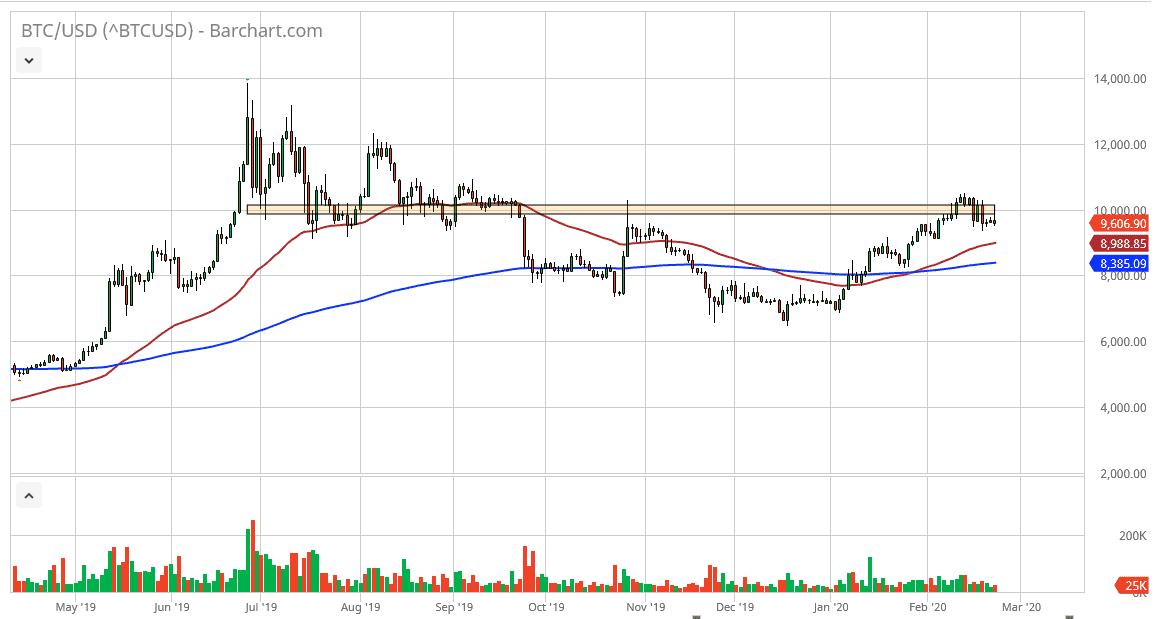

The Bitcoin market initially tried to rally during the trading session on Monday, but as you can see failed at the $10,000 level yet again. Ultimately, this is a market that I think is going to continue to have issues at the $10,000 handle, as it is a large, round, psychologically significant figure. By failing there yet again, it does suggest that perhaps we are to pull back a bit, but what I also see as potentially negative is the shape of the candlestick, although not a classic “shooting star”, it does suggest that the sellers are getting much more aggressive.

Looking at this chart, the 50 day EMA is roughly around the $9000 level, and therefore that could be the initial target. If we break down below there, then the market is likely to go towards the 200 day EMA underneath at the $8400 level. Ultimately, the market should continue to see buyers underneath eventually, but we have rallied a bit and it looks as if the market is simply getting exhausted. Furthermore, most of the reason the market had been rallying as of late was money escaping from China, and quite frankly that seems to have decelerated as of late. Also, something that crypto traders don’t pay attention to, is that this is the same as a Forex pair. You are trading the Bitcoin market in relation to the US dollar. The US dollar is very strong, so therefore it makes sense that Bitcoin could be a bit sluggish against the USD. For what it’s worth, Bitcoin has had a better move against other currencies such as the Euro.

If the market does turn around a break above the highs of the last couple of sessions, then it’s possible that the market may go looking towards the $11,000 level. There is the halving in May that people are banking on, but at this point I don’t know that it’s as big of a deal as it once was. At this point, pullbacks probably offer value, but the market needs to drop at least to the 50 day EMA or break to the upside before I would put money to work. I’m not necessarily looking to short Bitcoin, but I do recognize that there is a lot of downward pressure showing up all of the sudden. It looks as if Bitcoin is starting to show a bit of a divergence against gold, as the two had been moving in the same direction for quite some time.