Gold markets tried to pull back a bit during the trading session on Tuesday, but also saw some buying at the lower levels to turn things around and stabilize a bit. The gold market of course has been getting a bit of a bid due to the coronavirus noise, and as well as the central banks out there looking to keep monetary policy extraordinarily loose. That being the case, the market is very likely to see a lot of demand for gold, as it typically works against the easing of monetary policy of the longer term.

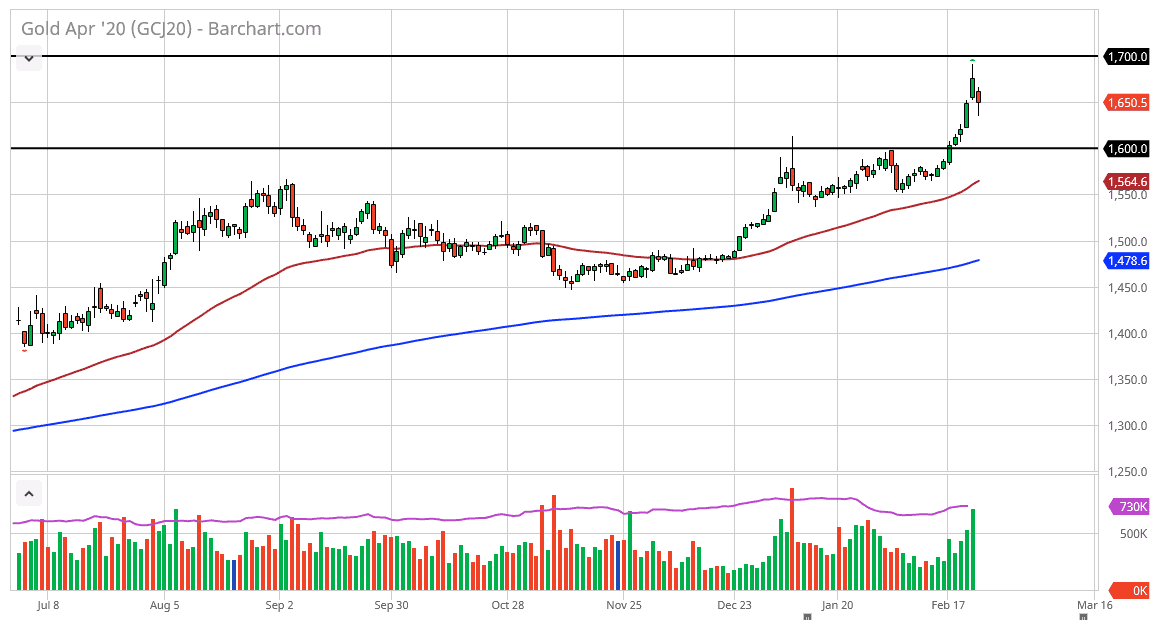

The market did pull back a bit from the $1700 level, which of course is a large, round, psychologically significant figure. Ultimately, the market is in an uptrend, and that’s the only thing you really need to know. Buying the dips has worked for quite some time, and the 50 day EMA is starting to clear the $1550 level and that looks very likely to go looking towards the $1600 level. The $1600 level of course is a large, round, psychologically significant figure that people will pay attention to, especially considering that it had been resistance previously. That being said, I like the idea of buying these dips as I think the market is trying to pick up enough momentum to finally go to the upside. That being said, expect a lot of noise due to the coronavirus and all things China related. Ultimately, in if we were to break above the $1700 level it’s likely that we could then go much higher.

To the downside, if we were to break down below the 50 day EMA it could send this market much lower, but I don’t think it happens anytime soon, because there are far too many negative things out there to keep gold going higher. Furthermore, I anticipate that those who have missed the run to the upside will also want to get involved as it is such a bullish market. With this, I am looking for an opportunity to take advantage of value when it occurs, buying gold “on the cheap.” I think that eventually the rest of the markets will as well. Because of this, being patient and waiting for signs of stabilization is the way to go. Bounces will occur occasionally, and those bounces are to be bought into as the case for gold is still certainly very strong.