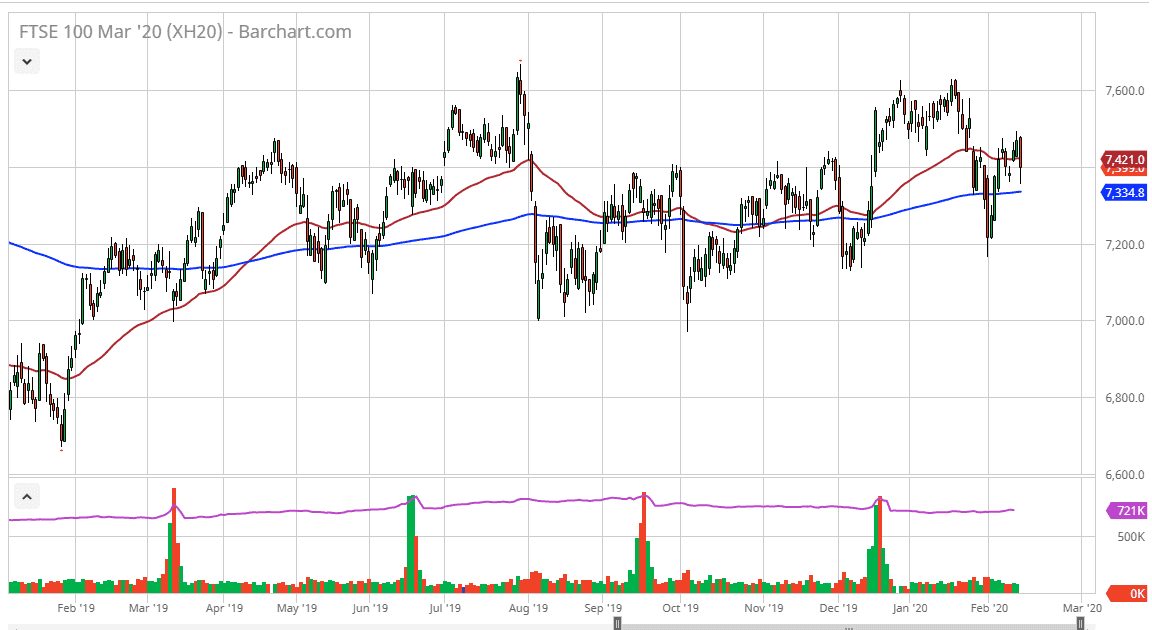

The FTSE 100 has broken down significantly during the trading session on Thursday to kick things off, but then turned around at the crucial 200 day EMA to show signs of life again. When you look at the longer-term chart, the FTSE 100 is bouncing around in a channel, and therefore you need to look at the channel as a bit of an indicator in itself. It is rising a bit over the long term, but it is a messy and choppy affair, something that makes quite a bit of sense considering that the British are still negotiating with the European Union what the new trade deal might look like.

Ultimately, the British pound has shown a little bit of strength during the day so perhaps that part of what has worked against the FTSE 100 on Thursday, but longer-term it’s very likely that this market will continue to grind higher simply because it is undervalued due to the Brexit nonsense that took three years to get through. Now that we are through the question about whether or not the British are leaving, it comes down to what the trade deal between the UK and the EU may be. Furthermore though, British company should do quite well in the sense that the Americans are more than likely going to offer something close to a free trade deal with the UK.

However, if we were to break down below the 200 day EMA it’s likely that we will go looking towards the 7200 level which should represent demand. At that point I would fully anticipate some type of bounce. The alternate scenario of course is that we turn around a break above the highs during the trading session on Friday, which should open up the door to the 7600 level. The FTSE 100 futures contract is suggesting that we are continuing the uptrend over the longer term but is going to take quite a bit of time. All things being equal, I do believe that we go to the highs again over the longer term, but it may take a while to get there. Alternately though, if the market was to break down below the 7200 level, it’s likely that we could go much lower, perhaps down to the 7000 handle and below. With that, if you have more of an investment standpoint, then it might be the way to go in buying it, but if you are looking for short-term trade there are probably easier places to make money.