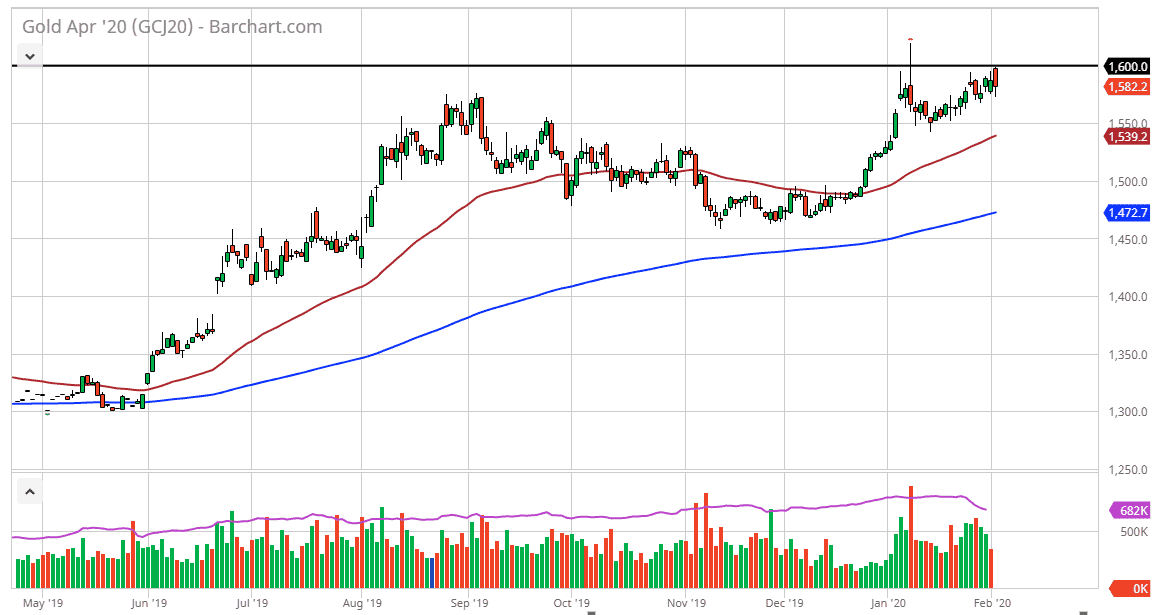

Gold markets fell hard from the $1600 level during trading on Monday, as it looks likely to continue to find buyers on dips. The market has been bullish for some time, and as a result it’s likely that buyers will continue to flock to this market every time it offers value. The $1600 level above should continue to cause a lot of selling pressure, but mainly due to the psychological standpoint more than anything else. This was the most recent high, so it makes sense that sellers could come back into play based upon that alone. Nonetheless, I’m not a seller in general as the market has been very bullish, and therefore it’s hard to find the trend anyway. Furthermore, there is a lot of fear out there and fear is an easy thing to sell. In other words, headlines will continue to have people nervous, and therefore gold should continue to get a bit of a bid.

The $1500 level is the absolute “floor” in the market, but I also recognize that the 50 day EMA reaching towards $1550 level will probably offer quite a bit of support as well, so it’s only a matter of time when you should see buyers come in and pick this market up. Furthermore though, if we were to break out to the upside in close above the $1600 level on a daily candlestick, that could also have the market going higher. Regardless, there is no scenario in which a willing to sell gold anytime soon, and quite frankly there are so many potential issues out there that it’s difficult to imagine a scenario where suddenly it’s completely “risk off” and gold falls apart.

There are also quite a few people out there believing that the Federal Reserve may cut interest rates later this year, and if that’s going to be the case then it should send the gold markets even higher, as it reacts to loose monetary policy out of central banks in general. The central banks around the world all look to be very loose with monetary policy and it should be noted that central banks around the world are net buyers of gold anyway, so in a sense there is a bit of a “built in” buyer for the market. With this, the longer-term trend is higher, and of course it’s only a matter of time before the Federal Reserve does some type of quantitative easing that gets gold markets rallying due to the fact that there is no hint that they are going to raise interest rates anytime soon.