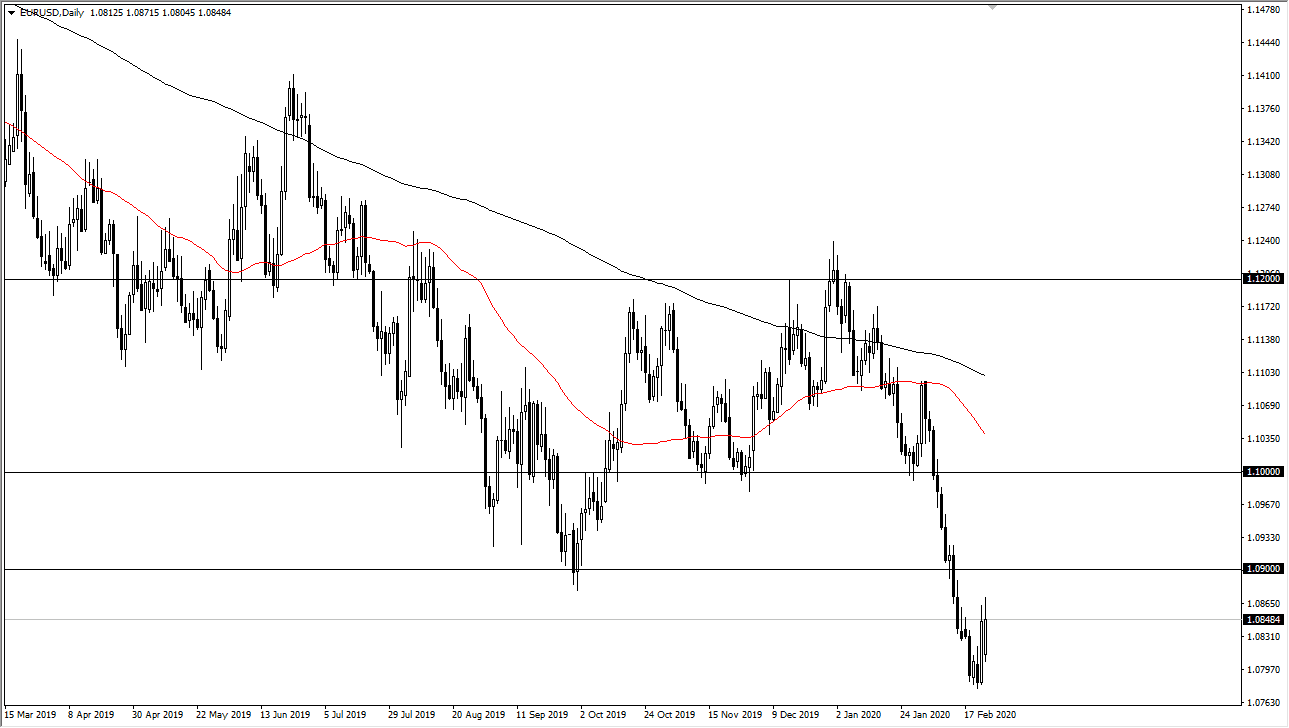

The Euro initially gapped lower to kick off the trading session on Monday, but then turned around to fill that gap. In fact, the Euro rallied quite significantly to show signs of resiliency. The German Ifo Business Climate figures came out better than anticipated, so that of course is a good sign for investment. That being said, there are still a ton of reasons to believe that the Euro will continue to struggle against the US dollar. Having said that, the bullish scenario is that the Euro is oversold, and it did it form a hammer from the previous week right at a gap. As far as the technical analysis is concerned, it’s a great place to turn everything around. However, the fundamentals don’t necessarily line up with that attitude.

US Treasuries have attracted a ton of inflow over the last 24 hours, and that helps to the US dollar in general. Furthermore, Italy now is starting to see a significant ramp up in the coronavirus cases there, so that could weigh upon the Euro as well. I suspect at this point that the bounce is probably more of a “relief rally” more than anything else. While Monday was rather impressive, I believe that the real trade comes a bit higher when we form a resistive daily candlestick. I will be wanting the 1.09 level above, and then the 1.10 level after that. Signs of exhaustion will be punished as I believe it will offer a sign that the US dollar is getting “cheap.”

If we were to just rollover from here, then I believe that the 1.0750 level is massive support. Breaking down below there would open up a move down to the 1.05 handle. All things being equal, I have no interest in shorting this market, so it’s simply a matter of waiting for the Euro to get a little overextended. I don’t really have a scenario where I am comfortable buying and holding the Euro, so I’m simply waiting for some type of exhaustion to start selling again. If the Euro breaks above the 1.10 level, then it’s likely that the market could continue, but it is going to take a significant amount of pressure to make that happen. I still believe that fading rallies will continue to be the best way trading this market and therefore have to be patient to wait for the set up.