The German index rallied again during the trading session on Wednesday to make fresh, new highs in the futures market as well as the cash market. This is a market that is very bullish currently, due to the added fiscal stimulus that so many stock traders have become accustomed to. It is difficult for traders to short the market when the central bank is willing to step in and add liquidity to the market. This means that bonds are yet again paying almost nothing in interest rates, and therefore stocks are the only place to go. You should think of Germany as the “blue-chip index” of the European Union, so it makes quite a bit of sense to see markets rise.

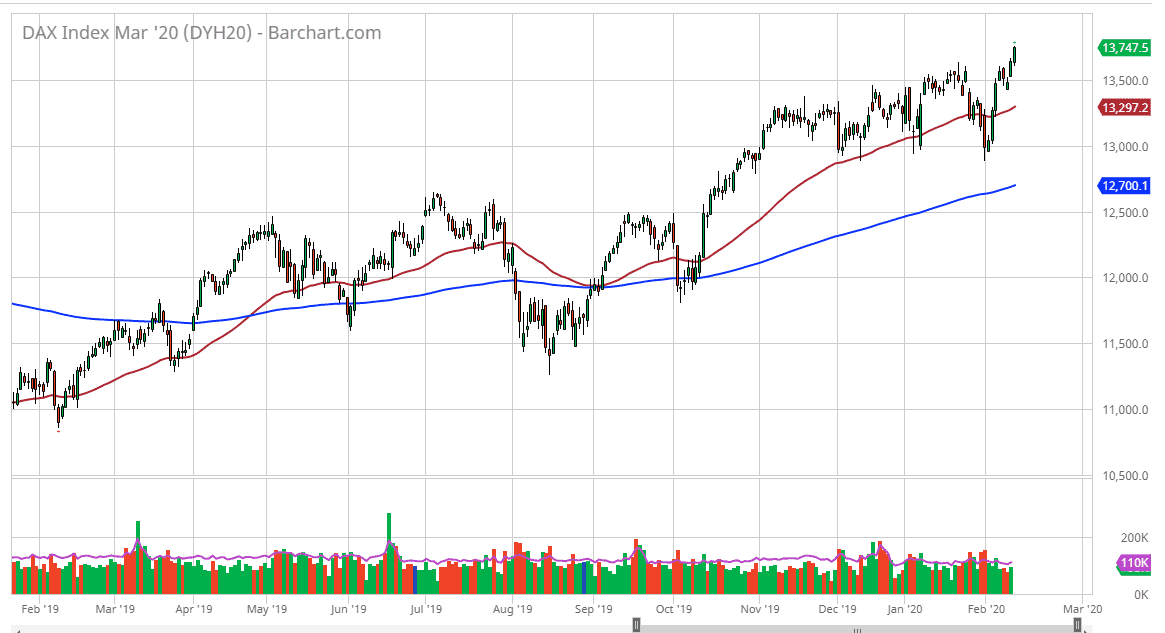

Beyond that, stock markets in general around the world are rising, so it should be noted that the buyers remaining control, and the technical analysis also backs up the idea of going long. The 50 day EMA is underneath and offering support at the 13,300 region, and of course starting to tilt to the upside. In below there, the 200 day EMA offers a massive amount of support at the 12,700 level, assuming that we could even get there. Between the two, the 13,000 level of course will offer a lot of psychological support as well as structural based upon the most recent pullback.

I do not believe that we will get to the 13,000 level, but the 50 day EMA could come into play down the road. In the meantime, buying short-term pullbacks will be the only way to play this market, as simply jumping in now would probably be a bit of a messy entry. Nonetheless, it certainly looks as if 14,000 would be the next target, and then eventually 15,000 down the road. With this, the trend remains intact and therefore I have no interest in trying to fight what has been such obvious bullish pressure. Ultimately, I believe that dips should be thought of as value in this extraordinarily bullish market. Shorting is all but impossible until something fundamentally changes either in the European Union, or global economy on the whole.