Covid-19 continues to threaten the global supply chain, and as volatility in gold increased, a bullish bias emerged. Before the outbreak in December, the economic outlook for 2020 was already depressed. The fragile system was unprepared to handle unexpected disruptions, and this safe-haven asset reflects the nervousness underneath headlines driven by fresh all-time highs in US equity markets. A host of core fundamental indicators point towards an extended slowdown, exacerbated by the virus. This precious metal is anticipated to initiate a fresh breakout sequence, leading to fresh 2020 highs.

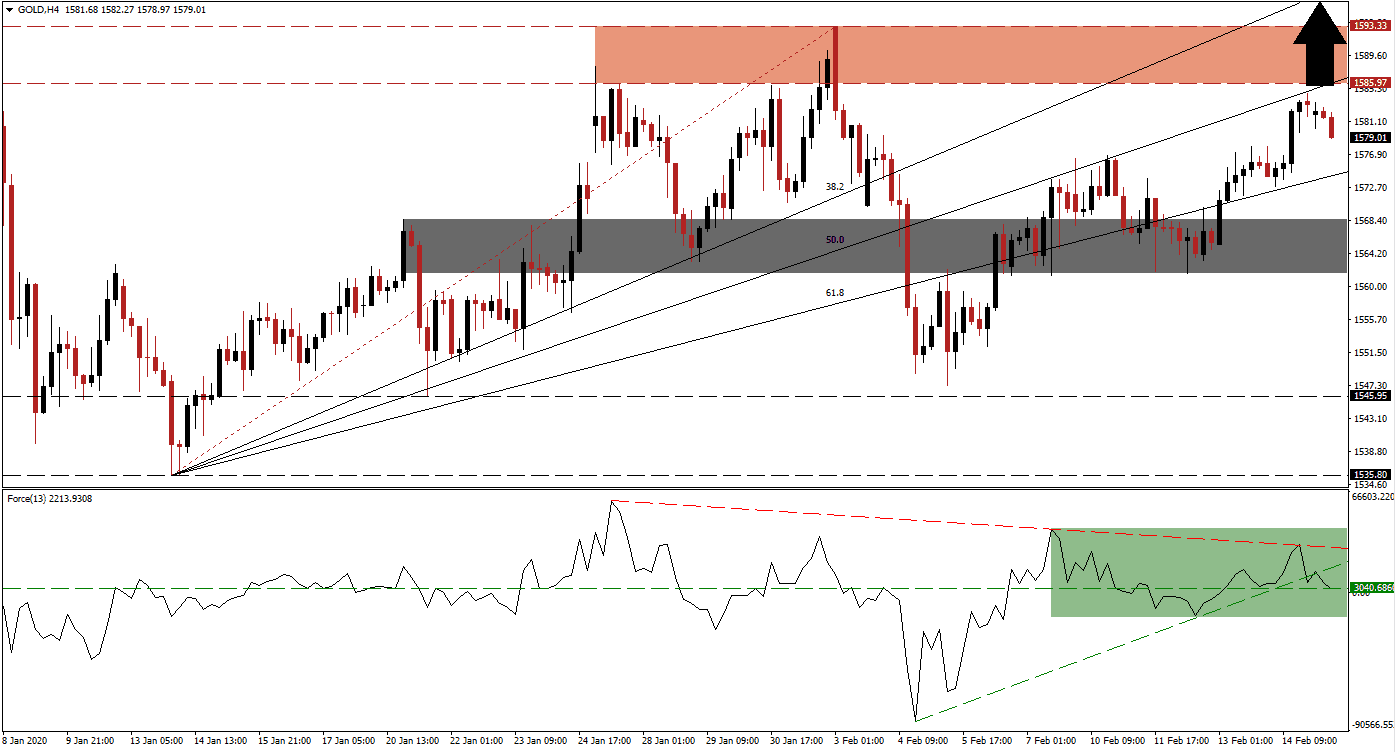

The Force Index, a next-generation technical indicator, contracted to a new 2020 low, as price action entered a quick but sharp reversal off of its resistance zone. It washed out excessive bullishness, giving gold a chance to enter a sustained growth rate. The Force Index recovered, and an ascending support level formed, guiding it into a conversion of its horizontal resistance level into support. This technical indicator was rejected by its descending resistance level but remains in positive territory with bulls in control of this precious metal.

Bullish momentum expanded after gold reclaimed its short-term support zone located between 1,561.93 and 1,568.58, as marked by the grey rectangle. The initial breakout was reversed by its ascending 50.0 Fibonacci Retracement Fan Resistance Level, which has caused a second rejection. It did create a series of higher highs and higher lows, as the Fibonacci Retracement Fan sequence is favored to lead price action farther to the upside, after this precious metals retests its 38.2 Fibonacci Retracement Fan Support Level.

An advance into its resistance zone is expected to be followed by a breakout from where price action is well-positioned to push above its 2020 intra-day high of 1,611.07. The resistance zone is located between 1,585.97 and 1,593.33, as marked by the red rectangle. A sustained breakout above its current 2020 peak will lead to an accelerated move in gold into its next resistance zone, located between 1,645.82 and 1,672.22, dating back to 2012. More upside is likely unless fundamental conditions change. You can learn more about a resistance zone here.

Gold Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1,580.00

Take Profit @ 1,672.00

Stop Loss @ 1,555.00

Upside Potential: 9,200 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 3.68

In case the Force Index detaches further from its ascending support level, leading to a breakdown below its horizontal support level, gold could be pressured to the downside. Due to the dominant bearish forces impacting the global economic outlook, any breakdown from current levels will grant traders an outstanding buying opportunity. The downside potential is confined to its long-term support zone, located between 1,535.80 and 1,545.95.

Gold Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1,550.00

Take Profit @ 1,536.00

Stop Loss @ 1,557.00

Downside Potential: 1,400 pips

Upside Risk: 700 pips

Risk/Reward Ratio: 2.00