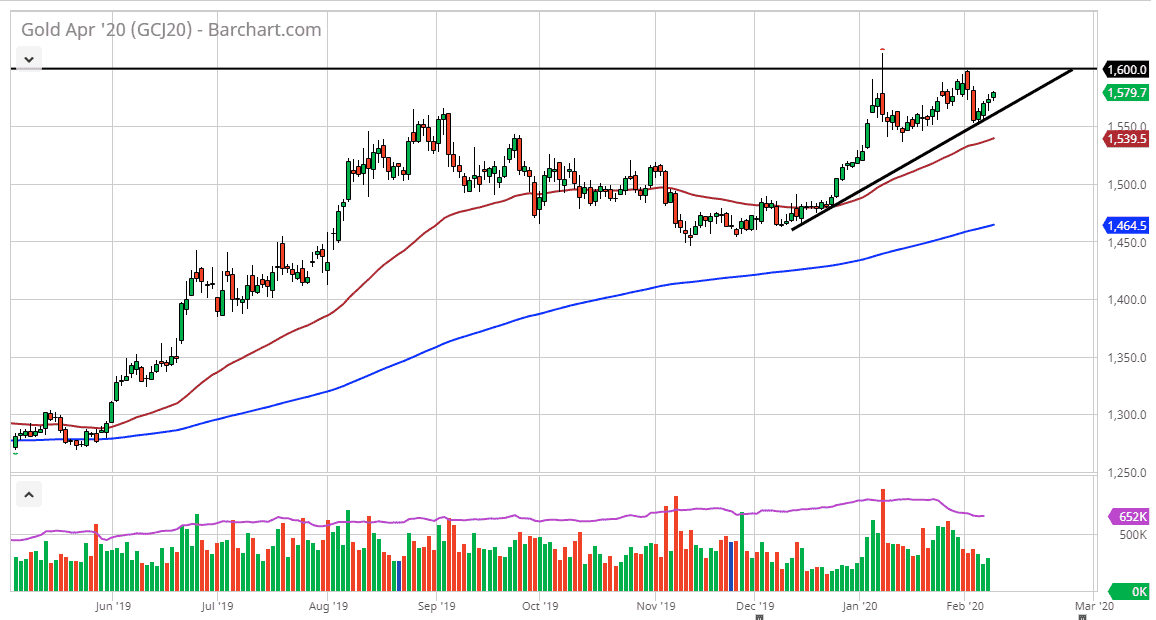

Gold markets have rallied again during trading on Monday to kick off the week as fears about the coronavirus and global growth continue to be an issue. That being said, the market is likely to continue looking at this uptrend line as something to pay attention to.

Gold

Gold markets have rallied slightly during the trading session on Monday, showing signs of life again, as the gold markets look clearly ready to go looking towards the $1600 level. At this point, I believe that it is a bit of a forgone conclusion that we can make this move, and therefore I like the idea of buying short-term dips. In fact, I would put an intermediate floor in the market closer to the $1550 level, so I don’t see any scenario in which I will be selling.

Keep in mind the gold markets were rising before a lot of the coronavirus concerns came to the forefront anyway. This means that the coronavirus is simply the latest reason to get long on safety currencies and trades. In other words, this is simply the latest excuse to go long. After all, the global growth was slowing down heading into this event and central banks around the world were continuing to loosen monetary policy. With that being said it’s very likely that we will continue to see gold rise regardless of the coronavirus, but quite frankly it’s just more fuel to the fire. Having said all of that, the $1600 level has been very difficult to break above, and I suspect that it won’t be done easily. However, I do expect it to happen relatively soon, as concerns around the world are increasing, not falling.

The market breaking above the $1600 level opens up the door for a move to the $1800 level based upon my previous longer-term chart work. Gold certainly look strong at the moment and favors a “buy on the dips” type of mentality, as the charts have clearly shown over the last several months. Gold does tend to be volatile, and despite what many people think it’s a relatively thin market, but for a longer-term trader building up a core position for the impending breakout could work out to their advantage. If the market was to break down below the $1550 level, then I think the next battleground will be closer to the $1500 level where I see even more support.