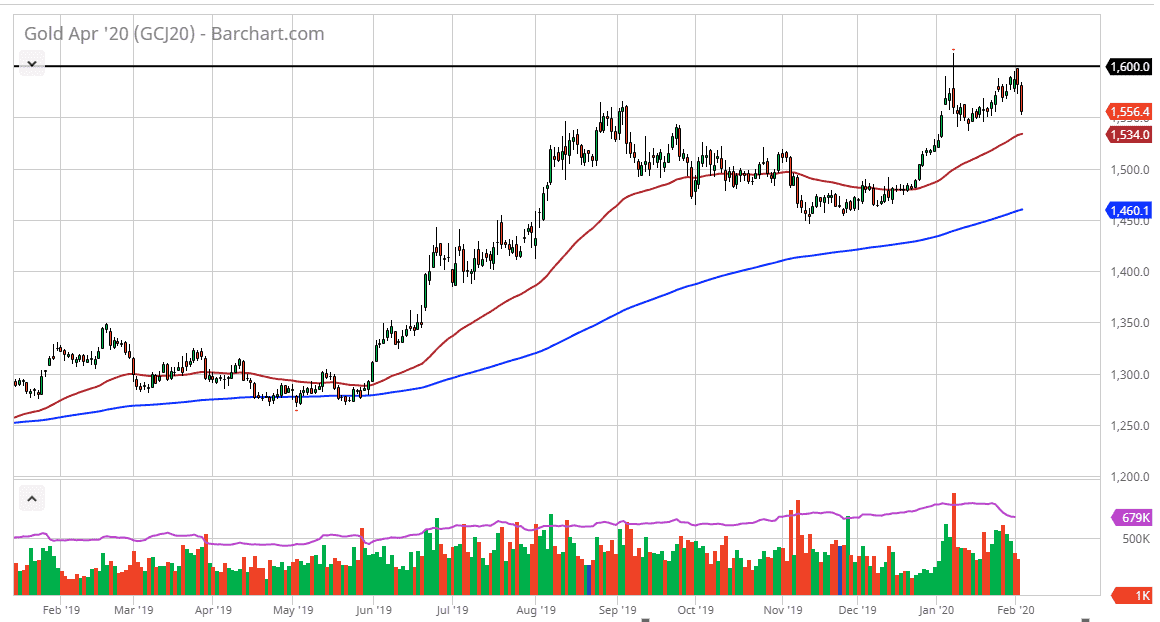

Gold markets fell during the session on Tuesday as more of a “risk off” scenario has overtaken the markets, pushing money out of safe haven assets. At this point though, the gold markets are starting to approach an area that I think could attract a certain amount of value hunting. The $1550 area has attracted buyers recently, and therefore would not be a huge surprise to see the return that this area. Furthermore, the 50 day EMA is starting to race towards this area so think about more or less as a “zone” that buyers may return to.

The $1600 level has obviously been very resistive so it should not be a huge surprise that we have pulled back from there. That being said though, it looks a lot like a scenario where traders simply realize that perhaps a lot of the fears about the coronavirus may have been overdone. That being said, the reality is that gold had been in a longer-term move higher before thin, so therefore only so much of this can be attributed to the virus outbreak.

There are plenty of geopolitical risks out there that could come into play, so therefore gold will continue to attract a certain amount of demand. Furthermore, central banks around the world continue to have very loose monetary policies, and looks likely to continue doing so, if not extending those loose monetary policies. That should be good for the longer-term outlook when it comes to precious metals, and therefore I look at this as a potential buying opportunity. That being said though, you don’t need to be the hero here, simply wait for some type of daily candlestick that shows the buyers are returning.

I suspect that in the next day or so we should see buyers return, but even if we break down below the 50 day EMA it’s very likely that the $1500 level will also offer significant support. The market has been rallying for some time, but it’s obvious that the $1600 level continues to cause major headaches. If we can get a turnaround and a breakout above there on a daily close, that would be a sign that we are heading much higher, which is something that I do anticipate seeing in the relatively near future. At this point, I have no interest in trying to short gold, rather I simply stay neutral or bullish going forward.