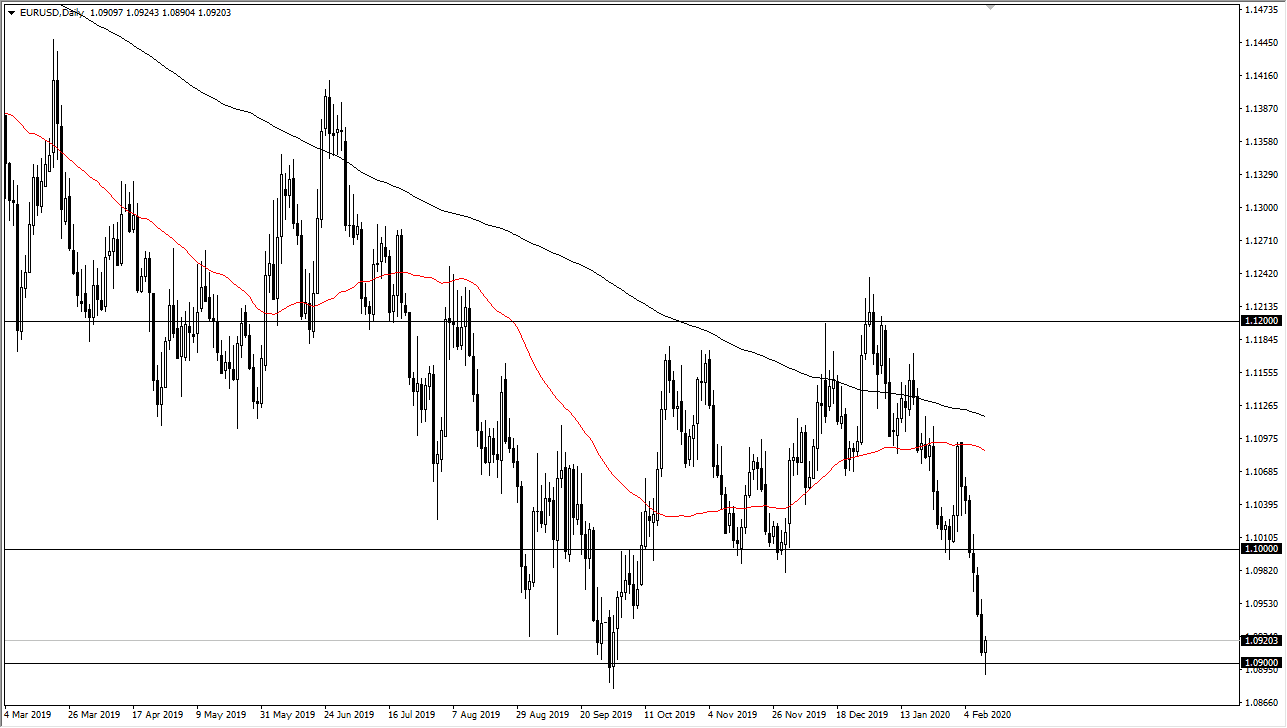

The Euro has initially broken down below the 1.09 level during the trading session on Tuesday but turned around to show signs of life after Jerome Powell gave his speech in front of Congress. That being said, the Euro is oversold in general. The 1.09 level has offered significant support in the past, and all one has to do is look at the last week or so to see just how oversold this market had been. I believe that a bounce is likely, but the longer-term outlook for the European Union isn’t that great. Nonetheless, I believe at this point a bounce is more likely than not, but I would be concerned about any bullish positions the closer the market is getting to the 1.10 level.

The alternate scenario of course is that the market breaks down below the hammer and continues to fall from there. That would of course be a very negative as it would have everybody who tried to recover the Euro losing money almost immediately. The market would then go looking towards the 1.08 level and then eventually the 1.0750 level which is the scene of a gap that has yet to be filled. Breaking down below the bottom of the hammer is a very negative sign, and one of my favorite trades as far as shorting is concerned.

Looking at this chart, it’s very likely that the bounce is more of the relief rally kind than anything else, so this is why I believe the move higher is probably somewhat limited, but it certainly looks to be possible. If the market was to capture the 1.10 level, then of course I would have to look at it in a different light. Until then though, I am very cautious about going long and I still prefer selling, especially near the 1.10 level on signs of exhaustion. The European Union continues to have horrific economic numbers coming out of it, so the fundamental certainly favor the United States, when it comes to trade in this pair.