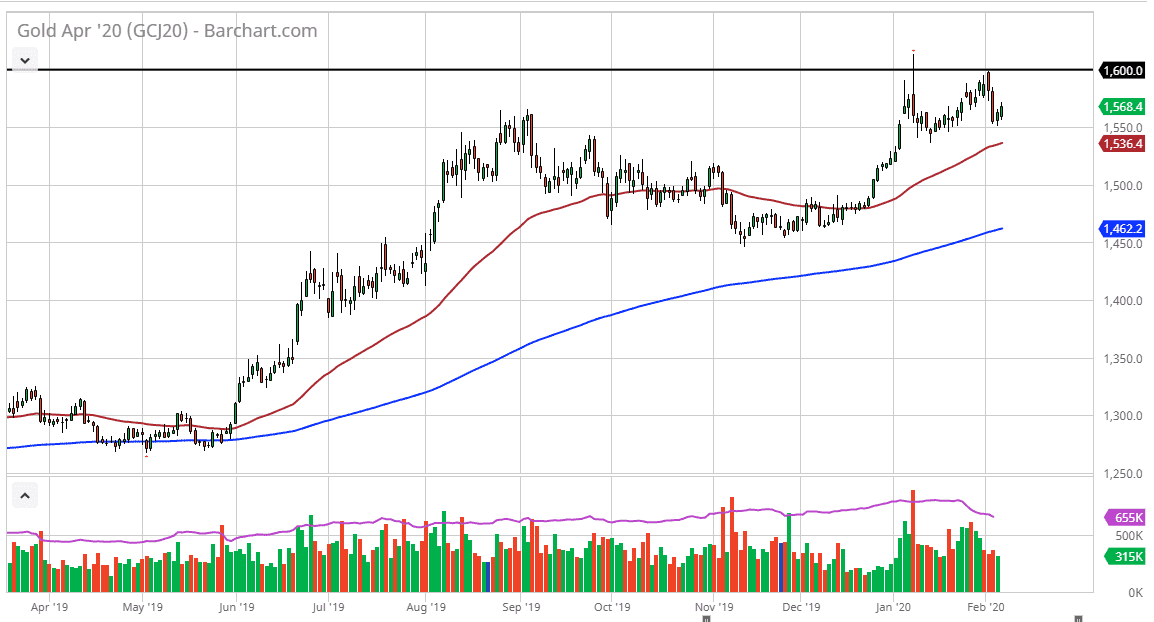

Gold markets rallied a bit during the trading session on Thursday, breaking above the highs on Wednesday which of course is a very bullish sign. The $1550 level is an area that has offered some stability and support more than once, and this last week wasn’t any different. Because of this, it’s likely that we will continue to see buyers jump in and try to reach towards the $1600 level which was the recent high. If we can break above there, then the overall long-term trend will continue to push to the upside, and I do think it happens eventually. However, Friday of course is the jobs figure and it’s very likely that we will continue to see a lot of volatility. I look at any pullback at this point as a potential buying opportunity, especially near the 50 day EMA which is currently at the $1536 level.

Even if we break down through there, the market is very likely to go looking toward support at the $1500 level. At this point, the $1500 level should be thought of as the “floor” in the market, with the 200 day EMA racing to get there, offering even more support. I do think that the last couple of days showing stability is exactly what the gold market needed, and it should be noted that there has been a bit of a run towards the US dollar in the currency markets, suggesting more of a “risk off” feel out there. Gold continues to look very bullish, and if you have the ability to trade gold and other currencies, you may wish to look at it through terms of Euros or British pound specifically. If the gold futures market can break above the $1600 level, I believe that the $1650 level is the initial target, but longer-term we are going to go looking towards the $1800 level based upon the longer-term chart work that I have done over the last couple of weeks. I have no interest in shorting gold, as it has so much massive support underneath. Longer-term, building up a larger core position is probably the best way forward.