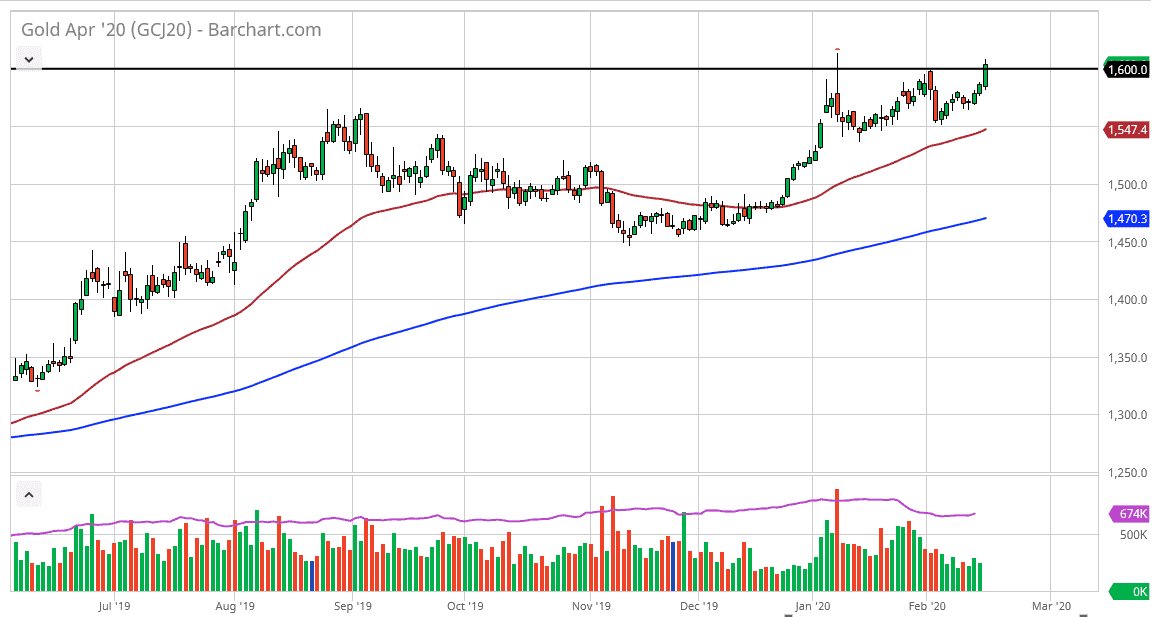

Gold markets rallied a bit during the trading session on Tuesday, breaking above the $1600 level. This is a market that has been bullish more than once, and we have in fact even rallied after every pull back for some time. Breaking above the $1600 level was the “first shot across the bow” to the sellers, and it clearly has sent a message. If the market can break above the top of the candlestick, it’s likely that we will continue to reach towards the highs that the market recently made, and then continue to go much higher than that. Ultimately, I do believe that gold goes all the way to the $1800 level, based upon longer-term trend work that I have gone over previously.

The market seems to have plenty of support near the $1550 level, which is the bottom of the recent range that we have seen. The market has bounced from that level a couple of times, and at this point it’s likely that the market will use that as a “floor” in the market. Furthermore, the 50 day EMA is starting to cross that level and if it continues to grind higher it just simply will drag the floor right along up with it.

I still like buying pullbacks in goal because there are a whole host of reasons why it should go higher. Not the least of which of course is going to be the fact that the central banks around the world continue to loosen monetary policy. The ECB in the RBA are to the biggest culprits, but the BOJ is also involved. Furthermore, it looks as if the Federal Reserve is going to think about cutting rates further down the road, and that of course can boost this market even further. Beyond all of that, we have a lot of global headwinds out there that will continue to have people looking for safety, which of course gold can offer. The reason I know this is both gold and the US dollar have been rallying so therefore it’s more of a safety play than anything else. I have no interest in shorting this market and believe that we need to break down below the blue 200 day EMA at the very least before the trend will have changed. At this point, every time this market dips I believe there will be buyers looking to pick it up.