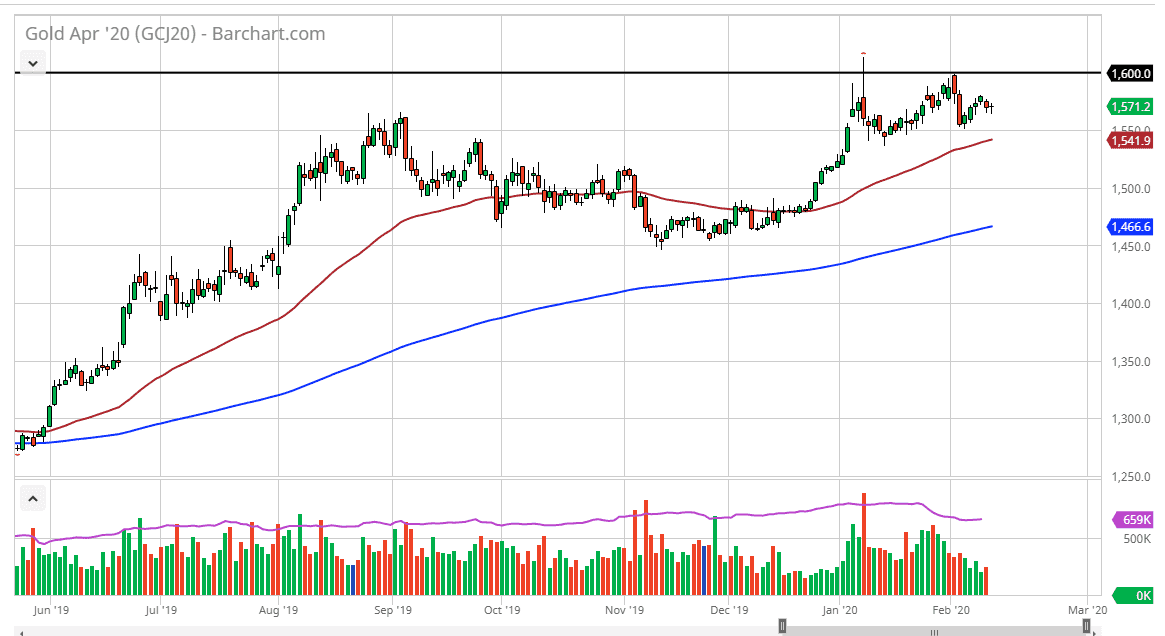

Gold markets have pulled back a bit during the trading session on Wednesday but turned around to show signs of life again in order to form a hammer shaped candlestick. This of course shows that there are buyers underneath and it means that we are more than likely going to continue to see buyers on these dips. That makes quite a bit of sense as central banks around the world keep monetary policy rather loose. I think at this point it’s likely to be a scenario where people will be looking to take advantage of “cheap gold” as it appears.

The $1550 level underneath should be supportive, as it has recently. That being said, there is also the 50 day EMA coming into the picture right there, so that is another reason to think that buyers will return. Even if we were to break down below that level, I believe that the $1500 level offers a significant amount of support so quite frankly if you were to buy gold and it continued to fall, it should only offer more opportunities underneath. The 200 day EMA is starting to reach towards the $1500 level as well, and then of course the psychological significance of the round figure makes quite a bit of sense for buyers to step in as well.

One could make an argument for a potential ascending triangle, but I think at this point it’s probably better to think of the range that we are trading in right now as more of a rectangle than anything else. The market is simply trying to build up enough momentum to break out to the upside as the $1600 level has offered an extraordinarily resistive area to deal with. If the market was to break above there, it would signal the next move higher which could have told reaching as high as $1800. At this point, there are plenty of concerns out there that should continue to lift gold anyway, well beyond the coronavirus. Global economies are slowing down and if that’s going to be the case, we should see plenty of stimulus from banks which does tend to help gold overall.