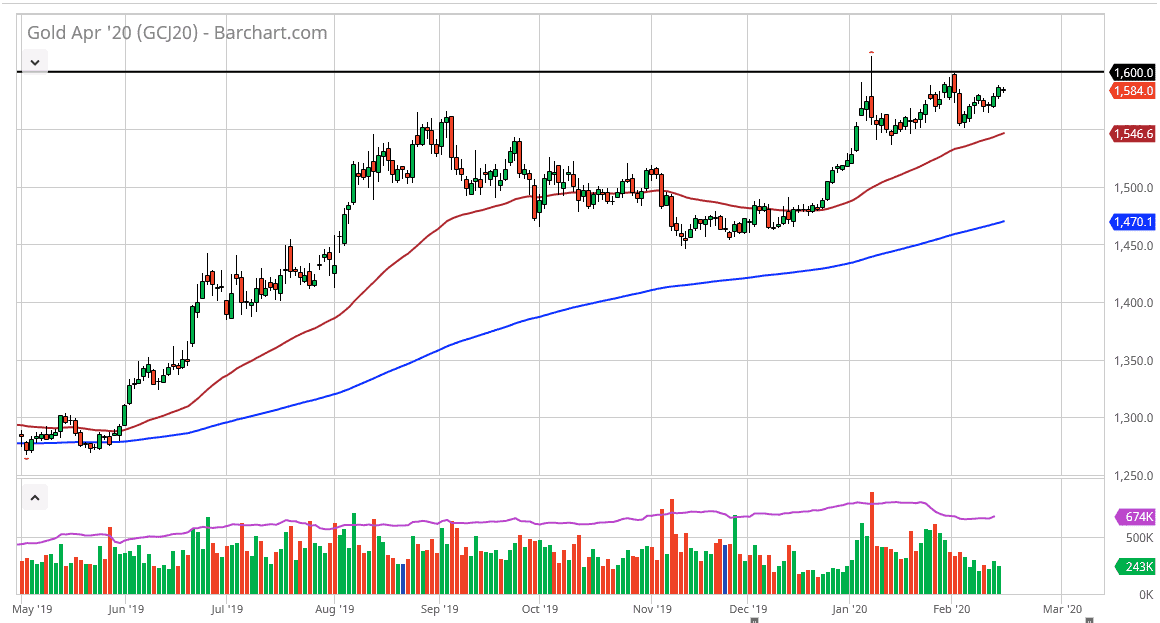

The gold markets did very little during the trading session on Monday, as it was Presidents’ Day in the United States. This means that there was somewhat limited electronic Globex trading more than anything else, and therefore you can’t read too much into the candlestick during the session. Having said that, it does appear that we are trying to form an ascending triangle, and that ascending triangle could signal that the market will be ready to go looking towards the $1675 level on a breakout above the $1600 level on the daily close.

I think in the short term though, it’s very likely that the market will continue to pull back and look for value underneath, especially at the $1550 level. Furthermore, the 50 day EMA is starting to cross that level so it’s likely that we will see a significant amount of buying pressure in that area. If we were to break down below that area, I think that the market also has a lot of support based around the $1500 level, especially as the 200 day EMA is starting to get towards that area as well.

In fact, it’s not until we break down below the $1500 level that I would be concerned about gold, and even then, I would have to rethink any shorting opportunities. After all, several banks around the world continue to loosen monetary policy and that should help lift precious metals in general. I don’t have any interest in shorting gold or silver, although there are times where it’s a better value than others. Ultimately, looking at dips as value is probably the smartest piece of advice that I could give you going forward. Once we break above the $1600 level, especially on a weekly candlestick, I suspect that there will be a lot of people who will be looking at gold as a trade that they wish to get into, with a fear of missing out. If the market breaks below the 200 day EMA, then I will have to reassess the entire situation, but the fundamental still favor gold going higher more than anything else. This will be especially true if the Federal Reserve also starts to loosen monetary policy, something that traders think could happen later this year. As it stands right now, the Reserve Bank of Australia and the European Central Bank both are loosening monetary policy and Switzerland has had negative interest rates for ages.