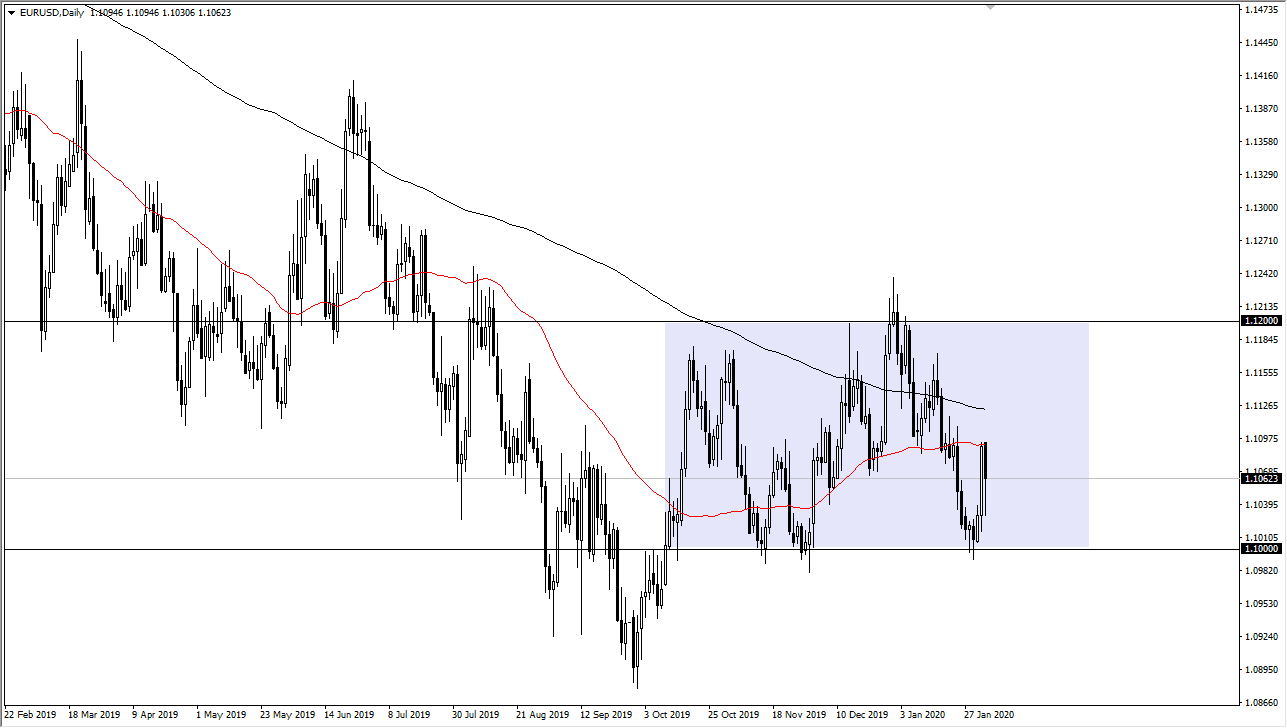

The Euro fell significantly during the trading session on Monday, reaching down below the 1.1040 level. That being said though, the market also have the 50 day EMA that I fell from after closing up there on Friday. The ISM Manufacturing PMI figures came out better than anticipated, so this helps the US dollar as well. Longer-term, the market is still very negative anyway, but we have been trading in a 200 point range for ages now.

The 1.10 level underneath is the “floor” in the market, and we have in fact seen buyers come in on this day. However, I believe that the 50 day EMA will continue to begin a significant resistance barrier and the form of the 1.11 level essentially, with the 50 day EMA and the 200 day EMA both offering the outer range of what I think is going to be a significant barrier to break above.

If we did break above the 200 day EMA, it’s likely that the market will go looking towards the 1.12 level, which has been significant resistance. That being said, I think it’s more likely that we will find sellers coming back into the market, if for no other reason than to see the US dollar accelerate its strength globally. As there are so many “risk off” type of situations out there, it makes sense that there will be quite a bit of interest in the US dollar.

The European Union of course continues to suffer at the hands of weak economic data, and of course the noise coming out of the Brexit situation. While there are no true final solution to the Brexit situation, that entire question will continue to hang over the head of the European Union as well. Ultimately, this is a market that continues to see a lot of back and forth action, as the 1.10 level, the 1.11 level, and the 1.12 level have all been so influential. This is more or less a short-term trading type of situation, looking for little bits and pieces here and there. In the short term, it would not surprise me at all to see the market goes looking towards the 1.11 level, struggling there. However, if we do break out to the upside than I believe that the 1.12 level will be very resistive as well. That would also require some type of big “risk on” type of event, driving money away from the US dollar in general. Right now, it doesn’t seem very likely.