Gold markets fell a bit during the trading session on Wednesday, gapping to show signs of extreme negativity. Ultimately, the market fell a little bit further and then turned around to rally yet again. This is a market that is bullish to say the least, so it does make sense that we should continue to see a bit of a rally going forward. That rally will more than likely continue to offer opportunities for those who are resilient and can wait for value. Gold is getting a bit of a boost due to the coronavirus obviously, but it is also being driven higher due to the fact that central banks around the world are driving down rates and that should continue to drive money into gold.

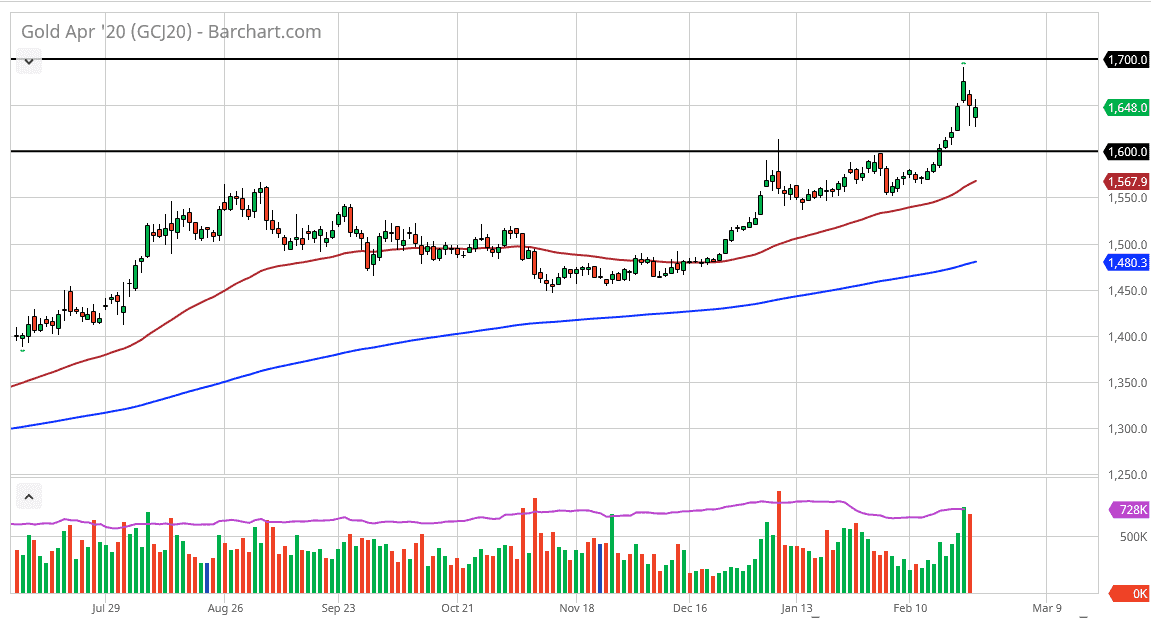

A mixture of uncertainty and low interest rates is Nitro for gold, and therefore it looks like we could explode to the upside given enough time. That being said though, we had been a bit overdone for some time, so this pullback has made a bit of sense. I believe this point the $1600 level underneath is now the “floor” in the market, as it was previous resistance in the market. At the end of the day, the market breaking down below there would be a very negative sign but at this point I don’t think that’s going to happen. The 50 day EMA is starting to race towards that area as well, and therefore it offers yet another reason to think that the $1600 level should be crucial and supportive.

At this point, the market looks very likely to eventually go looking towards the $1700 level, which is a major resistance barrier, but I do think we eventually break above there, especially if the coronavirus situation continues to be so negative. At this point, any pullback should continue to offer value the people are willing to take advantage of. This being the case, the market is going to continue to show signs of resiliency going forward as the market is most decidedly in an uptrend, and therefore can’t be sold into anyway. The fact that we have reached towards the $1650 level of course is a good sign for the market, but be aware the fact that the market continues to go back and forth and is choppy so make sure to keep your position size reasonable.