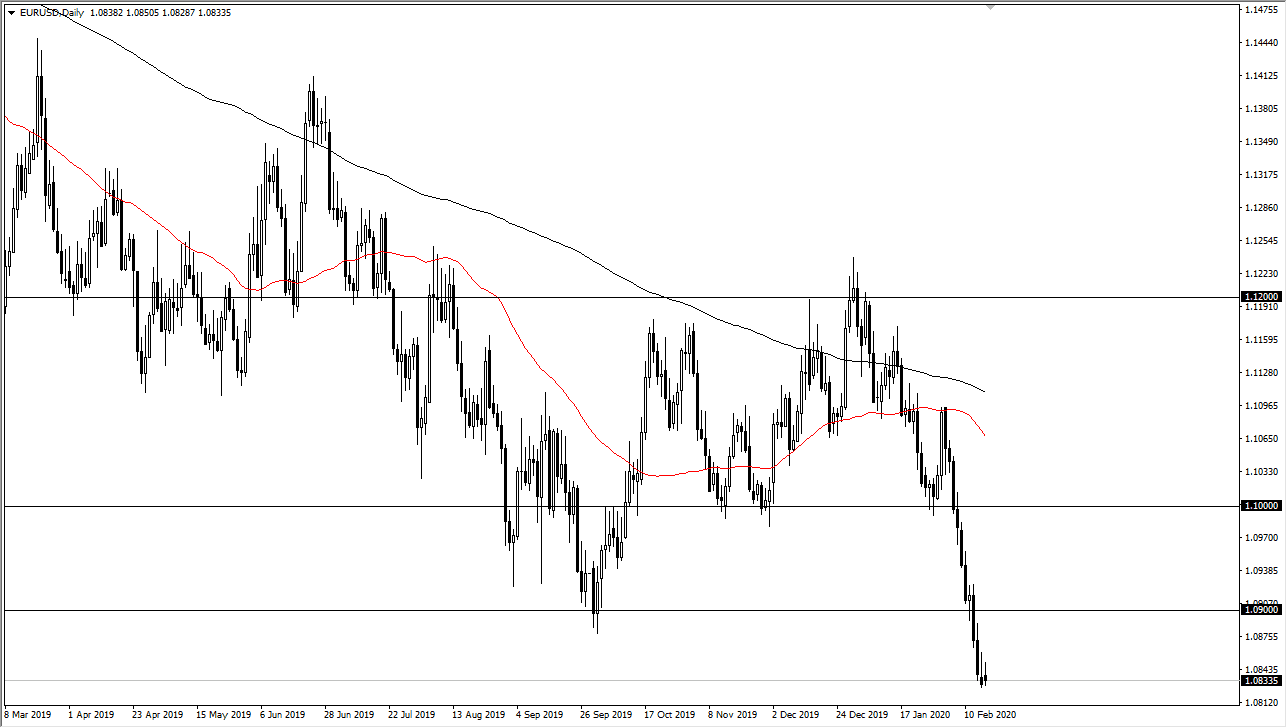

The Euro initially tried to rally during the trading session on Monday, but then rolled over to show signs of exhaustion again. That being said, the market would have been a little bit thin due to the fact that the Americans were celebrating Presidents’ Day. With that being the case, you can’t read too much into the candlestick on Monday, but it does mirror what we have seen on Friday, so it suggests that we could see a bit of a continued move to the downside, but this is a market that is a bit oversold.

The 1.09 level above is significant resistance, as it was significant support in the past. Furthermore, the 1.10 level above is resistance. Ultimately, the market is very negative, so look at any rallies as an opportunity to pick up the US dollar “on the cheap.” After all, this is a market that fundamentally favors the United States, so it makes quite a bit of sense that the market continues to find these rallies as an opportunity to get involved. The United States continues to do quite well, reaching the 2% inflation rate that people believe the Federal Reserve is aiming for. On the other hand, the ECB has seen almost no inflation coming out of the European Union. In other words, we should continue to see plenty of reasons for this pair to go lower. Furthermore, the US dollar is considered to be a bit of a “safety currency”, so therefore I like the idea of shorting.

If we do break down below the bottom of the candlestick during the trading session on Monday, then it’s possible that we could go lower, but I don’t like the idea of simply shorting here. After all, this is a market that is oversold, so given enough time I think you could find yourself in trouble if you do jump in. This is a pair that typically doesn’t move that much, so the fact that we have dropped 175 pips over the last couple of weeks is a sign that perhaps we need to bounce in order to find more selling pressure. I do believe that given enough time, the market is likely to go looking to fill the gap underneath, reaching towards the 1.0750 level to fill a gap on the weekly chart. I do think we eventually get there but it’s going to take some time. This pair never really seems to go in one direction for very long.