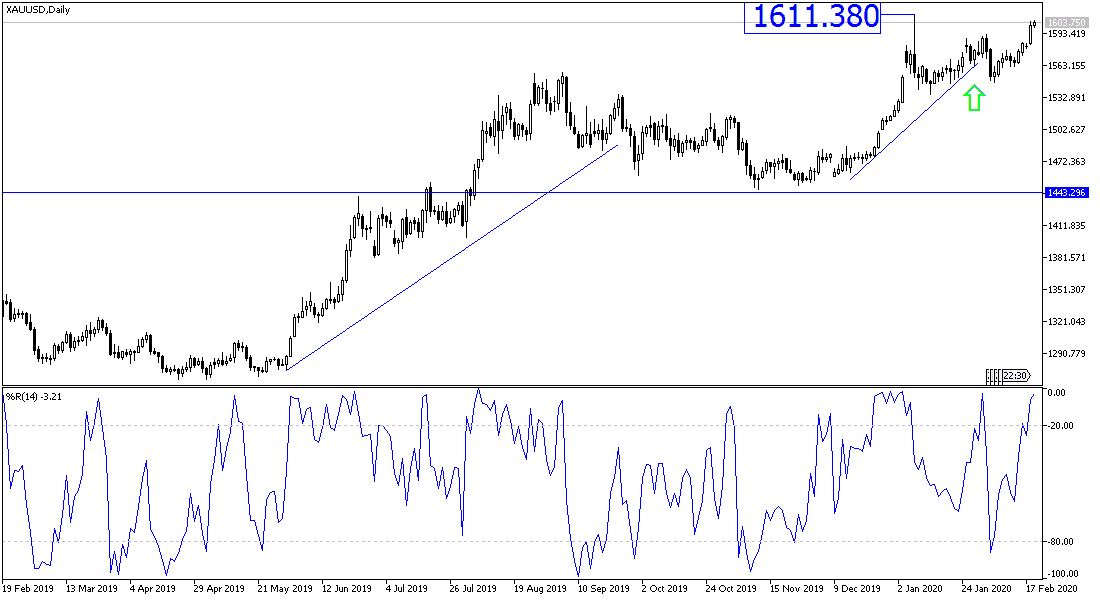

It was natural for gold prices to continue to rise, especially with the persistence of global concerns about the continued outbreak of the Chinese Corona pandemic and its negative impact on the future of global economic growth. The price of gold jumped to the $1605 resistance, the highest for gold in seven years. We noted a lot in the recent technical analyzes that gold may return to move towards the $1611 resistance, which was recorded in the first hours of trading in 2020.

Economists now expect Chinese growth to stop and decline to odd numbers in this quarter, while Japan, where dozens of people are confirmed infected with the virus there, is definitely heading towards recession. These expectations are fertile soil for the yellow metal in achieving more as an ideal safe haven for investors in times of uncertainty and will not be more severe than the current time.

"The biggest unknown is whether the crisis will lead to a significant reduction in spending by Japanese consumers," Marcel Thilliant of Capital Economics said in a comment. "While the new Corona virus is not as deadly as SARS, consumer spending can be put under pressure as families refrain from visiting shops and restaurants," he added. "Obviously, there is a risk that Japan will slide into recession early this year," he said.

Governments elsewhere are also preparing to act to mitigate the virus stroke. The Singapore government announced a budget of 6.4 billion Singapore dollars (4.6 billion dollars) as special measures to provide additional financing for health care and subsidies for companies and families. Southeast Asian farmers, especially at the tropical areas along the southern border of China, are struggling to find markets for crops that they are unable to market due to transportation disturbances and quarantine restrictions in central and eastern China.

But the turmoil in tourism and the manufacturing sector has a much wider scope. So Chinese authorities encourage factories to return to work, but a survey of manufacturers in the Yangtze River Industrial Zone conducted by the American Chamber of Commerce in Shanghai last week found that nearly 80% did not have enough staff to operate at full capacity. Nearly a third of the logistics matters were their biggest concern. More than two-thirds of the 109 companies surveyed had already returned to work, but many said their business was hampered by quarantine restrictions and doubts about government approvals.

The markets were shaken recently. Technology giant Apple is warning revenue will fall short of previous forecasts in the second fiscal quarter due to cuts in production and falling demand for iPhones in China. Apple stores are either closed or operate for a few hours only.

According to the technical analysis of the gold price: On the chart, the price of gold reached the top of its upward channel, amid confirmed signals by all technical indicators that gold prices are at saturated areas. The next peak for gains is $1611 and breaking above that may be aiming for new highs. There will be no reversal of the trend without the final announcement of a vaccine that completely eliminates the Coronavirus, which is still not possible despite global efforts, especially from China, the source of the epidemic. The closest support levels for gold are currently 1593, 1585 and 1572, respectively.

The gold price will interact with the corona developments, and the announcement of British and Canadian inflation figures. Then the US data, producer price index, building permits and the content the last Fed meeting.