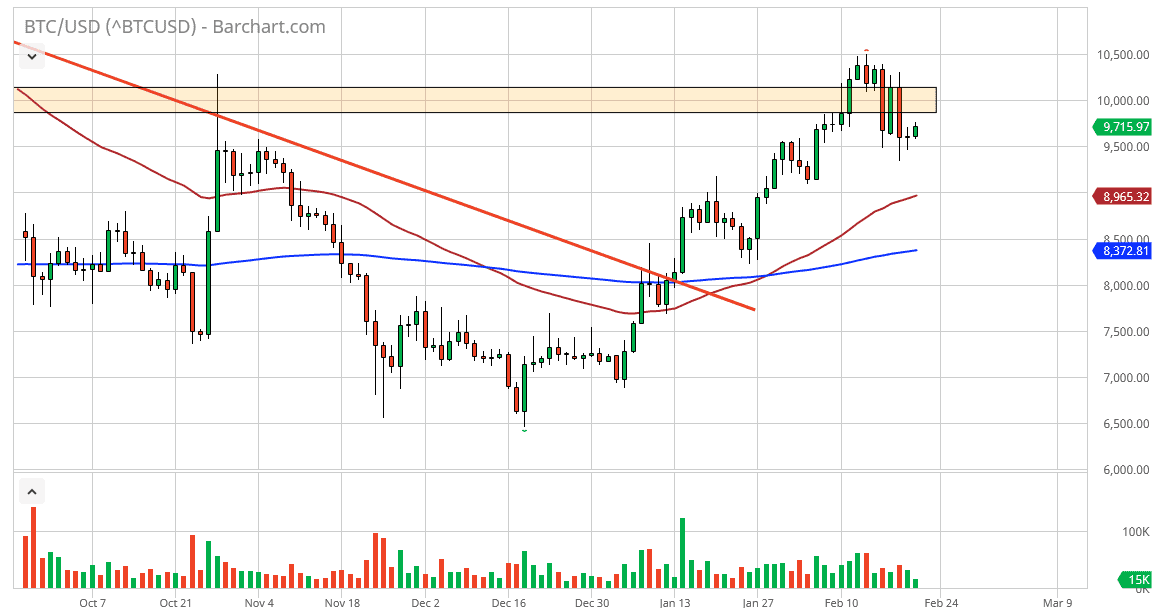

Bitcoin rallied slightly during the trading session on Friday, showing signs of life again at the $9500 level. This is an interesting area to pay attention to as the market has gone back and forth between the $10,500 level in the $9500 level. This is extensively making the $10,000 level the magnet for price, so it’s very likely that the market will continue to go back and forth here. The Thursday candle is a bit of a hammer, bouncing from that $9500 level. The market will more than likely go looking towards the $10,000 level initially, and then perhaps higher than that. This looks a lot like a market that is ready to consolidate in general, so don’t be surprised at all to see it do just that over the weekend.

Bitcoin has gained a bit due to the outflow of currency from China, but it has also been a bit of a safe haven asset lately. In fact, the entire crypto currency markets got a bit of a boost from money looking for a home. As long as the coronavirus situation continues to be a major issue in China and worse yet, further beyond its borders, it’s likely that crypto currency will get a bit of a bid. Beyond that, there is also the halving in May that some people are banking on driving up the price of Bitcoin but regardless of what the scenario you look at, it appears that there are a lot of things lining up for Bitcoin at the moment.

The technical analysis suggests that the 50 day EMA, currently trading just below the $9000 level, should continue to reach towards the $9500 level and offer a bit of a boost as well. To the upside, I think that it might be a bit difficult to break above the $10,500 level during the weekend, but sometime next week it could be very possible. The alternative scenario is that we break down below the 50 day EMA and go looking towards the 200 day EMA where we would have to rethink some things. What’s particularly impressive about this is that Bitcoin is rallying at the same time that the US dollar is, showing it as a safe haven asset currently. Ultimately, this is an area that has been massive resistance in the past so it’s not a huge surprise to see it offer some at the moment.