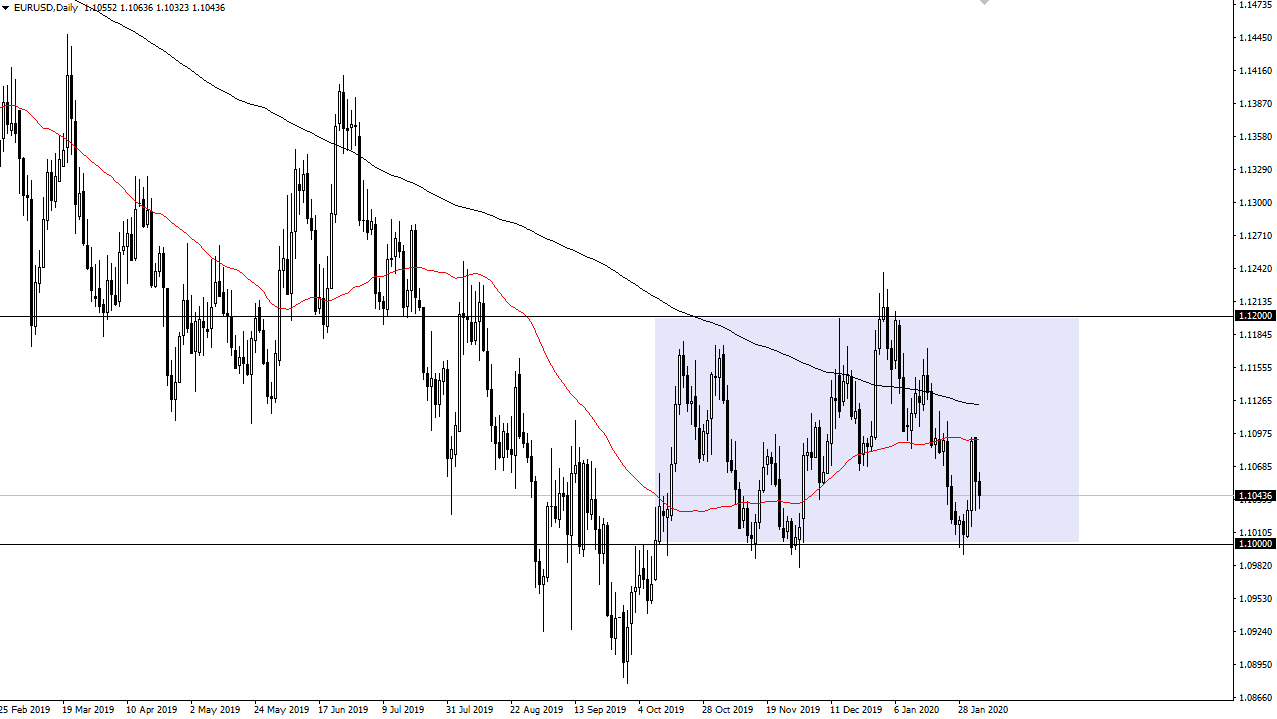

The Euro initially fell during trading on Tuesday but found enough buyers underneath the turn around and form a slightly supportive looking candle. The EUR/USD pair has been trading between the 1.10 level on the bottom and the 1.12 level on the top for what seems like ages now, and there is nothing on this chart that doesn’t suggest it won’t continue to be the case. At this point, the 50 day EMA offered a little bit of resistance, and we have in fact pulled back from there. However, I think that the 1.11 level is truly what the market will be aiming for, as it is essentially the “fair value” of the market.

Keep in mind that this pair tends to be very choppy as both central banks have adopted a very loose monetary policy regimen. That being said, instead of worrying too much about fundamental analysis, most traders are simply playing this market back and forth until that back-and-forth action doesn’t work anymore. Looking at the longer-term chart, we have most certainly been in a downtrend, but it’s been messy all the way from the top to current pricing. I don’t see anything that suggests it will be any different in the meantime, but if we were to break down below the 1.0980 level, then I think the market probably goes looking towards 1.09 level and then eventually the 1.0750 level based upon the gap underneath. To the upside, the market was to finally break above the 1.1250 level, then we could be talking about a major trend change and a “buy-and-hold” type of situation. The initial target there of course could be the 1.15 level as it is the next major psychological resistance barrier.

The US dollar continues to get a bit of a bid as overall there has been a lot of fear the markets, but it should be noted that it hasn’t truly affected this pair as you would normally expect. Choppy day trading conditions with high frequency algorithmic traders continue to be the most common thing you see here. A slight negative slant, but nothing more than slight continues to be how this pair trades. If you’re looking to deploy range bound systems, this could be the market for you. However, if you are looking for a bigger move, you will probably need to continue looking elsewhere as you simply are not going to find it here, at least not in the short term.