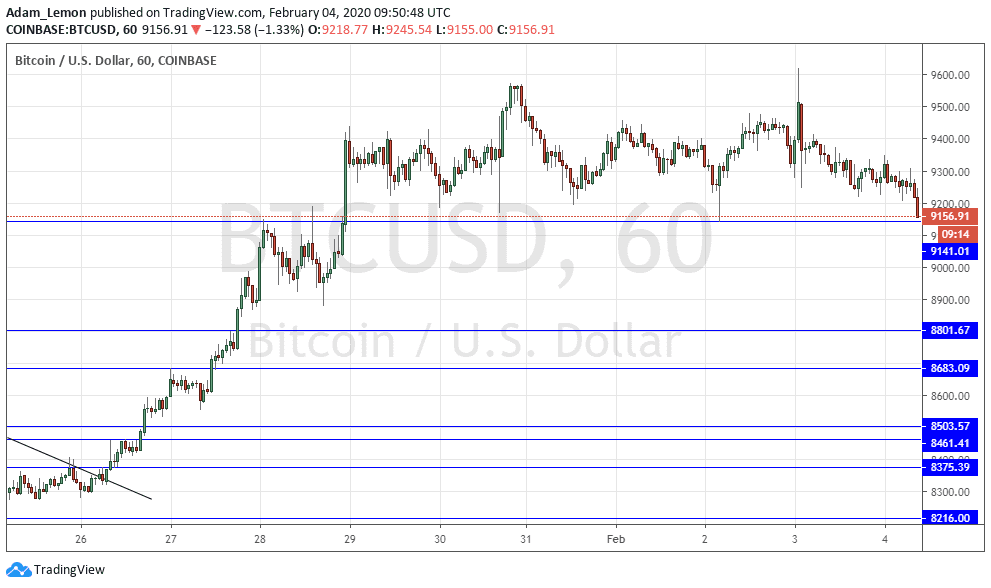

BTC/USD: Weakly bullish above support at $9,141

Yesterday’s signals were not triggered as none of the support levels were reached within the specified time.

Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades must be entered prior to 5pm Tokyo time Thursday.

Long Trade Ideas

Go long after a bullish price action reversal on the H1 time frame following the next touch of $9,141, $8,802, or $8,683.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is $50 in profit by price.

Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote yesterday that I maintained a weak bullish bias, but it that it was looking more likely that the support level at $9,141 while pivotal would break down.

This was a fairly good call as although the level has continued to hold until now, it looks even more likely to break down, with the price failing to advance and coming down now to test the support.

I would expect a deeper bearish retracement if we get a couple of consecutive hourly closes today below the level at $9,141 to at least $8,900 so would take a temporary bearish bias if that scenario plays out.

It could be that the support at $9,141 holds but I would only want to take a long from there today is the bullish reaction is strong and fast, so be careful with any long trade entries there as it really is looking like a bearish breakdown.

There is nothing of high importance due today concerning the USD.