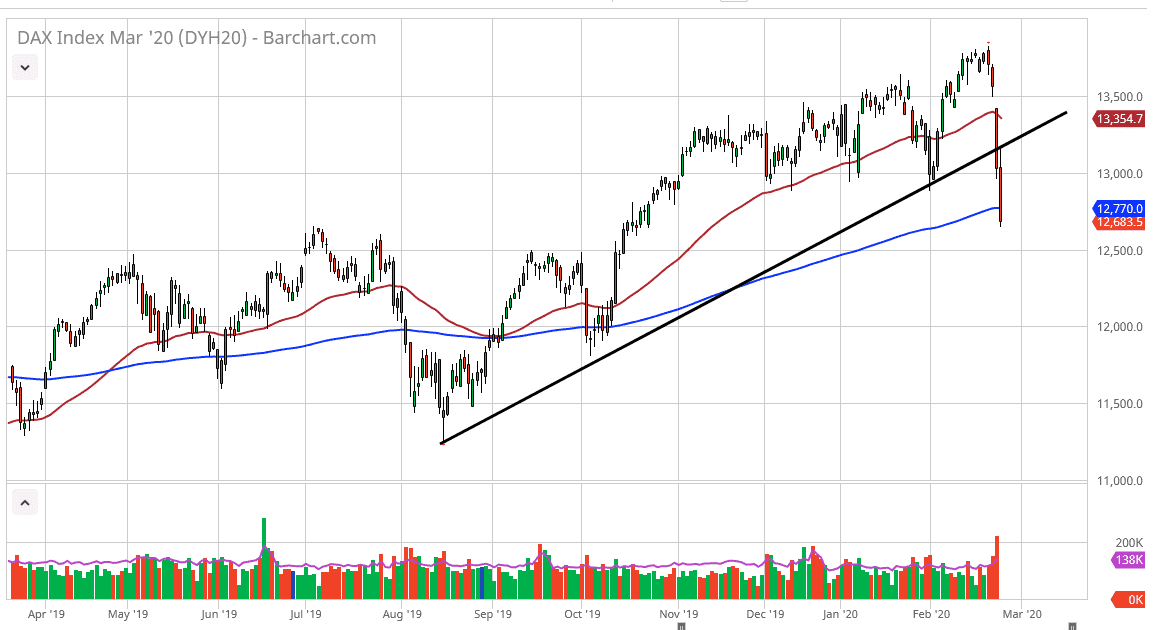

The German index initially tried to rally during the trading session on Tuesday but found resistance at the previous uptrend line. By doing so, it looks as if the DAX is completely broken, and what’s even more ominous is that the futures closed below the 200 day EMA. That of course is a very negative sign, so at this point I suspect that we have a day or two to recover, or things could get rather ugly.

The candlestick closed at roughly the bottom of the range, so that is not a good look to say the least. The 12,500 level sits just below, and it could offer a bit of support based upon structural parts of the market, but at this point I don’t know that you can count on that. Sure, there will probably be some type of bounce, but that bounce could very well end up being sold into. Remember, Germany is likely heading into a recession, and if that’s going to be the case it will certainly wear upon the earnings of German multinationals.

The market participants seem to be bailing on the European Union in general, and the selling has only accelerated over the last couple of days. This is a market that represents the so-called “blue-chip” companies of the European Union, but if we are going to see a lot of selling pressure when it comes to stock markets, then this of course will be one of the first places that people start selling. Alternately, if the market does turn around the DAX is one of the first places people start buying because those are the “safer” companies. That being said, the market has a significant amount of resistance above built into the previous uptrend line as well. If we were to be able to turn around a break above, there that will obviously be a very bullish sign. To the downside, if the market does break down below the 12,500 level, it’s very likely that the market then breaks down below the 12,000 handle after that. Either way, I would expect a lot of noise but clearly you have to favor the downside at this point, lease for the next couple of days. In fact, the next couple of days could be very influential as to where we go for a much bigger move. Pay attention to the next two candles.