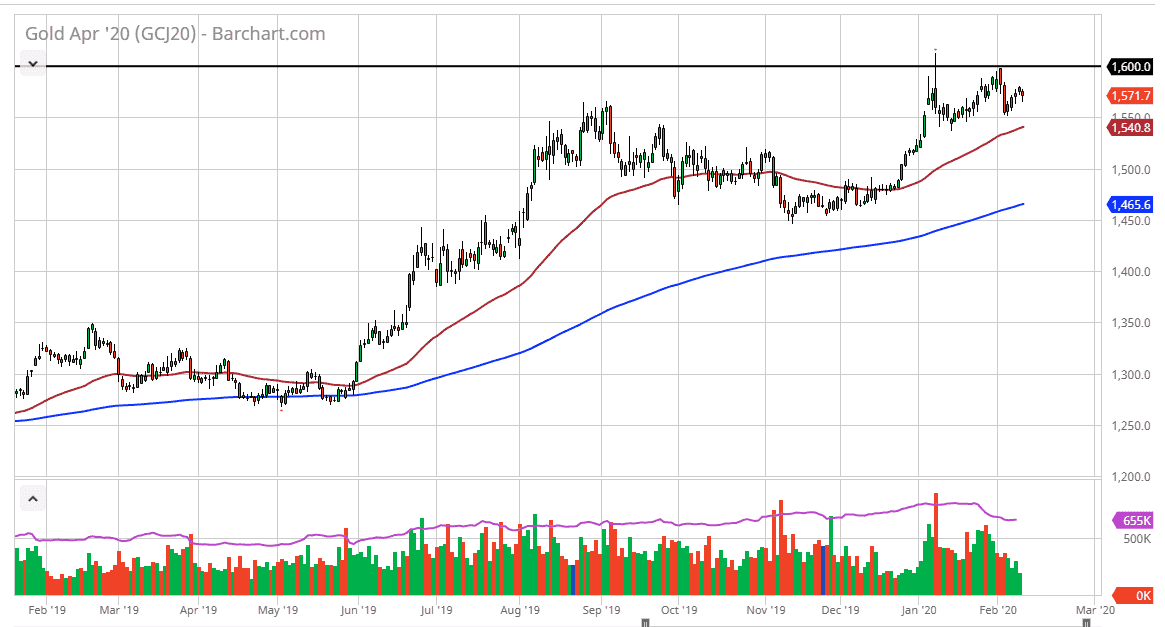

Gold markets pulled back a bit during the trading session on Tuesday but found enough buyers near the $1565 level to turn around and show signs of life. The market is looking very likely to close as a hammer, and that suggests to me that the market is ready to continue granting to the upside. If the market breaks the top of the candlestick for the Tuesday session, it’s likely that the market goes looking towards the $1600 level above, which is an area where we had seen a lot of resistance and previous selling.

Underneath, the 50 day EMA is currently at the $1540 level, and it looks as if it’s trying to get to the $1550 level. This is an area where we have seen buyers before, and it’s likely that we will see them again if we do break down to that area. The 50 day EMA is an area that a lot of technical traders like to get involved, as is evident on longer-term charts.

I believe at this point the market is going to continue to try to find buyers on dips to offer value, as it is going to take a significant amount of momentum to finally break above the $1600 level. If we do break above the $1600 level, then it’s likely that the market goes looking towards the $1800 level as it is a target of mine from longer-term charts. The overall uptrend is very much intact, as you can see the 50 day EMA is spread out nicely from the 200 day EMA. As far as selling is concerned, I’m not interested in doing so until the market breaks down below the $1500 level, which I see is a large, round, psychologically significant figure. Furthermore, I believe that the 200 day EMA will probably start reaching towards that area so if we were to break down below it, that would be a very strong sign. All things being equal, I don’t have any real scenario in mind where I’m looking to short the market, so this is a “buy on the dips” market going forward as it has been for quite some time. However, if we do break down below that $1500 level then we need to start looking for shorting opportunities.