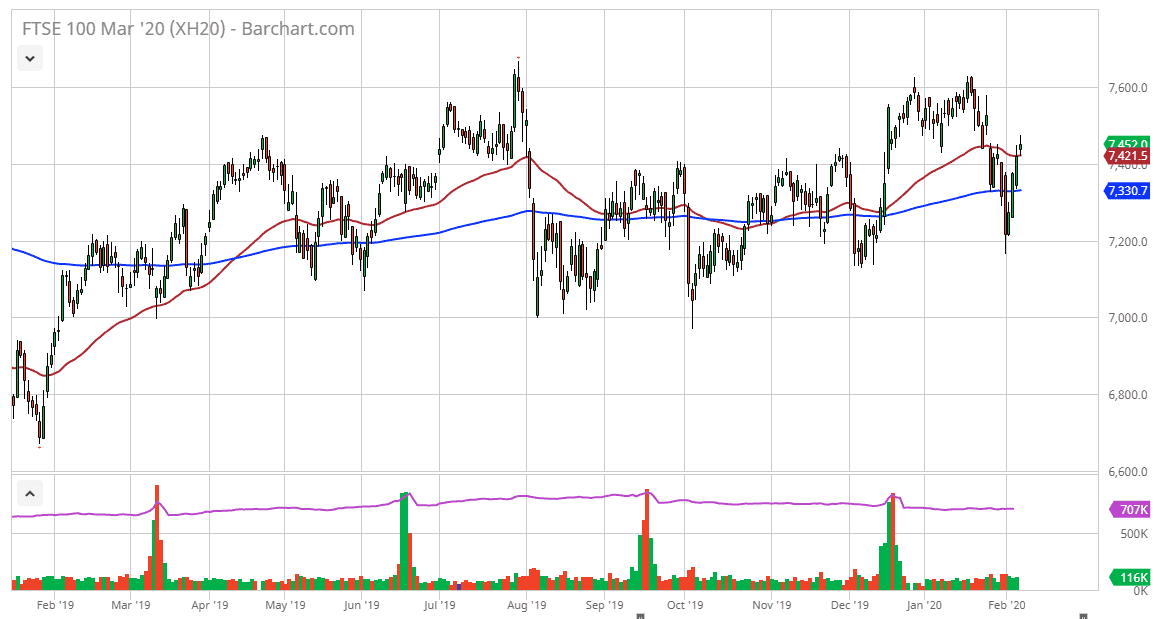

The FTSE 100 rallied a bit during the trading session on Thursday, reaching to fill the gap from a couple of weeks ago. Now that that gap has been filled, the market of course pulled back a bit and now it looks as if we may find buyers underneath based upon the recent action. If the market can break above the 7500 level the market can continue to go towards 7600 again. That is an area where we’ve seen a lot of selling pressure previously, and you could even make an argument for a bit of a “double top.” At this point, I would not be surprised at all to see the market try to grind towards that area, because if you look at the longer-term chart, you can see that we have been grinding with a slightly upward tilt for months. Having said that, this is a market that has been very choppy.

If we can break above the 7600 level, and I think we can, we will eventually go higher and go looking towards the 8000 handle. The British pound fell during the trading session so that could have helped keep the FTSE 100 a little bit afloat, but the futures contract as you can see has faded late in the day. Underneath I anticipate that the 7400 level could offer support, and then of course the 7330 level after that. The reason for the 7330 level is the 200 day EMA which always seems to attract a certain amount of attention.

Keep an eye on the jobs number and the United States, while not necessarily a direct correlation to the United Kingdom, much of the market will probably be very quiet going into that announcement, so Friday could be a bit of a lackluster trading session. There is likely going to be buyers underneath based upon the last couple of days though, so I think in the draft lower is more than likely going to be a nice opportunity. Ultimately, I look at the 7200 level underneath as a bit of a floor in the market right now. If we were to turn around a break down through that level, things could get rather ugly.