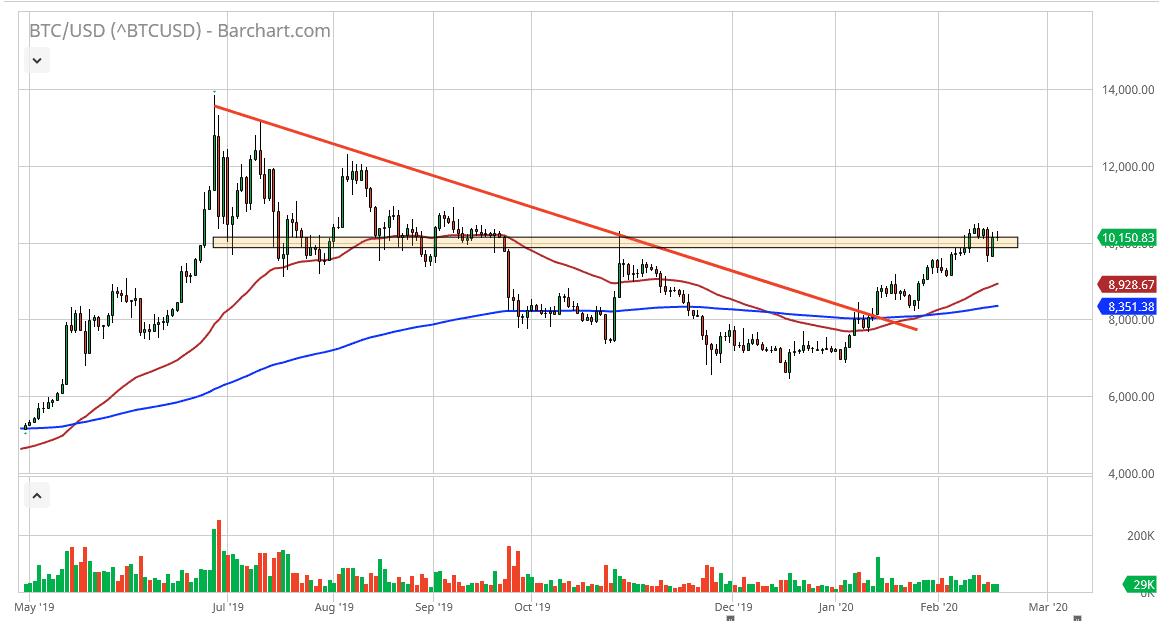

The 50 day EMA is starting to turn higher again, so give it enough time it should offer plenty of support. It is colored in red on the chart and had recently crossed above the 200 day EMA which of course forms the so-called “golden cross” that attracts a lot of attention. Underneath, the market has plenty of support near the $8000 level underneath as well, and I would consider that to be massive as far as the ability to offer a “floor” in the market. That being said though, we will have to pay attention to the next couple of candlesticks to see if there is an impulsive candlestick that we can get involved in.

If the market breaks the last several highs that have been formed over the last couple of candlesticks, then the market is likely to go to the $11,000 level, and then possibly even the $12,000 level after that. Bitcoin had gotten quite a bit of a boost from the Chinese outflows, and now people are going to start looking towards the halving in the month of May, which could help as the reward for solving a block will bring down the supply of coins, or at least the rate of new coins. Nonetheless, Bitcoin has been working along the lines of gold lately, as central banks around the world look likely to continue liquefying the markets. However, if the market gets a long red candlestick, then it’s possible that we could roll over but that is something that I will base upon a daily close and not just simply breaking a particular number. At this point, I believe that we are likely to see a lot of choppiness, so be patient and wait for the market to make up his mind before putting money to work.