Gold markets have gone back and forth during the trading session on Thursday, as we had broken to a fresh, new high. This makes quite a bit of sense when you think about the situation around the world, with coronavirus destroying the global growth story, at least on the temporary timescale. Ultimately, the market is one that you can buy on pullbacks and has been for quite some time. When you think about the fundamental reasons, it makes quite a bit of sense that gold would continue to rally.

The first reason of course is the fact that central banks around the world continue to keep loose monetary policy. China has cut interest rates, just as Indonesia has. Interest rates, just as South Africa and Mexico have. The European Central Bank is likely to keep its monetary policy stance rather loose, so that helps boost the case for gold as well. Furthermore, there are arguments out there for the Federal Reserve to follow the same path, so that makes an argument for gold to continue going higher as well.

Obviously, the coronavirus story is still one that you should pay attention to, and the global growth story is being threatened. This puts a lot of demand for gold out there, and therefore I think that there will be plenty of buyers for this reason as well. In fact, about the only thing that is keeping this market from going parabolic is the fact that the US dollar itself is relatively strong. In other words, if you have the ability to trade gold in other currencies you may find even more returns over there.

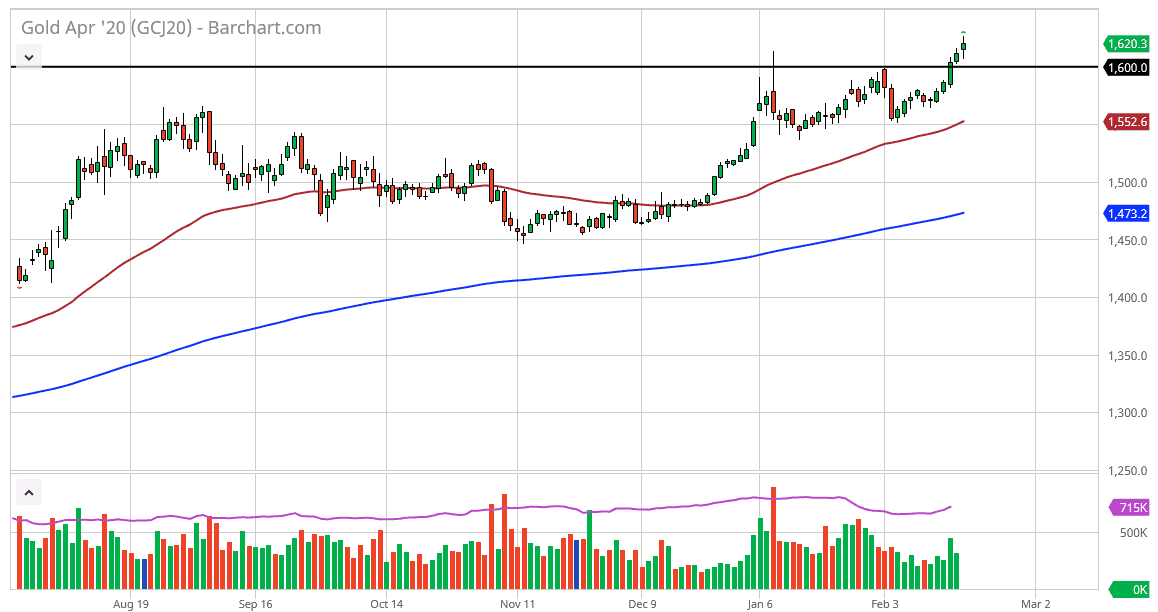

To the downside, I believe that the market will find support at the $1600 level, but also down at the $1550 level and the 50 day EMA that is crossing at that level right now. Furthermore, if we were to drop from there, I think $1500 will be crucial as well, as the 200 day EMA will be approaching that relatively soon. Nonetheless, don’t be surprised at all if we don’t get much of a pullback if any at all. I believe that based upon the ascending triangle that we just broke out of; the gold market should go looking towards the $1700 level. Based upon even longer-term analysis, I can make a strong argument for the $1800 level as well. Gold is still definitely a market that you should be buying on dips.