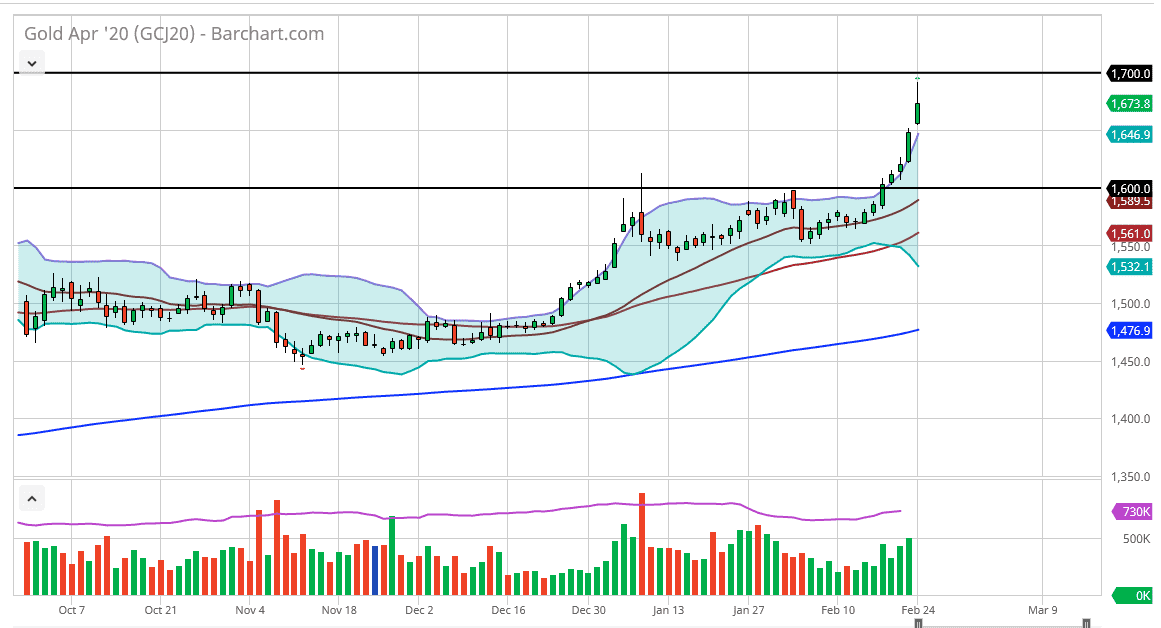

Gold markets gapped higher to kick off the trading session on Monday, as fear of the coronavirus spreading to larger masses continues to cause major issues. At this point, the market then shot towards the $1700 level before fading again. It ended up forming a bit of a shooting star but at this point even though it is a negative sign, the reality is that the market is simply a bit overextended, so at this point I think waiting for some type of value is probably the best way to go. The market is currently sitting outside of the Bollinger Bands, meaning that it is more than two standard deviations away from normal trading. Because of this, I think that we will more than likely find some type of pullback that we can take advantage of, and therefore that’s exactly how I will be playing this market.

The 20 SMA is currently reaching towards the $1600 level, so I think at this point that will essentially be the “floor” in this marketplace. Somewhere between current pricing and that level I will be looking for a support of candle or of bounce that I can take advantage of. That being said, I have no interest in shorting this market, even though I truly do believe it will pull back. That is something that inexperienced traders do, trying to pick up every last dime in both directions. The reality is that the market is in a very strong uptrend for a reason, as central banks around the world continue to loosen monetary policy. Furthermore, people are worried about the coronavirus disrupting the global economy, so I think it’s only a matter of time before people run back towards gold.

It is noteworthy that the Asian and European sessions seemed to focus more on gold than the American market did. That has been the case for quite some time, the Americans are buying gold, but they are jumping into it with both feet, unlike the other traders. That being said, look for value in the market, and I will of course let you know here at Daily Forex as to what I’m doing but I will tell you that it will be based upon a daily close more than anything else. However, the market was to break above the $1700 level it would show an impulsive move that would of course be very impressive.